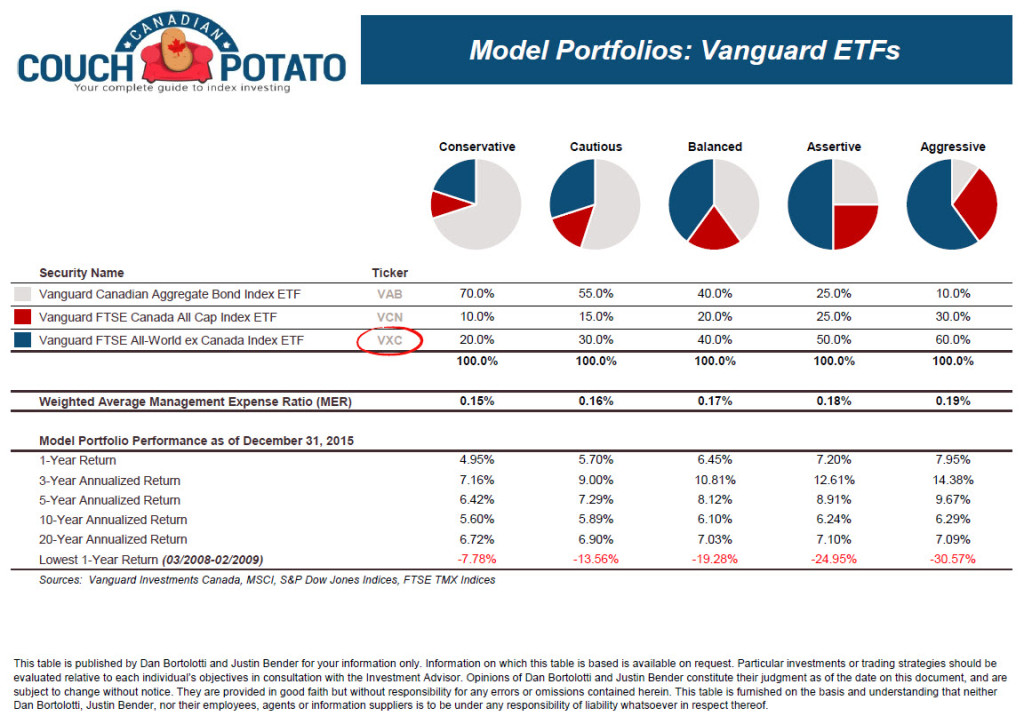

The Couch Potato portfolio has it all – low fees, broad-diversification, and simplicity. There’s not a whole lot of room for improvement, but with a few tweaks, investors can lower their costs even further.

One such improvement can help mitigate the drag from foreign withholding taxes levied on dividends paid from US and other international companies. If we look at the Couch Potato model ETF portfolios, we find that they hold just a single foreign equity fund, the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC). Pretty simple, right?

Source: www.canadiancouchpotato.com

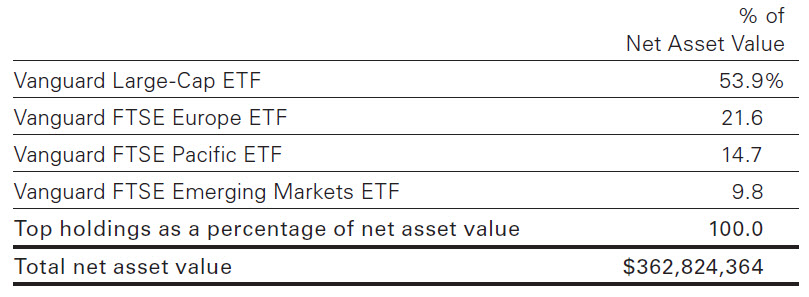

If we pop the hood of VXC, we find that it holds four US-listed ETFs, which together hold over 7,500 stocks from across the globe. This “wrap” structure is not such a big issue in a taxable account, but the additional costs become more apparent when the fund is held in an RRSP account (which is discussed in more detail throughout our Foreign Withholding Taxes white paper).

