In my last blog post, we worked out the approximate asset class weights for US, international and emerging markets stocks targeted by the iShare Core MSCI All Country World ex Canada Index ETF (XAW). Now that we’ve got our breath back and our allocations in order, let’s sharpen our scissors and start running through what it would take to slice up a 3-ETF portfolio holding a single global XAW fund into a 5-ETF portfolio holding the same positions in individual ETFs.

For example, a balanced 3-ETF portfolio (such as 20% Canadian stocks, 40% global stocks and 40% Canadian bonds) could be recreated into a 5-ETF portfolio by multiplying the 40% global stock target asset allocation by each of the US, international and emerging markets stock allocation weights that we calculated in our previous blog. This would lead us to invest 21.37% of the portfolio in US stocks, 13.89% in international stocks and 4.74% in emerging markets stocks.

Money Makes the World’s ETFs Go Round

Do you remember why in the world we’d want to create a more complicated handful of holdings out of your simple three-part portfolio to begin with? The simple answer: money. In an RRSP account, there can be noticeable foreign withholding tax and product cost savings to be had by breaking up with your global stock ETF. The larger your portfolio, and the higher your allocation to global stocks, the greater the potential savings.

By moving to a 5-ETF portfolio, you can potentially save $100s if not $1,000s per year.

Have I got your attention? Now to the logistics.

Breaking Up for Fun and Profit

Here are what the allocations described above look like in table form:

| Stock Asset Class | XAW Weight (A) | Global Stock Portfolio Allocation (B) | Balanced Portfolio Allocation (A × B) |

|---|---|---|---|

| US | 53.43% | 40% | 21.37% |

| International | 34.71% | 40% | 13.89% |

| Emerging Markets | 11.86% | 40% | 4.74% |

| Total | 100.00% | 40.00% |

So if you were managing a $100,000 balanced portfolio, you would allocate $20,000 to a Canadian equity ETF ($100,000 × 20%), $21,370 to a US equity ETF ($100,000 × 21.37%), $13,890 to an international equity ETF ($100,000 × 13.89%), $4,740 to an emerging markets ETF ($100,000 × 4.74%) and $40,000 to a Canadian bond ETF ($100,000 × 40%).

Intentionally Familiar Turf

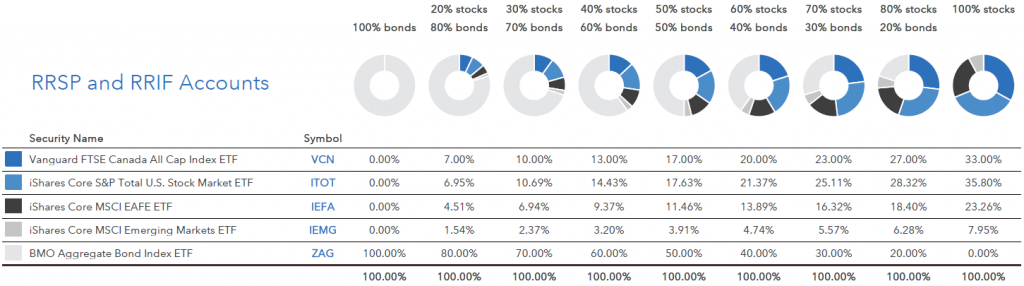

I’ve included the portfolio weights for other asset allocations below (as of September 30, 2017). If you’ve already noticed that these portfolios closely resemble my 5-ETF model portfolios, give yourself a gold star, because this is no coincidence. My model portfolios are meant to approximate these asset mixes, albeit with fewer decimal points to clutter the view.

As of September 30, 2017

The Not-So-Fine Print

There’s a catch, of course. Isn’t there always? To score the cost savings that make the exercise worthwhile, you will need to purchase US-listed ETFs in your RRSP account. This requires mastering the Norbert’s gambit strategy for converting your loonies to dollars as cheaply as possible. (I’ve posted step-by-step Norbert’s gambit YouTube tutorials to help with this task.)

If you feel intimidated by the process and would rather stick with your easier 3-ETF portfolio, that’s certainly your call. But before you dismiss the idea entirely, remember: The savings can be as much as the management expense ratio (MER) you’re already paying each year. For example, a balanced 3-ETF portfolio has an MER of 0.14%. The foreign withholding tax and product cost savings of a 5-ETF portfolio in an RRSP account is also about 0.14%. Are you sure you want to leave that much money behind?

To help you decide, check out the table below, showing estimated tax and cost savings for a 5-ETF portfolio. If you have less than $50,000 in your RRSP account, a very conservative asset allocation, or both, you may decide the potential savings – about the cost of a modest meal – just isn’t worth the extra complexity. At the other end of the spectrum, if you can feast on major money spared, you may want to go for the gusto.

