Many investors consider the recent stock market pull-back to be a great buying opportunity, and are eager to rebalance (at least the ones that aren’t panicking and selling their stocks). But should they rebalance now, or wait a bit longer?

To make this decision easier, I’ve created a downloadable rebalancing table that incorporates Larry Swedroe’s 5/25 rule, which is an excellent way to keep your rebalancing schedule disciplined in times like this. Using the 5/25 rule, you would rebalance your portfolio if an asset class wanders either plus or minus 5% from the original asset allocation target, or plus or minus 25% of the original asset allocation target (whichever one is less). If this all seems a bit confusing, download the rebalancing table and plug in your target asset mix (the spreadsheet will automatically calculate the minimum and maximum rebalancing thresholds for you using the 5/25 rule).

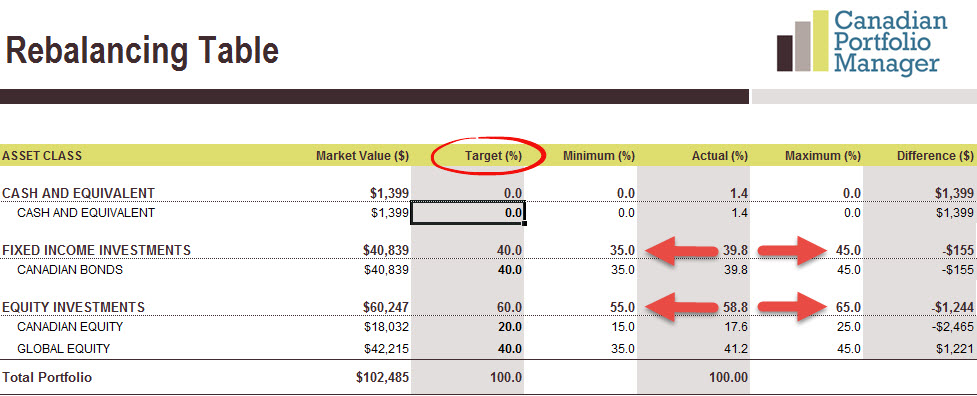

Rebalancing Table: 40% Fixed Income + 60% Equity Target Asset Mix

*ETF Portfolio is comprised of 40% Vanguard Canadian Aggregate Bond Index ETF (VAB), 20% Vanguard FTSE Canada All-Cap Index ETF (VCN) and 40% Vanguard FTSE All-World ex Canada Index ETF (VXC)

As long as your asset class weightings are within these minimum and maximum rebalancing thresholds, you can just sit back and not enjoy the ride. If cash from distributions or new contributions has accumulated, top-up whichever asset classes are underweight.

Believe it or not, many investors will be surprised to learn that their portfolios are still relatively in balance. As of the market close on August 25, 2015, the asset allocation for a balanced ETF portfolio* purchased at the beginning of 2015 would still be within their minimum and maximum rebalancing thresholds (see chart above as of August 25, 2015).