Underlying Holdings of the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC)

Source: Vanguard Canada Quarterly Portfolio Disclosure as of March 31, 2016

Small potatoes?

Although VXC’s wrap structure may not seem important at first, holding the underlying US-listed ETFs directly in your RRSP would be much more tax-efficient.

To help illustrate this concept, I’ve estimated the total cost of holding VXC (0.71%) versus holding the underlying US-listed ETFs directly (0.19%). By holding the US-listed ETFs directly, an additional cost savings of 0.52% per year can be expected (this estimate includes the lower expense ratios of the US-listed ETFs, as well as the lower foreign withholding taxes levied – however, it does not include the costs of currency conversion, which can be substantial if not carefully implemented).

For more information on how not to get hosed by the big banks on currency conversions, please read about the Norbert’s gambit strategy.

Estimated expense reduction of using US-listed ETFs in your RRSP

| Vanguard FTSE Global All Cap ex Canada Index ETF (VXC) | Allocation (%) | MER (%) | Estimated FWT | Total Cost |

| Vanguard US Large-Cap ETF (VV) | 54.76% | 0.27% | 0.30% | 0.57% |

| Vanguard FTSE Europe ETF (VGK) | 21.98% | 0.27% | 0.65% | 0.92% |

| Vanguard FTSE Pacific ETF (VPL) | 14.23% | 0.27% | 0.51% | 0.78% |

| Vanguard FTSE Emerging Markets ETF (VWO) | 9.03% | 0.27% | 0.69% | 0.96% |

| Weighted Average Cost | 100% | 0.27% | 0.44% | 0.71% |

| Underlying US-Listed ETFs | Allocation (%) | MER (%) | Estimated FWT | Total Cost |

| Vanguard US Large-Cap ETF (VV) | 54.76% | 0.08% | 0.00% | 0.08% |

| Vanguard FTSE Europe ETF (VGK) | 21.98% | 0.12% | 0.17% | 0.29% |

| Vanguard FTSE Pacific ETF (VPL) | 14.23% | 0.12% | 0.15% | 0.27% |

| Vanguard FTSE Emerging Markets ETF (VWO) | 9.03% | 0.15% | 0.29% | 0.44% |

| Weighted Average Cost | 100% | 0.10% | 0.09% | 0.19% |

| Difference | 0.17% | 0.35% | 0.52% |

Sources: FTSE Index Fact Sheets as of May 31, 2016. The Vanguard Group Annual Financial Statements as of October 31, 2016.

Although holding US-listed ETFs in your RRSP is not absolutely necessary for couch potato investors, it can lead to substantial cost savings over time. These benefits should first be weighed against other factors (i.e. lack of simplicity, additional trading costs, US estate taxes, etc.) before making a final decision on the appropriate plan of action.

[…] will use my CAD RRSP to demonstrate since the benefits of US-listed ETFs are greatest in an RRSP. You will note that I have nick-named my RRSP to make it easier to identify […]

Stumbled upon this post while looking to rebalance with more VXC for the year. Now has me looking deeper. The 0.52% savings per year, not sure if this is worth the extra tracking of following the 4 underlining ETFs and the currency conversion with Norberts within the RRSP.

At what point would you consider this switch from VXC to the underlying US listed ETFs being worthwhile?

@Cytizen: That’s really up to each investor (I’m not sure what dollar value you would personally consider to be worthwhile).

This post is a little out of date, but let’s assume you’re using XAW for global equity exposure (which is cheaper and more tax-efficient than VXC) – XAW has total product fees and foreign withholding taxes of 0.58% per year. If you instead held ITOT, IEFA and IEMG (refer to my CPM model ETF portfolios for RRSPs and RRIFs for more details), you could lower this cost to 0.19% (for a savings of 0.39%). This would save you $390 annually on a $100,000 holding in ITOT/IEFA/IEMG, relative to XAW. But this would only save you $39 annually on a $10,000 holding in ITOT/IEFA/IEMG, relative to XAW.

