“It’s not you, it’s me”.

These words have been professed during breakups throughout history, so we all know what they really mean:

“I can do better”.

And maybe you can. True, your life has been simpler and more balanced since you paired up last year, but the thrill is gone. Plus, you’d love to find someone less demanding on your wallet. Sure, a new relationship may complicate your life in other ways, but your mind is made up: You’ve decided it’s time to sell your Vanguard Asset Allocation ETF.

Before you do, let’s look at some of the pros and cons.

Separation Anxiety

One of the many benefits of the Vanguard Asset Allocation ETFs is convenience. You need only place a single trade to gain exposure to a basket of Vanguard’s globally diversified ETFs. You also avoid the hassle of having to manually rebalance your ETF portfolio each time you add new money to your accounts.

For this automatic rebalancing feature, Vanguard charges a very reasonable 0.08%–0.10% per year on top of the underlying 0.15%–0.17% annual ETF fee. To put this in perspective, if your portfolio is worth $100,000, you pay Vanguard another $80–$100 per year for automatic rebalancing. Most robo-advisors charge 4–5 times that for similar service (although to be fair, the Vanguard option still requires you to place some trades).

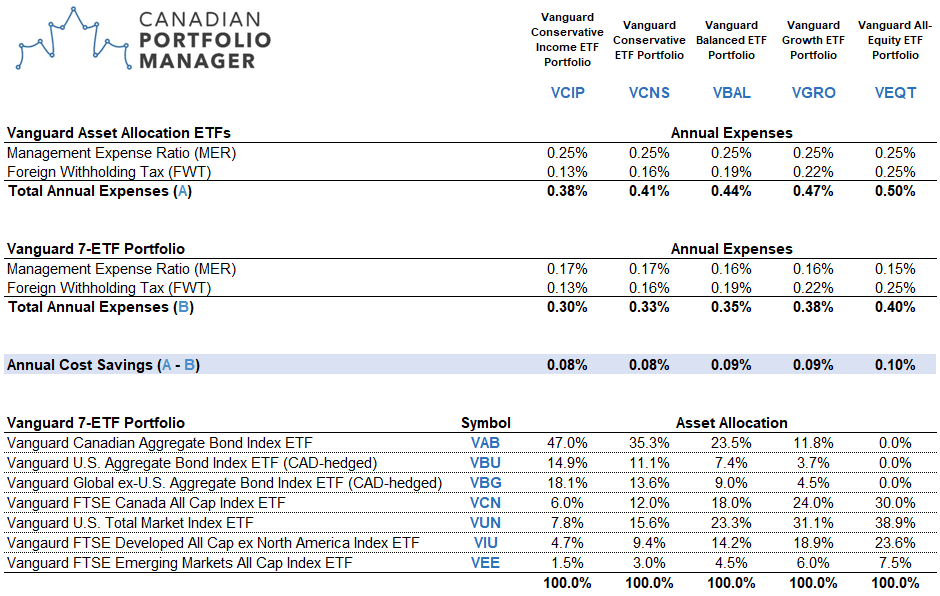

In the chart below, I’ve compared the annual cost savings from breaking up a Vanguard asset allocation ETF into its underlying holdings. You’ll notice the savings are the result of a slightly reduced MER; the foreign withholding taxes are the same either way.

If these modest savings don’t get you excited, I can’t really blame you. However, if you have substantial RRSP assets, there are more portfolio tweaks you can make to reduce your annual costs by up to 0.37%. That may be enough money to help you get over the heartache of a break-up.

Sources: Vanguard Investments Canada Inc., The Vanguard Group, Inc., Bloomberg, FTSE Russell, CRSP, as of December 31, 2018