Estimated Annual Tax and Cost Savings: 5-ETF Portfolio vs. 3-ETF Portfolio

| RRSP Value ($) | 100% bonds | 20% stocks 80% bonds | 30% stocks 70% bonds | 40% stocks 60% bonds | 50% stocks 50% bonds | 60% stocks 40% bonds | 70% stocks 30% bonds | 80% stocks 20% bonds | 100% stocks |

|---|---|---|---|---|---|---|---|---|---|

| $50,000 | $0 | $22 | $35 | $47 | $57 | $69 | $81 | $91 | $116 |

| $100,000 | $0 | $45 | $69 | $93 | $114 | $138 | $162 | $183 | $231 |

| $150,000 | $0 | $67 | $104 | $140 | $171 | $207 | $243 | $274 | $347 |

| $200,000 | $0 | $90 | $138 | $186 | $228 | $276 | $325 | $366 | $463 |

| $250,000 | $0 | $112 | $173 | $233 | $285 | $345 | $406 | $457 | $578 |

| $300,000 | $0 | $135 | $207 | $280 | $342 | $414 | $487 | $549 | $694 |

| $350,000 | $0 | $157 | $242 | $326 | $399 | $483 | $568 | $640 | $810 |

| $400,000 | $0 | $180 | $276 | $373 | $456 | $552 | $649 | $732 | $925 |

| $450,000 | $0 | $202 | $311 | $420 | $513 | $622 | $730 | $823 | $1,041 |

| $500,000 | $0 | $224 | $345 | $466 | $570 | $691 | $811 | $915 | $1,157 |

| Cost/Tax Savings (%) | 0.00% | 0.04% | 0.07% | 0.09% | 0.11% | 0.14% | 0.16% | 0.18% | 0.23% |

Number crunching

So now that you’ve seen the potential cost savings and you understand what’s involved with managing a 5-ETF portfolio, are you considering making a change? Feel free to leave your comments below about your experience managing a 3-ETF or 5-ETF portfolio, and why your chosen number works for you.

Hi Justin,

I have previously been following your zag/xaw/vcn model but began looking into changing into an all-equity XEQT or the 5 model XIC (25%), XUU (45%), XEF (24%), XEC (6%) (not enough $ to make it worth using itot/iemg). I’ve calculated a MER of 0.1155% with 5 model vs 0,2% for XEQT. I then looked at https://larrybates.ca/t-rex-score/?fbclid=IwAR3O8S_CiUFolI8aC2AmlvNMxa4RfbHjQhZRELkI9jx67u0aNPBQgHvMA7c to calculate the fees lost and found that with a return rate of ~6% and a $100000 porfolio over 25 years I’d be losing thousands on the all-in-one model due to the management fees and am now leaning towards XEQT. Just wanted to run my train of thoughts with you as people have said the difference in management fees is minimal but seems pretty substantial to me. The can equivalent of XEQT is the xic,xuu,xef, xec I’ve listed above with those proportions right?

I am also wondering whether it makes a difference as to whether I put the etfs in my TFSA vs RRSP. So far I’ve been keeping bonds in the RRSP but for the xic/xuu/xef/xic it seems both accounts are the same?

*leaning towards using the 5 model rather than XEQT

@vic – Most investors are better off with a simple one-fund solution. However, if you’re comfortable meticulously managing multiple ETFs to slightly reduce the MER, I don’t see anything wrong with that.

There’s no foreign withholding tax differences between holding XIC/XUU/XEF/XEC in an RRSP vs. a TFSA.

Hi Justin, I currently have VCN/VUN/XEC/XEF/ZAG in my TSFA and VAB/VCN/VXC (<50k) in my RRSP via Questrade. I was thinking of just selling my RRSP positions and doing a VEQT/VGRO mix going forward to simplify things until it gets to 200k then switch to a 5 ETF model to save on the withholding taxes. Should I just keep my TFSA the way it is if I keep rebalancing it appropriately? Thank you.

@Mario: I don’t see any issues with keeping the TFSA as is for now (until you’re ready to pull the trigger on a simpler portfolio).

Hello Justin, I just transfered about 100K RRSP from robo-advisor in a new brokerage account to become fully DIY.

This amount is all in a RRSP. I was about to invest it following the 3 ETF model, and I noticed your explanations on benefits of th 5ETF for RRSP for foreign witholding tax

woah , I am not ready emotionnaly to study all this Norbert gambit strategy thing I am still learning how to place trades lol. Maybe in a year or two I will do this fine tuning.

But here’s my question:

In this RRSP , considering the foreign tax, is it cheaper to invest it all in VGRO, or the 3ETF with XAW? I guess VGRO have the same foreign tax than the 3 ETF…?

Thanks, I am waiting for your answer before investing all this for the first time

Have a great year!

@Doum: VGRO would have slightly higher foreign withholding tax than ZAG/VCN/XAW, as it includes foreign bonds, but the difference is very small.

If you’re just starting out, a one-fund solution is a great option.