Hi Justin,

Can you perform the same analysis for holding VXC in a TFSA?

Would material savings be realized if it were broken into the components instead?

Thank you.

@adam: There would likely not be a material difference if you broke up VXC into its component parts within a TFSA account.

Hi… Can you explain what you mean by “material difference”? Sorry for not understanding. Basically, I am wondering if the total cost of holding VXC is still 0.71% in a TFSA like in a RRSP? Should I change VXC to XAW? Thank you!

@Bree: I mean, basically zero difference, once you account for all costs (such as currency conversion fees).

XAW is cheaper and more tax-efficient than VXC when held in a TFSA or RRSP account: https://canadianportfoliomanagerblog.com/war-of-the-worlds-ex-canada/

Hello Justin,

I have been an avid reader of your blog for sometime.

I have around 260000 cdn to invest.

I am not sure that I will be retiring in Canada so Investing in RRSP would not be worth it

I was thinking of the following:

In taxable account: (total 200 000 CDN)

30% VUN

30% VIU

40% VSB

In my RRSP (I will max it out)

Individulal canadian stocks one canadian reit ETF as well as an emerging market ETF market listed on TSX.

I will be rebalancing once year my taxabale account

Would appreciate you input.

Thank you and regards

@Ben: VSB is tax-inefficient in a taxable account (BXF may be a better option). XUU is cheaper than VUN (but VUN is still a great choice). International equities (i.e. VIU) have the highest dividend yields, so VIU would arguably be a better option for the RRSP than emerging markets (a Canadian-listed emerging markets equity ETF held in an RRSP will generally face two levels of foreign withholding taxes). I don’t ever recommend holding individual Canadian stocks.

These articles should help:

http://www.canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

http://www.canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

http://www.canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

https://canadianportfoliomanagerblog.com/bxf-tears-a-strip-off-competitors/

Hello Justin,

Thanks a lot for the quick reply.

Small correction. Made a mistake regarding the RRSP. I will be maxing out my TFSA and not my RRSP.

Thank you also for the links provided…

Ben

Hi Justin,

Your stuff is very informative. Thank you.

In the case of RBC direct investing, the 0.1% saving of using Norbet’s gambit is to compared to buying USD (non-cash rate) online at RBC investing? If yes, the following way seems to achieve more savings.

I could shop around and give RBC the Vancouver best cash rate available (even much better than the listed RBC non-cash rate ) and RBC could match that rate at the branch to convert my CAD in chequing to USD and put in my high interest savings USD account (no monthly fee). Then I could transfer the fund from savings to investing.

Thank you.

Sue

Justin,

I keep reading your blog deeper and deeper :) It’s so great to have such people like you – helping investing noobs to control their money!

I came to Canada 15 years ago and now am mortgage-free and have $150.000 in my RRSP (being just an electrician), so I know how to save but need education on how to invest.

Anyway. Canadian couch potato – is my Bible. That’s how I found your blog. I used e-series funds for a while and now took plunge into Questrade. Next step – I questioned myself about holding US ETF in US currency. That’s how I read your blog about Norbert’s gambit – thanks for the hint to watch youtube video!

Now I have next question for you:

is your recommendation for US ETF structure still true? (stick to Vanguard) I’m asking because Dan Bortolotti just updated his portfolio with iShares…

And one more (if you may): there is no tax for RRSP accounts, right? But what about RRIF? (it’s still 25 years ahead for me but still)

Thanks again!!!

With best regards,

Aleks

@Aleks: Holding foreign equity US-listed ETFs in an RRSP account is generally more tax-efficient than holding Canadian-listed ETFs. Whether to hold US-listed iShares or Vanguard ETFs does not make much of a difference overall. For example, sometimes I hold ITOT and sometimes I hold VTI to obtain US-equity exposure in an RRSP account.

The foreign withholding tax implications are the same in an RRIF as they are in an RRSP account.