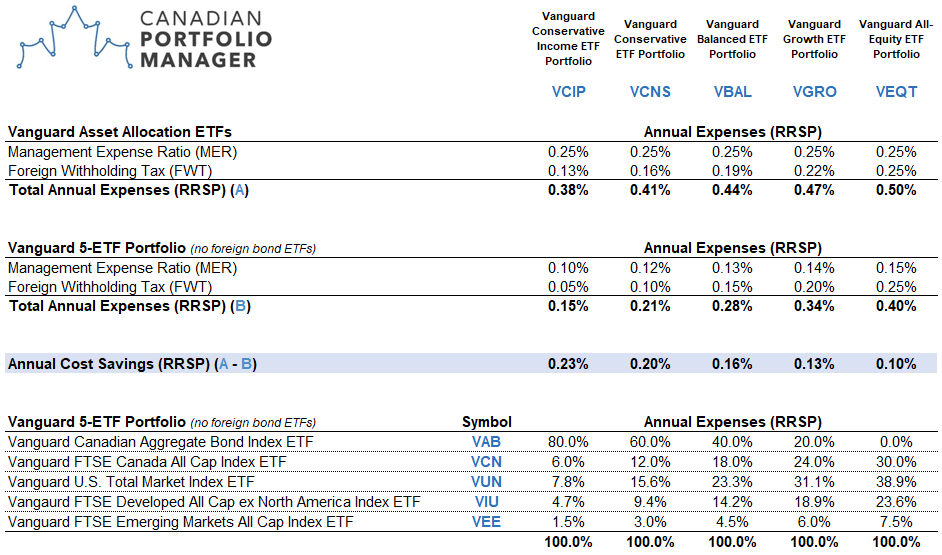

Ditch Foreign Bonds

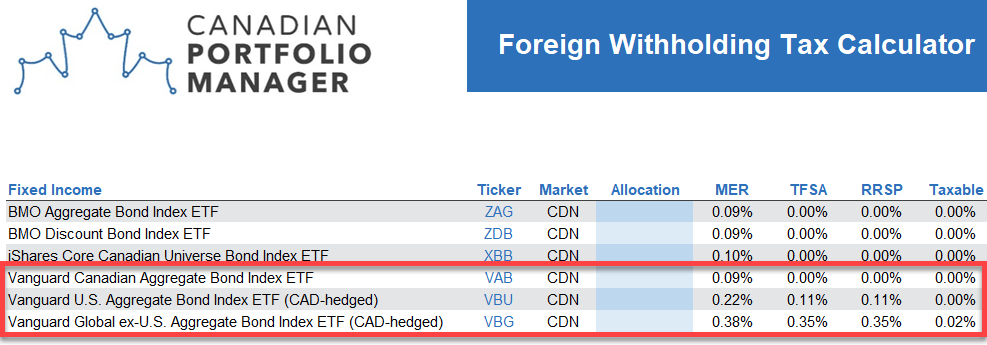

With annual bond yields hovering around 2% these days, you can’t afford to be frivolous with your fixed income investments. If you’re already planning to buy the underlying Vanguard ETFs directly, you could take this opportunity to forgo the foreign bond ETFs, which have higher costs and foreign withholding taxes than comparable Canadian bond ETFs. The trade-off is that your portfolio’s fixed income investments will no longer be globally diversified.

Sources: Vanguard Investments Canada Inc., The Vanguard Group, Inc., Bloomberg, as of December 31, 2018

By excluding the two foreign bond ETFs, your 7-ETF portfolio decreases to 5, reducing the number of moving parts you must tend to. Plus, you could increase your annual RRSP cost savings by between 0.10%–0.23%.

Sources: Vanguard Investments Canada Inc., The Vanguard Group, Inc., FTSE Russell, CRSP, as of December 31, 2018

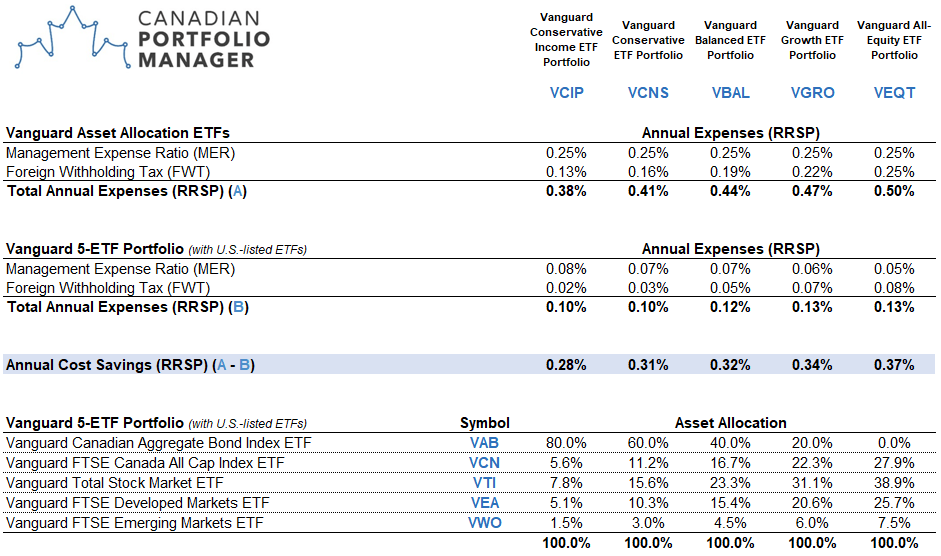

Buy American

Finally, if you’re investing within an RRSP, there’s even more opportunity to reduce your costs by switching to U.S.-listed foreign equity ETFs. Not only are they cheaper than their Canadian-listed counterparts, they’re also more tax-efficient in an RRSP. This can substantially reduce the drag from foreign withholding taxes.