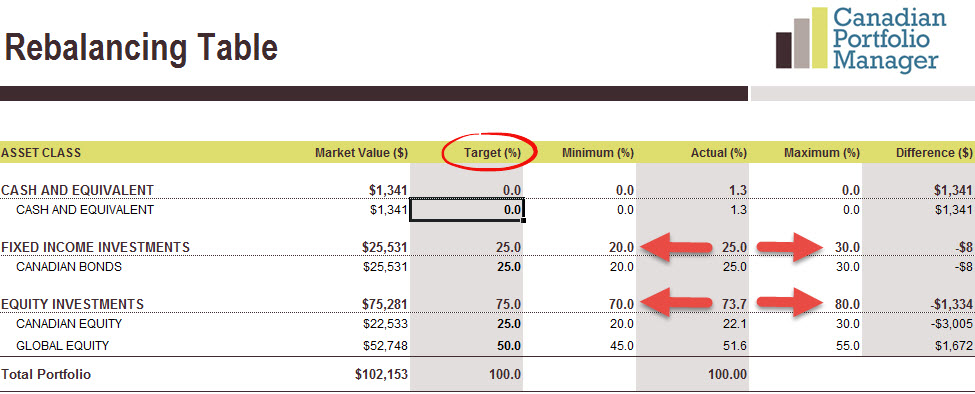

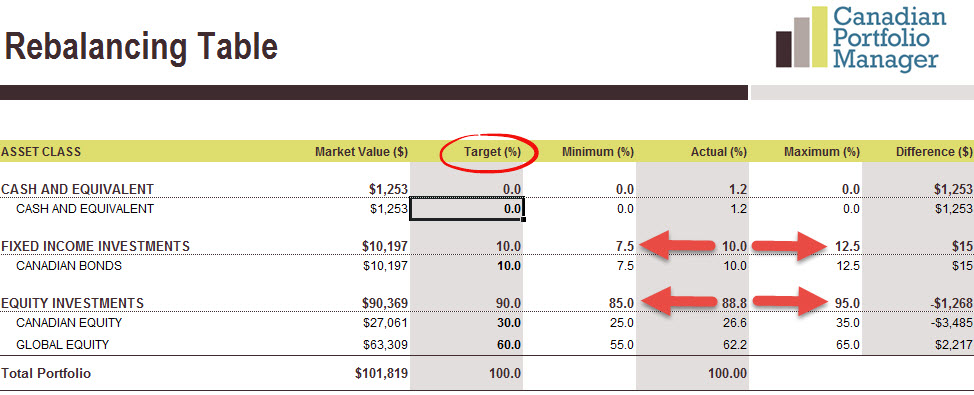

More aggressive investors will likely find the same result. Although their Canadian equities will be down slightly, most portfolios will generally be within their rebalancing thresholds (see charts below as of August 25, 2015).

Rebalancing Table: 25% Fixed Income + 75% Equity Target Asset Mix

*ETF Portfolio is comprised of 25% Vanguard Canadian Aggregate Bond Index ETF (VAB), 25% Vanguard FTSE Canada All-Cap Index ETF (VCN) and 50% Vanguard FTSE All-World ex Canada Index ETF (VXC)

Rebalancing Table: 10% Fixed Income + 90% Equity Target Asset Mix

*ETF Portfolio is comprised of 10% Vanguard Canadian Aggregate Bond Index ETF (VAB), 30% Vanguard FTSE Canada All-Cap Index ETF (VCN) and 60% Vanguard FTSE All-World ex Canada Index ETF (VXC)

Justin, I have a question about your rebalance worksheet. How do you enter US ETFs there? Do I need to covert to CAD or just leave as is in US dollars? I’m just a bit confused on multi-currency investments. I’ve noticed that due to the currency, rebalance is a bit harder to do. Any recommendations…

@Anastassia: If you hold USD-denominated ETFs, you will have to convert their values to Canadian dollars before entering them into the spreadsheet (and if you have to buy or sell a certain amount of the ETF, you will also have to convert this CAD figure back to USD when calculating the number of shares to buy or sell).

I made an Excel Workbook that can be used to rebalance a portfolio. The asset allocation logic is done in a way to save on taxes. It is a generic template, so I suggest you check with your advisor to make sure the results are right for you. This is a free tool, but you can let me know if there is any problem.

Here is the download link. Make sure you download the file first to have all the features working:

https://drive.google.com/open?id=0B6x4qQK9cyjheDNXY29SeEtSS3M

… [Trackback]

[…] Informations on that Topic: canadianportfoliomanagerblog.com/should-i-rebalance-my-portfolio-now/ […]

Just a special thank you for the extremely handy rebalancing calculator you provide on your blog. I use it regularly to ensure we’re investing in the right index ETFs, and as a helpful tool to provide a report to my significant other on the status of our investments. Cheers!

@Adam – I’m so glad that you found the calculator to be useful – best of luck with your investments!

@Justin: Is this website still updated? I like the information I found here and on CCP websites. I would really like to see new articles and annual datas and stats updated.

Thank you.

@Sebastien – I have updated a number of documents recently on the blog – is there something in particular you are looking for?

I was studying for my second TEP exam during Q3-2015, which is why there have not been any postings during this time. Hopefully I will have time to add some posts later this month/quarter.

Hey Justin,

I think this particular part of your article may be worded incorrectly: “Using the 5/25 rule, you would rebalance your portfolio if an asset class wanders either plus or minus 5% from the original asset allocation target, or plus or minus 25% of the original asset allocation target (whichever one is less).” You say the same thing twice with two different numbers. I think you mean to say plus or minus 25% of the relative asset allocation target, or some other word. I think you’ll know what I mean!

Love reading your blog, excited for future posts, thanks!

Hi Nik – the wording is a bit confusing (which is one of the reasons I’ve uploaded a spreadsheet that does the calculations for the investor). The second part of the rule means: 25% “of” the target…I’ve used “of” to indicate multiplication.

Hopefully this helps! I’ll definitely start posting more blogs now that I’m done studying for awhile.

Oh shoot, you’re right. Clearly I was the one who didn’t check it properly. I understood what was meant, but I thought you had mistyped it. My apologies!

It would be better if it said “5 percentage points” rather than 5%.

I notice that cash is included as an asset class in the tables (with target of 0%, so any amount of cash will put it outside the 25% relative threshold). Do you normally follow the 5% rule with cash as well?

Thanks!

@Tyler – I try to keep cash balances under 1% of the overall portfolio whenever possible. If you’re trading with ETFs (and pay commissions), you could consider placing excess cash in the more expensive big bank index funds until you accumulate enough where a trade would be worthwhile.