Hi Justin,

What about in a TFSA, is it still more tax efficient to hold US listed ETFs there too? I assume for foreign withholding dividend tax its not, because it cannot be claimed on your returns, except for in a non-registered account (and in an RRSP it doesn’t matter), but I’m wondering your thoughts.

Thanks Justin!

Vito

@Vito: Holding US-listed foreign equity ETFs in a TFSA does not mitigate the foreign withholding tax drag (the 15% withholding tax is still levied and cannot be recovered) – for this reason, I tend to just hold Canadian-listed foreign equity ETFs (like VUN or XUU) in TFSA accounts.

Hi Justin,

thanks for the response. I think I may have mis-read your other previous comment, because I said US listed ETF, and should have said CAD listed ETF, my apologies. However, just so I’m clear in the understanding, I am planning on starting index investing and have made the decision to start with the following funds, XAW, VCN and VSB in a TFSA.

I’ve made the decision to start this simpler 3 ETF Portfolio; it ended up being a decision from a number of factors, and coincidentally ended up being what you recommend in your ETF models portfolio with short-term bonds, with the added addendum note in italics you provided of the alternative ETF swap (ie. XAW in place of VUN, XEF, XEC).

My question is, from a “tax” perspective in a TFSA (and RRSP), are those 3 ETFs a good choice for a long term horizon (ie. 20+ years)?

As I suppose the other question that’s been bugging me after re-reading your previous response, when and where would a Canadian investor want to invest in US-listed ETFs? I can only think of is in an RRSP (because the tax is a non-issue because of tax treaty, correct me if I’m wrong) or a non-registered account since you can claim the 15% withholding tax with the CRA.

As always, thank you for your continued support educating us DIY investors.

All the best Justin!

Vito

@Vito: A combination of VSB, VCN and XAW would be a great place to start for a long-term TFSA (and RRSP) account. As you get more comfortable with investing, you may decide to start using US-listed ETFs in your RRSP for the foreign equity allocation (but only when you’re an expert at implementing Norbert’s gambit ;)

An RRSP is generally the only place that a Canadian investor would want to invest in US-listed ETFs. You could make an argument to hold them in taxable accounts as the MERs of US-listed ETFs are lower than their Canadian-listed counterparts, but then you may be subject to T1135 reporting requirements.

Hi Justin,

Please forgive my ignorance, there are times when I feel like I understand and other times where I’m not sure, so here goes my question as a follow up to clarify what you said, hope you don’t mind.

How is investing in an RRSP with a Canadian listed ETFs that tracks US equities different from investing with US listed ETFs that track US equities? Isn’t it the same thing? I’m just trying to see if I understand where the advantage would be if they both track the same foreign equity exposure (ie. S&P 500, etc). Can you provide some tickers on both sides to compare, maybe then I would get a better visual understanding.

And as got Nortber’t Gambit, I’ve already done that a few times using my Questrade account this year, when converting CAD to USD to buy some individual US stocks and needed USD currency. Questrade charges 2% to convert and I don’t think that’s reasonable.

I actually started a thread about it on RFD just asking people if my math was correct to tax purposes and someone who seemed quite knowledgable gave some advice that was actually different from what you and Dan provided on your white papers (by the way, why are they called white papers?). He told me what he does, in order to evade the ECN fees, he places non-marketable limit order of 1 cent BELOW the bid price when buying and 1 cent ABOVE Ask when selling. The only thing I can think of that may not be good with his strategy is that the order may not fill immediately and lose on the opportunity cost? To me, the ECN fees don’t seem expensive but I get his point that if converting in very high amounts, they can certainly add up.

Thanks again Justin. Love the video tutorials, they’re awesome!

@Vito: If you hold VUN rather than VTI in an RRSP account, the US government will withhold 15% tax on the foreign dividend. If the dividend yield on US equities is about 2%, then this withholding tax will create an additional expense of 0.30% per year (2% dividend yield x 15% withholding tax). The management fees on Canadian-listed ETFs are generally higher than their US-listed counterparts, so this would lead to additional cost savings: http://www.canadianportfoliomanagerblog.com/wp-content/uploads/2014/09/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf?850eac

What does a perfect ETF portfolio look like for a retiree wanting to generate maximum distributions for income from their portfolio?