It Can All Add Up

If you’ve been following along, your total annual cost savings from all these changes can range between 0.28%–0.37%. That’s a savings you could learn to love.

In the 5-ETF portfolio below, the Vanguard U.S. Total Market Index ETF (VUN) has been swapped with the Vanguard Total Stock Market ETF (VTI), while the Vanguard FTSE Emerging Markets All Cap Index ETF (VEE) has been replaced with the Vanguard FTSE Emerging Markets ETF (VWO).

You could continue to hold the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU). But swapping it for the Vanguard FTSE Developed Markets ETF (VEA) can further maximize your savings.

That said, there’s extra work involved if you do. Unlike VIU, VEA invests over 8% of the fund in Canadian companies. So, you’d want to adjust your allocation to VEA to avoid short-changing yourself on international stocks. This adjustment also increases your portfolio’s weight to Canadian equities, so you’d reduce your allocation to the Vanguard FTSE Canada All Cap Index ETF (VCN) accordingly.

Sources: Vanguard Investments Canada Inc., The Vanguard Group, Inc., FTSE Russell, CRSP, as of December 31, 2018

The Grass Is Not Always Greener

For me, the cost savings become most enticing after the final step of including U.S.-listed ETFs. But before you decide to make a clean break of it, make sure the following applies to you:

You have significant RRSP investments. If your RRSP is worth $10,000, you’re only saving up to $37 per year (before costs), but adding a lot of financial chores to your day. IMO, that’s totally not worth it.

Your brokerage doesn’t charge trading commissions on ETF purchases. If you’re paying $10 for each ETF trade, the trading costs can soon easily offset the savings. If you’re going to make the switch to individual ETFs, consider switching to a low-cost brokerage too.

You’re comfortable performing Norbert’s gambit at your brokerage. To purchase U.S.-listed ETFs, you’ll need to cheaply and efficiently convert your Canadian dollars to U.S. dollars. The Norbert’s gambit strategy is your best bet in this regard, so you’d better be a pro at it.

You enjoy working with portfolio rebalancing calculators. Remember, any time you add new money to your accounts, you’ll need to visit Vanguard’s site, collect the underlying ETF target weights for your desired asset allocation ETF, input them into your calculator, and place multiple trades. Your one-minute biweekly task has now stretched into at least a half-hour.

You’re good with numbers. You’ll also need to take the Canadian dollar figures from your rebalancing spreadsheet and convert them into U.S. dollars before calculating how many shares of each U.S.-listed ETF to purchase. If you tend to mix up whether to multiply or divide a quoted currency pair, you and your portfolio could be in for a world of pain.

Thanks for the great article and resources your website provides!

I have a TFSA and an RRSP account. Currently my RRSP is invested in iShares XGRO, and I would like to invest my TFSA similarly. However I’m wondering if it makes more sense to invest in the ETF’s individually so that I have 30% of my total savings in bonds and 70% of the total in equities; rather than having the money split into 30% of my RRSP account in bonds, 30% of my TFSA account in bonds, and then 70% of my RRSP account in equities and 70% of my TFSA in equities.

I am pretty new to investing and I am not familiar with Norberts Gambit, but I also want to maximize my portfolio.

Thanks!

@Jolene – If you’re new to investing, I would suggest sticking with an asset allocation ETF. I’ll be releasing more asset location videos over the next few months, so feel free to watch those to learn more.

Hi Justin, thank you so much for all you do for us! My husband and I are in a bit of a different situation as we only have a corporate account and RRSPs. We are in our early 50’s. About 60% of our investments are in corporate (75% XIU and 25% ZDB) and the rest in our RRSPs (VBAL). I’m thinking of selling our VBAL and purchasing VXC and VAB in order to trim down our Canadian equity. I understand that Canadian stocks are best in our corporate account for tax purposes which is why I would leave that account alone and tweak our RRSPs. I’m not comfortable with purchasing US etfs in our RRSPs so I understand it’s not quite as tax savvy but is this a good way to trim down our Canadian equity a bit? Or should I not bother and just stay with VBAL? My concern with that also though is when we retire and and need to draw from only VBAL from our RRSPs. I imagine we would have to split it up anyways at that point?

@Nicole – It doesn’t sound like you have a target asset mix. I would first determine what you’re aiming for, and then look to allocate your overall portfolio accordingly. As you already have a portfolio that includes multiple ETFs (i.e. XIU ad ZDB), I don’t think combining VXC and VAB in your RRSP increases the complexity of the portfolio.

Thank you so much for your reply. Yes, we do have a target asset mix of 70%/30% right now. Because VBAL in our RRSPS is 60/40, I maintain a 75/25 in our corporate account and it brings our target asset mix to 70/30.

Right now with 100% Canadian in our corporate account (XIU and ZDB) and VBAL in our RRSPs, It amounts to us having a 77% Canadian portfolio which isn’t diversified nearly enough from what I understand. At first, when I asked you, I was thinking of selling VBAL from our RRSPs and purchasing VXC and VAB in order to trim down our Canadian equity, however after crunching the numbers, that would still leave us at 74% Canadian so not worth it.

We currently invest monthly in both our corporate account and RRSP’S and the corporate will always be about 60% of our total portfolio while our RRSPs will be 40%. So it looks like there is nothing I can do on our RRSP side of it, so now it moves me back to thinking of slowly adding VXC into our corporate account and slowly water down our 100% Canadian there?? But the reason I put all Canadian equity and ZDB was because that is better for a corporate account for tax purposes. So I guess what I’m asking is should we be more concerned about diversification or about tax implications in our corporate account?

And like I mentioned below, I’m not comfortable with purchasing US listed etf’s, so VXC is the easiest for me at this time if need be.

@Nicole – I would be more concerned with diversification than tax-efficiency. Many of my clients have larger corporate accounts, and we hold foreign equity ETFs in them.

Ok, diversification it is, thanks!

I hope I can bother you with one last question? Now I’m trying to figure out if VXC/XIU/ZDB is more tax efficient in a corporate account than just holding VEQT/ZDB? And also if VXC/XIC/VAB is more tax efficient in an RRSP than just holding VEQT/VAB?? Thank you so very much!!!

@Nicole – Holding VXC/XIU/ZDB would be just as tax-efficient as holding VEQT/ZDB in a corporate account. Likewise, holding VXC/XIC/VAB in an RRSP would be just as tax-efficient as holding VEQT/VAB.

I achieved my 70/30 portfolio by holding VGRO in my corporate account and VAB in my RRSP.

It’s been fantastically simple even during the Covid crash.

Keeping things simple trumps tax efficiency for us now.

There is no perfect portfolio.

Hey Justin

I was reading up your post on the CPM Ridiculous ETF portfolio, and had an outstanding question. Another google search and found myself here.

https://www.pwlcapital.com/canadian-portfolio-manager-introducing-the-ridiculous-etf-portfolios/

In my RRSP account, I am considering converting my VGRO holdings into the 5 etf holdings ( VAB, VCN, VTI, VI, VWO ) for lower product costs and lower foreign witholding taxes. The need to convert CAD to USD is a step, but not a deal breaker because the initial amount of VGRO is S100K+. However, moving forward the regular contributions would be in small amounts. What do you suggest one do until the amount gains to a sizeable amount to make Norbert’s gambit worthwhile ( $10,000 a pop ). Should i simply keep it in a savings account or money market until it’s bigger.

@Kevin – You could purchase more units of VGRO until it is a sizeable amount, sell it, implement the gambit for the foreign equities, and then place your individual ETF purchases (and then repeat this process).

Thank you Justin for replying.

It seems obvious once you mention it, and a bit more reassuring coming from a professional. I will weight in and see how it compares to just letting it sit in a savings account ( EQ bank ). thannks again

Hi Justin, Thanks as always for the very informative posts.

In regards to your reply to R Johnson about U.S.-based iShares Core Allocation ETFs, I’ve also been looking at this, as I have a significant amount of savings in USD and I’d like to keep it in USD as I plan to move to the US in the next 5 years.

Do you mind giving me a sense of how much the tax drag will differ (if at all) between XGRO and AOA when in RRSP/TFSA/Taxable account?

I’ve read your posts on FWT (https://www.pwlcapital.com/part-i-foreign-withholding-taxes-for-equity-etfs/, https://www.pwlcapital.com/part-ii-foreign-withholding-taxes-for-global-equity-global-bond-and-asset-allocation-etfs/) and what I gathered was, since I already have the USD (so no need for currency exchange), for US-equity, it can be beneficial to buy US-listed ETFs vs Canadian listed ETFs (For RRSP, US-listed equity is more tax efficient, for TFSA/taxable account, FHT applies in the same way for both US-listed ETFs and Canadian listed ETFs). Then for international equity, US-listed ETF is only better for RRSP, but worse for TFSA and taxable accounts).

So does that mean, in terms of tax efficiency, AOA will be better than XGRO in RRSP but will be less efficient in TFSA and taxable accounts?

Thanks a lot for your help.