Thanks

@Deb: In most cases, a high income generating portfolio like the one suggested would be far from perfect. The more income you receive that is not from capital gains, the less tax-efficient the portfolio (at least for portfolios that have a taxable component). Generally, it makes sense to put together a retirement plan first to determine how much risk you need to take with your asset allocation. Once this has been done, you can then choose one of the model ETF portfolios from my site, and tweak it based on your individual circumstances (i.e. GICs instead of bond ETFs, high-interest savings accounts for short-term cash flow needs, etc.).

Thank you Justin. I will look at them in more detail.

@Justin,

I have a Canadian friend who moved to the US after graduating, got an American citizenship, and now has returned to live in Canada permanently, but with dual citizenship now. So he’s now a Canadian/American residing in Canada.

His current self-employment income is in vicinity of $65k/year, and he has about $150k savings. I’m trying to encourage him to not just leave those savings in the bank and instead educate himself in DIY investments following the model ETF portfolio, in a taxable account.

However, one thing I’ve not had success figuring out is how his dual citizenship impacts tax optimization.

Since he’s taxed worldwide as an American cititzen, can I just follow US-centric DIY advice; meaning he might as well open a US brokerage account and buy US ETFs since the selection is better and the cost is lower?

Or is his Canadian residence and citizenship the overriding factor and instead follow the same advice as what Canadian’s follow?

Thanks!

@Will H: I would recommend speaking with your friend’s accountant prior to implementing an ETF portfolio – there could be additional filing costs if they use Canadian-listed ETFs.

@Justin

Many thanks for your informative website!

My apologies if this has already been covered. Do you have an estimated total cost for VXUS by chance?

@Ryan: The latest annual reports would suggest that VXUS would have an additional cost of about 0.20% in an RRSP/taxable account, and 0.63% in a TFSA/RESP account.

Thanks Justin – very informative blog post along with the white paper. I’m curious whether foreign withholding taxes apply to bonds (and bond funds). Might it be worth it to hold the US domeciled BND and BNDX as opposed to VBU and VBG in an RRSP?

@Rick – foreign interest income is not generally subtract to withholding tax (just foreign dividend income), so holding VBU and VBG should be fine in the RRSP (they also hedge away the currency exposure, which I would recommend for foreign fixed income investments).

I am new to “controlling” my own RRSP savings. JUST sold a managed global dividend fund in my RRSP That only gave me a return after expenses of 4.3% since 2002. HELP. I’m 55. Reading , reading and more. Now confused. Andrew Hallam says, LOW FEE INDEX FUNDS. approx, age in bonds, uses the Cdn Couch Potatoe portfolio. ANY SERIOUS suggestions. I’m ready to tell my BMO advisor on the phone , I would hate to see his face, substantial amt of $$.

@Donna Lukasik – I have suggested some simple model ETF portfolios on my blog: http://www.canadianportfoliomanagerblog.com/model-etf-portfolios/

If you require additional tax and planning advice, I would recommend speaking to an advisor (not a biased advisor that pushes their company’s high-cost products though). You could even consider a combination of a low-cost robo-advisor and a fee-only financial planner. Please let me know if you have any additional questions.

Hey Justin, right now I hold 25%VSB, 25%VUN, 25%XIU, 25%XEF in a TFSA, and 25%VSB, 25%VUN, 25%VCN, 25%XEF inside my RRSP. Do you think it makes sense to do this? or, rather then holding these funds twice, just hold my canadian funds (VCN, XIU, VSB) in the TFSA, and international funds (VUN, XEF) in the RRSP. I also believe the costs of the international funds may be cheaper in the RRSP then the TFSA. I’m really happy with the funds I hold, just trying to figure out the most efficient way to set it up with a maxed out TFSA, and now the beginning of contributing to my RRSP. And with a $50,000 portfolio is this even worth worrying about?

Cheers,

Jeremy

@Jeremy – for the size of your portfolio, I don’t see any issues with how you’ve set-up the portfolio. VUN and XEF have the same foreign withholding tax implications whether they are held in a TFSA or RRSP account. As you contribute to both accounts, it’s fairly simple to just add to the most underweight asset class.

As your RRSP account grows, you could consider using a US dollar RRSP account (to hold the US-listed VTI instead of VUN) if you are comfortable with converting currencies (using the Norbert’s gambit technique), but this change would be expected to save you less than 0.10% per year on the entire portfolio.

Thanks Justin! I’ll keep the same game plan until my portfolio grows enough so VTI and maybe VEA are worth it with Norbert’s gambit.

Cheers,

Jeremy

Being a tax professional, and a DIY investor, I have always been sensitive on this issue. Generally simplicity will supersede the additional drag created by the foreign taxes. For part of the U.S exposure, I use my work place US index fund, which is reserved only for registered retirement plan investor. In other words, because of this restriction, it benefits from the tax convention and is exempt from withholding taxes. I actually found this out by accident when one day I tried to buy in in a taxable account and was not available. Readers with work place accumulation accounts should ask if their plans have similar funds, it is convenient and cheaper.

@Daniel S. – I only recently learned about this structure when Dimensional Fund Advisors (DFA) was interested in launching a version of their U.S. equity fund that could only be held in RRSPs, and was also exempt from foreign withholding taxes. It would be interesting if ETF companies could somehow organize this same type of structure for their U.S. equity products.

What if I buy XEC and XEF in a taxable account? They invest directly in stocks and I would get a tax break for the tax paid on the US stocks.

@Mary – XEF holds the underlying stocks directly – XEC holds a US-listed ETF (IEMG). I’m not sure what you mean by “get a tax break for the tax paid on the US stocks”? If you mean that the 15% foreign withholding taxes levied by the US on dividends paid from IEMG to XEC are generally recoverable in a taxable account, then that would be accurate – but you would still pay full tax on the dividends received (so you don’t avoid taxes on dividends).

Remember that international/emerging markets stocks have a dividend yield of around 3%. If you hold them in a taxable account, you are getting taxed on their relatively high dividend yield (even though a portion of the foreign withholding taxes may be recoverable).

So to be clear – if I have a choice – should I put international/emerging markets ETFs in a taxable account or in my RRSP for the best results after tax. Also where should I put US ETFs. Too hard to figure out.

Thank You.

@Mary – the decision on what to hold in RRSPs vs. taxable is so client specific, I won’t be able to give you a definitive answer. I can tell you that these days, I ‘generally’ tend to hold international ETFs and emerging markets ETFs in my client’s RRSP accounts (again, this depends on the specific client situation). I will usually hold US-listed ETFs in the RRSP accounts (and use Norbert’s gambit to convert the currencies) – however, as I wrote about in a recent blog post, holding IEFA vs. XEF in an RRSP is not expected to save that much in fees/taxes: http://www.canadianportfoliomanagerblog.com/foreign-withholding-taxes-in-international-equity-etfs-revisited/

I will sometimes hold VTI in RRSPs, or VUN in taxable accounts, or both (the dividend yield is only about 2%, so it’s more tax-efficient than international/EM ETFs in a taxable account. I also tend to hold Canadian ETFs and tax-efficient bond ETFs (BXF, ZDB) or GICs in the taxable accounts. The bond ETFs allow me to have some liquidity for unexpected capital calls from clients (which happen more than you’d expect), so that I won’t be forced to sell equities and possibly realize big capital gains in a single year. They are also readily available for rebalancing opportunities.

Great article Justin. Based on the research you and others do, I’ve been convinced for some time to avoid “wrapped” products and simply a) invest in the underlying assets where possible and/or b) unbundle the ETF where I can.