Hi Justin

I’ve been managing my portfolio of mostly Cdn dividend stocks for many years now. I find your articles and videos very, very informative. Because of my age and my wife having no understanding of investing, I have decided to revamp our portfolio and go with one of the Ishares balanced portfolios. It’s going to cost a little more but but the peace of mind is well worth it. My problem is we have a portion of our investments in USD. Because we still like to travel and pay for many of our vacations in US funds I do not want to convert all my investments to CAD. Is there an Ishare ETF in USD funds that would compliment my all inclusive Ishare balanced CAD portfolio? Thanks

@R Johnson – You could check out the U.S.-based iShares Core Allocation ETFs (AOR, AOM, AOA, AOK):

https://www.blackrock.com/us/financial-professionals/products/239765/ishares-moderate-allocation-etf

Thanks Justin!

In a taxable account what would be the size of the portfolio where you would consider the 5 ETF portfolio with 3 of the holdings as US denominated ETFs as worthwhile (relative to hassle of extra trading and repeated norberts gambit etc). I know the FWT benefit is not there in a taxable (non RRSP) account but there would be an MER decrease of 0.20% which may be helpful over a long time horizon. Would you consider this worthwhile at 100 G 500 G or over a million etc…. thanks for your opinion!

@Sumeer – I don’t typically recommend holding U.S.-based U.S. or emerging markets equity ETFs in taxable accounts (as this complicates the portfolio management and tax reporting). However, if you’re comfortable with the additional complexity, you can just determine the MER savings and whether you feel it’s worth it to you.

@Justin Thanks for your reply. One other quick question I had is whether you think the greater tracking error of VUN to VTI is significant/relevant. On Vanguard Canada’s website, over the last 5 years it is about -0.5% relative to benchmark for VUN but VTI tracking error is essentially 0.

Also, is the difference in returns over the last 5 years between VUN and VTI solely just based on currency fluctuation? I’ve read that in VUN you still hold US stocks in US dollars (through VTI) so without currency differences the return should be the same?

@Sumeer – VTI’s performance is before the 15% U.S. withholding tax (as VTI’s reporting is from the perspective of a U.S. investor). It also has a lower MER of around 0.03%.

VUN’s performance is quoted after the 15% U.S. withholding tax (which creates a ~0.3% drag on returns). It also has a higher MER of around 0.16%. Both of these explain the majority of the difference.

Check out my video on the topic: https://www.youtube.com/watch?v=D8wnrDJOFLY

@Justin: I notice in some examples in your model portfolios, you include VTI and VWO in RRSP accounts, which makes complete sense, but in that same portfolio you stick VIU in the RRSP. Why not use VEA? Just because of the Canadian content and having to scale back VCN?

Thanks, Que

@Que – That’s correct. I wanted the comparisons across the portfolios to be similar. I personally use IEFA and IEMG in the RRSPs I manage.

@Justin: Why would you choose the IEFA/IEMG combo over the VEA/VWO combo?

@Que – Because VEA/VWO include Canadian stocks (which I already have an allocation to in the portfolio).

Hi Justin,

Thanks for the the post. Would you recommend this for an RESP portfolio? Though I think that given the lifetime limit for RESP, the extra work is probably not worth it.

@Simon Ikuseru – There’s no foreign withholding tax benefit to breaking up an asset allocation ETF in an RESP. As RESP accounts are modest in size, they are generally better suited for asset allocation ETFs.

Any comment on US bonds ETF like:

– TLT,

– IEF,

– SHY

@Jean: I don’t invest in U.S. bond ETFs that do not hedge the currency risk (as the main reason to include bonds in a portfolio is for risk/volatility reduction, which you typically get with Canadian bonds or currency-hedged foreign bonds).

Hi Justin,

Thank you so much for this great content. I will soon have a lump sum amount to invest in a taxable account. I was wondering what would be the biggest difference between buying the underlying funds of VEQT and your model ETF portfolio for taxable accounts?

@Philippe: One difference would be the split between Canadian and global stocks. This split is 1/3 and 2/3 in the CPM portfolio and 30% and 70% in VEQT.

Another difference is cost. VEQT is more expensive than holding the individual ETFs in the CPM portfolio.

Finally, VEQT is easier to manage than holding 2-4 individual ETFs (like in the CPM portfolio).

Hi Justin,

How do you define “significant RRSP investments”? is $100K significant? $200K? more?

@Abby: The definition of “significant” would be different for everyone. I tend to think if an investor has more than $100,000 in foreign equity ETFs in their RRSP, they may want to consider switching to a more tax-efficient alternative (although sticking with a simple 1-ETF solution, even past this asset level, has many benefits that go far beyond cost savings).

Thanks for this in-depth article Justin, it’s great to see the exact percentages per all-in-one fund. I shared it to PFC.

You’re right to mention those “grass isn’t always greener” caveats at the end. For people that aren’t good with numbers or anyone who’s got better things to do than input numbers into rebalancing calculators, they might find Passiv useful – it does those calculations for you and the paid version even executes trades and sends you portfolio drift notifications. It’s at http://www.getpassiv.com if anyone wants to give it a try, and you can see a walkthrough here: https://vimeo.com/groups/590910/videos/338692722

Justin, have you considered Mawer’s Balanced fund, MAW104 (or MAW105 for non-reg accounts) and compared to the model ETF portfolios? This is another great option to the standard 3-fund portfolio.

@Jesse: I do not recommend active investment strategies. There will always be some active funds that outperform a passive index strategy over various time periods (problem is, we don’t know which funds will outperform in advance).

If an investor does prefer an active strategy, Mawer has reasonable fees and a good track record (I can’t say whether this will continue going forward though).

I’m torn between MAW105 or XAW for my non-reg, my TFSA and RRSP are finally full. I’m not bullish on Canada and don’t want to add anymore, I’m thinking XAW would be better than VEQT and I don’t think I want bonds in my non-reg account. Any thoughts on this?

@Jesse: Your decision-making process should start by answering the following questions:

– What is your investment philosophy (i.e. do you believe in passive investing or active investing)?

– If you believe in both, what proportion do you want to allocate to each strategy?

– What is your target asset mix between stocks and bonds?

– What is your target asset mix between Canadian stocks and global stocks? (historically, 25% Canadian stocks / 75% global ex Canada stocks has had the lowest volatility).

– Where do you want to hold each asset class? (this will depend on your tax situation, cash flow requirements, tolerance for complexity, etc.)

Once you’ve come up with answers to these questions, you should be in a better position to make a thoughtful decision.

Justin,

Thank you for your clarification of capital loss write-off against outside gains in a premium bond. I had a basic brain cramp trying to consider whether such writeoffs were a good thing, taxwise, and offset the deficiencies of being taxed on 100%, while suffering recovery of only half on the CG side.

Your assertion that you’ve already considered this in evaluating the tax impact is a ready-made solution not to make this a factor, and by specifying our recent marginal tax rates, I was just inviting consideration that this, too, mattered enough to change any thinking.

So, I’ll take away the opinion that offsetting capital gains elsewhere don’t matter very much, even at max marginal rates, as you’ve already rolled them into your thinking that discount bonds are desirable in a taxable account.

We may be rolling our RRIF withdrawals into a one-year GIC, rather than rebuilding the three-year ladder that this maturing one would normally suggest.

I’m having trouble seeing the benefit of gaining only 0.30% for the extra two years locked in, but a continuation of the recent move to lower interest rates may make this a bad choice!

As always, the thoroughness of your response and your vastly-greater understanding of the concepts, is a beacon to be followed for us DIY types!

Hi Justin,

My question on the desirability of discount bond ETF in a taxable account is more basic, and trying to get my head around the concept:

1. For a “premium” bond, you suffer a capital loss on sale, for which you receive only a 50% credit, when you pay tax on the full income, as 100% taxable interest, right? So you’re paying tax on this differential.

2. Assuming you have capital gains elsewhere to offset this capital loss, does this in any way, balance out this effect? We have marginal tax rates on 2017 and 2018 ranging from 31% to 44%, and is this a consideration in any overall tax effect?

Still considering your GIC ladder vs bond ETF blogs, as we have the first of our three year ladder maturing next week, and difference between one and three year rates have shrunk from last year’s 0.7% differential to just 0.3% at GIC providers.

So it’s GIC renewal or bond ETF in the RRIF proceeds that are moving into taxable status, as GIC purchase within RRIF account is at a horrible interest rate compared to outside.

Any and all comments most welcome as our decision time arrives. Thanx,

Dave…

@Davie215:

1. Correct – you receive a capital loss that you can use to offset capital gains (if you have them). If capital gains were fully taxable, there wouldn’t be a premium bond issue.

2. If you have capital gains to offset the losses, this makes the tax drag less. However, most of my recent analysis assumes that the losses can be fully offset with existing gains (so the figures are already conservative). The analysis used the top rates for an Ontario taxpayer (I can’t look at the numbers any longer for different tax rates or I’ll go cross-eyed ;)

Perhaps just a middle of the road approach between bond ETFs and GICs would allow you to move forward with your decision without too much regret?

Hi Justin, thanks for the interesting post. So this would let you save money in management fees, which you can quantify. But I wonder how to quantify the the other side of things in terms of risk and return. For example, if you’re in a taxable account, and you break things apart and opt for ZDB (at 0.09%) instead of a mix of Canadian, US and global bonds, you’ll save on fees and bit on taxes, but I have difficulty figuring out how much it would cost because of the reduced diversification (even comparing ZDB to ZAG which has > 7x more holdings..). Do you have any insight into how to figure out if this is a worthwhile trade-off? Not sure what the dollar value of extra diversification is…

@Tyler: The diversification of ZAG over ZDB is deceiving. Even if ZAG holds more individual bonds, it is really the exposure per issuer which is relevant. For example, if ZAG holds 500 federal Government of Canada bonds, and ZDB holds just 100, it doesn’t mean that ZDB is less diversified. You would have to review all the holdings of each ETF to determine the issuer concentration (mainly focusing on corporate issuers). The last time I did this, I found ZDB to be more diversified by corporate issuer than ZAG.