For example, I can’t possibly hold 7,500 stocks in my portfolio (30-40 now is plenty!) but I can unbundle REIT ETFs like VRE, XRE and hold a few REITs directly that act like a proxy for the fund. I save money management fees by doing so and get the same returns for the most part.

“Wrapped” products provide easy-of-use and convenience but my experiences are convenience often comes at a cost – for the consumer.

Hope you’re having a great summer,

Mark

@My Own Advisor – hope you and your family are having an amazing summer as well, Mark! As the portfolio size grows, it usually makes sense to look for ways to make the portfolio more efficient and lower cost. For most investors starting out, a combination of VAB/VCN/VXC is definitely fine (or XQB/XIC/XAW).

@Justin: Interesting point. Rick Ferri suggests splitting International into it’s two components, Europe and Pacific to capture the rebalancing bonus from two less than perfectly correlated volatile assets. Another example of, do I make it more complicated to go after a bit higher return, (assuming I do actually rebalance at the right time), or do keep it simple and not worry about that.

@Grant – the benefit would depend on the particular holding period. Rebalancing into the lower performing asset class could produce higher returns (relative to holding a market cap position), but it could also produce lower returns if the lagging asset class continues to lag. In practice, I don’t see many great rebalancing opportunities, and when they do arise, most investors are too anxious to rebalance anyways. I personally don’t split up the Europe and Pacific regions, but I also see no issues with doing so.

Do ETF providers rebalance the funds within an ETF like VXC?

i.e. If the European VGK price rises and the Pacific VPL falls, does Vanguard sell VGK and buy VPL to maintain the asset allocation?

@Zach – great question. The mandate of VXC is to track the FTSE Global All Cap ex Canada China A Inclusion Index (which is basically a plain-vanilla market cap weighted index). If European stocks rise and Pacific stocks fall, European stocks would become a higher percentage of the index/fund, and Pacific stocks would become a lower percentage of the index/fund. Vanguard would not sell VGK to buy more VPL, because their fund will already be perfectly on target to its mandate. If they receive new cash inflows from investors, these would also be distributed as per the new weights (i.e. more would be allocated to European stocks, and less would be allocated to Pacific stocks).

@Justin – If I have just a few thousands USD to buy one of the US-listed ETFs, which one should I buy to get the most of my USD?

@Julio – what you should buy first would depend on what your portfolio allocation is (i.e. you should top-up whichever asset class is underweight). If your asset allocations for US, international and emerging markets are all underweight by a few thousand dollars and you want to rebalance your portfolio (and have both CAD and USD cash), US and emerging markets equities would likely reduce your foreign withholding tax bill the most (assuming that you purchase Canadian-listed international equity ETFs that hold the underlying stocks directly with your Canadian dollars).

Thanks Justin.

Thanks for presenting this Justin. I’ve learned much from your work over the years–very appreciative.

@Erik – you’re very welcome! I’m so glad to hear you’ve found the information to be useful :)

Another two minor tweaks which would lower costs a bit further and reduce the holdings by one is to hold VEA (MER 0.09%) in the place of VPL and VGK. And VTI (MER 0.05%) in the place of VV. The last switch also increases the amount of diversification by moving beyond large caps in the US market.

@Rick_J – substituting VTI (or ITOT) would certainly lower fees a bit more (and add small caps to the mix). VEA is not a perfect substitute for VPL/VGK as it holds Canadian stocks, but you could always lower your Canadian equity allocation to compensate for the overweight.

what about holding ishares XAW which holds international companies directly instead of VXC?

maybe not as good as holding US listed ETFs but a better alternative for people who don’t want to deal with forex, us estate laws, and additional trades.

@D – holding XAW in an RRSP account would cost about 0.54%. Holding the underlying US-listed ETFs instead would cost about 0.19%.

When are you updating the Foreign Withholding Tax paper?

@Lurker – it should be available shortly. We’ve simplified the upcoming version a bit, which should be helpful for investors (I’m just waiting on Dan with the final review of the paper ;)