As for foreign bond ETFs, once you include the additional MERs and foreign withholding taxes (relatively to Canadian bonds), they don’t look very attractive.

Hi Justin, I agree about the MERs (0.2% and 0.35% fees are not very appealing on the Vanguard ETFs), though foreign withholding taxes appear to be nearly completely recoverable because it seems to really only apply from the US to Canada (Vanguard reports only 0.2% of the BNDX’s dividend is foreign tax tax — compared to the ~16% on VBG from US to Canada). Was just curious if there was a general methodology to compare the benefits of the extra foreign exposure to the extra 0.1-0.3% in fees.

@Tyler: Without knowing what the future holds, we can only look at the past for any insight.

Over the past 20 years (as of June 30, 2019), a balanced portfolio without global bonds (before fees/taxes) had a Sharpe ratio (i.e. risk-adjusted returns) of around 0.5132.

If we split the bond allocation to 60% Canadian / 40% global, the Sharpe ratio decreases slightly to 0.5099.

If the global bond ETFs were cheaper and more tax-efficient, I think there would be a better case for them (as they aren’t expected to impact the portfolio’s risk-adjusted returns). I still think it’s fine to include them in a portfolio or asset allocation ETF, but I’m just not overly excited about the additional costs ;)

Very interesting, thanks Justin. That’s exactly the type of information I was hoping for :).

@Tyler: Glad to hear!

There is getpassiv for Questrade users. It’ll tell you how many shares to buy (or sell it you turn the option on). I used to use a spreadsheet as well but this made it really easy.

Hi Justin,

Is there a service that allows automatic copying and pasting of portfolio holdings into Google Sheets? I’d be willing to switch brokerages for this feature. Every time I add money to my portfolio, I go through the process of updating all the values of my holdings for each of my accounts in my asset allocation spreadsheet, and this takes a good 10 minutes every 2 weeks. I don’t think I can automate the ETF purchasing portion of my routine, but that would be good to automate too.

@Julien Brown: I haven’t found a decent service yet. I still copy and paste the figures into my own rebalancing spreadsheet – perhaps other readers can share their processes?

Thanks for another great post Justin! In your opinion would the results be similar if one was using iShares XBAL or XGRO but to a lesser extent? Interesting stuff and thanks for the time you put in to increase the body of knowledge for the DIY investor.

Cheers,

Josh

@Josh: The results would be similar if you subbed in U.S.-listed foreign equity ETFs (for the Canadian-listed foreign equity ETFs) in XBAL or XGRO. I’ll take a look at the savings in a future blog post.

Thanks for doing this Justin,

It really helps one think through this approach. I have decided to use VGRO + ZDB in my Corporate account. It might not be the most tax efficient but it is likely one I can live with. I realize that VEQT would have been more efficient but I appreciate the total market re balancing that VGRO has.

I figure the market would have to move a lot before I need to balance with my ZDB portion.

@Emily: There are so many ways to achieve a target asset allocation. If this way works for you, I say go for it! :)

What do you think of this strategy? I have VTI, VEA, VWO in my USD RRSP and VCE in my CDN RRSP. On a monthly basis, I’m purchasing XGRO on a PACC. There’s no cost to buy, but might be to sell. Once a year, I’ll sell XGRO, do Norbert’s Gambit to transfer CDN to USD and buy VTI, VEA, VWO in the appropriate amounts to keep my target allocations in range.

Seems like a sound approach that reduces trading fees and other costs. Or am I missing something?

@Ken: That sounds like a decent approach. There could be an opportunity cost (or benefit) if your brokerage does not allow you to complete the gambit on the same day (only certain brokerages allow this, like RBC Direct Investing or BMO InvestorLine). If you have to wait a few days for the sale of XGRO to settle before purchasing VTI/VEA/VWO, you could potentially miss out on some market growth (or loss).

Hi Justin;

Just read your post and and was glad to see it; well done again.

I went through a re-balancing exercise early last year, about 2 weeks before the Vanguard allocation ETFs came out. What an excruciating pain that was! Decided to utilize the new products in future and have been slowly migrating to those.I agree with all your comments regarding cost and do try to minimize those as much as possible, but the ease factor weighed heavily on my decision. The other factor you didn’t mention, although it was somewhat alluded to, is that as we get older, our ability to work with these financial products becomes more difficult. I like the set it, forget it factor that is part of the package and am willing to forego the additional savings for that.

@John Storjohann: All great points. Although 0.37% sounds like a big deal, the benefit of simplicity could easily overpower this cost savings.

Justin……I thanks for all the great advise and info you provide us with. The real benefit of the portfolios is its simplicity and ease of follow up required once its set up.I also think it might be a great vehicle for an Estate trust account which I don’t think you have touched on.

The small saving in doing it yourself just isn’t worth it. If you choice a DIU portfolio will you actually follow through consistently enough to achieve the same consistent exposure and results?

However you sparked my interest when you said to hold the same funds in the US equivelents.I wonder if you might expand on that and what the actual benefits are in an RRSP or Regular account?

@Gus Robertson: The Vanguard Canada Asset Allocation ETFs are not the same as the iShares U.S. Asset Allocation ETFs (so they shouldn’t be considered substitutes). You can visit the websites and check out the difference in their underlying holdings (but generally, the Vanguard Canada AA ETFs have more Canadian stocks and bonds than the iShares U.S. AA ETFs).

Similar question. Would holding VTI and VXUS be similar to VTI, VEA + VWO excluding china? Other than losing china A shares, is there any other difference?

@Erin: Holding VTI/VXUS instead of VTI/VEA/VWO would be very similar (other than not as much in China A shares, but that is likely to change in 2019/2020, as FTSE Russell starts including China A shares in their global equity indices).

Thanks for clarifying.

Hi Justin,

Another masterpiece that only you can do for us!

Rather than the complexity of multiple trades to keep the individual equity components, why not just take the asset allocation of equities from VEQT and add whatever Canadian bond ETF to it? Then only two components to worry about for commissions.

Unless you are reverting to USD components and blending to equate to same geographical components, this is far simpler to manage, though not the ultimate in tax efficiency.

VEQT seems to me was designed for just such a purpose — to allow an investor to choose both the level and the source of FI.

I’m pretty sure that the VT solution involves a different set of components that you’ve already discussed as being unlike the asset allocation components, and not as straightforward for dealing with the withholding impact?

@Davie215: Using VEQT does not address the foreign withholding tax issue in RRSPs.

A combination of VT/VCN (weighted properly) would be the closest 2-ETF alternative though.

“@Davie215: Using VEQT does not address the foreign withholding tax issue in RRSPs.”

Never claimed that it did. I read your piece as a 2-step process, where ditching the foreign bonds, leaves you with a 5-ETF package. Should you buy the four equity elements as CAD-domiciled, you suffer the multi-commission rebalancing to the prescribed asset mix. You warned about the cost of doing so.

But, with VEQT and your personal choice and level of fixed-income, it becomes a 2-ETF solution with full maintenance of Vanguard’s choice of global equity balance.

Step 2 in your analysis was to deal with the RRSP impact of foreign taxes on the equity side by buying US-domiciled holdings, giving more beneficial tax treatment.

I was simply responding to Part 1 of your process, not disputing your conclusions. Those who don’t elect to deal with USD equity holdings ought to have a benefit, too, without the complexity of 5-ETF rebalancing, don’t you think?

Justin, Thank you for this, I’ve been thinking of using something similar to your “Vanguard 5-ETF Portfolio” for our RSP/RIF accounts to reduce the FWT cost inherent in VGRO.

Question: Rather than using VTI, VEA & VWO for the foreign equity allocations, why not just replace them with VT – MER 0.09%? Simpler & less re-balancing required.

VT holds about 3.1% Canadian equity and this could be adjusted by reducing the allocation to VCN proportionally – a smaller adjustment than required if VTI, VEA & VWO are used.

Cheers, John

@John McKibbin: VT would be another decent substitute for VTI/VEA/VWO. Although slightly more expensive than the trio (with not exactly the same exposures), VT would be much easier to manage.

Justin, have you worked out the withholding tax for vxus in an RRSP ? The combination of VTI and vxus for usd RRSP should be fairly efficient and fairly easy to manage .

@MDJ: I haven’t, but the VTI/VXUS combo should be similar to VT in the spreadsheet.

Justin

I agree that VTI/VEA/VWO, combined, is slightly less expensive than VT but after re-balancing costs are considered probably not.

I also agree that VTI/VEA/VWO do not have exactly the same holding as VT – 12,204 vs. 8,014 securities. But VT covers more than 98% of the global investable market capitalization and I figure that’s close enough.

The same FWT costs that can occur in RSP/RIF accounts can also occur in register Canadian charity accounts.

Thank you for all work identifying the FWT costs associated with CAD & USD ETFs in the various types of investment accounts!