Hi Justin,

Sorry for the confusion. Let me explain further. Using your model portfolio ETF’s using asset location strategy to reduce taxes and keep the following overall asset mix. 30% bonds, 70% equities asset mix across all our accounts (rrsps, tfsa, taxable accounts), rather than 30% bonds and 70 % equites in each individual account. With equites split about 1/3 Canada, 1/3 USA, 1/3 outside North America. Using asset location across all accounts to reduce taxes and keep overall 30% bonds and 70% equities as described above:

place VCN into the taxable account. (Canadian dividends are taxed favourable)

place ZDB into the taxable account. (taxed favourably)

place ZAG mostly into the TFSA’s

place XAW or XEC,XEF, XUU,into taxable accounts ( are withholding taxes recoverable here?, getting Europe, Asia exposure)

place ITOT, into RRSP’s (no foreign withholding taxes here, lower mer’s, and get US equity exposure, using US dollars)

This may result in the entire RRSP’s just consisting of ITOT. Is that an issue in your opinion? Any problems with this approach?

thanks again.

@TJ: Asset location is an extremely complicated topic (most of your points are a bit outdated). There are two main approaches to asset location:

1. Traditional approach. This would have you holding equities in your TFSA first, taxable account second, and your RRSP third. I tend to just hold a mix of Canadian, U.S. international and emerging markets equities in the TFSA (as I don’t know which asset class will outperform going forward), but some investors prefer holding just Canadian equities, as there is no foreign withholding tax drag. For an Ontario taxpayer in the highest marginal tax bracket, you would generally hold U.S. equities in your taxable account first (low dividend yield), Canadian equities second, emerging markets equities third, and international equities last. If you needed to hold fixed income in your taxable account, you would hold a low-coupon bond ETF, like ZDB.

2. After-tax asset allocation approach. If you manage your portfolio asset mix from an after-tax perspective (most investors do not), your RRSP would be worth less (as the government technically owns a chunk of it). You would therefore want to hold equities first in your TFSA/RRSP (favouring U.S.-listed foreign equity ETFs in your RRSP first). You would then hold tax-efficient bond ETFs (like ZDB) in your taxable account.

Here’s a tonne of reading on the subject:

https://canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

https://canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-rrsps/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-rrsps-vs-taxable-accounts/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-taxable-accounts/

https://canadianportfoliomanagerblog.com/optimal-asset-location-applied/

HI Justin,

We have a large family portfolio, high 6 figures, which includes taxable accounts, tfsas, rrsps,

15 – 20 yrs away from retirement. Asset location suggests that for our US equity exposure we should keep our entire rrsp’s in US listed etfs to reduce mers and foreign withholding taxes.

Is there any problem with having our entire rrsp’s in US listed etf’s?

What about market timing and converting the Canadian dollar rrsp’s to US dollars with norberts gambit and currency risk?

It is a little nerve racking to convert such large amounts of Canadian dollars to US dollars all at once.

The Canadian equity, international equity, and Canadian bonds will be in the other accounts.

Your thoughts.

Thanks.

@TJ: Where does asset location suggest that you should hold your U.S. equity exposure in your RRSPs? Although holding U.S.-listed U.S. equity ETFs in your RRSP reduces your foreign withholding taxes, this does not imply that you should hold your U.S. equity ETFs in your RRSP, rather than in other accounts (for example, if you hold U.S. equity ETFs in a taxable account, the foreign withholding taxes are generally recoverable). U.S. equities have a very low dividend yield, so they can be very tax-efficient in a taxable account as well (especially if you’re following the traditional asset location advice of holding equities in your TFSA and taxable accounts first).

If you’re invested in Canadian-listed U.S. equity ETFs, you’re already exposed to the U.S. dollar. Just because your ETF trades in Canadian dollars, doesn’t mean that is your currency exposure. So switching a Canadian-listed U.S. equity ETF to a U.S.-listed U.S. equity ETF has no impact on your overall currency exposure.

Depending on your brokerage, there could be stock market timing issues of using Norbert’s gambit – I discuss this risk here (you could consider working with a brokerage that allows you to process the gambit in a single day, such as RBC Direct Investing or BMO InvestorLine):

https://canadianportfoliomanagerblog.com/when-should-i-dump-veqt-or-should-i/

Hi Justin,

You suggest that 5-ETF portfolio will save more money than 3-ETF portfolio.

Will a 6-ETF portfolio save more money?

What is a 6-ETF portfolio, if any?

@Albert: It’s not the number of ETFs that makes a significant difference on the fees, it’s the fact that the foreign equity ETFs are U.S.-listed rather than Canadian-listed (U.S.-listed ETFs avoid more foreign withholding taxes, and also have lower product fees).

You can also create a 3-ETF portfolio or 4-ETF portfolio using U.S.-listed foreign equity ETFs (I’ll be writing about these options in my next blog post this Monday).

Hi Justin,

Would you suggest someone who is putting in smaller amounts into their RRSP (and therefore may not be able to take advantage of Norbert’s Gambit) stay with XAW rather than breaking it up?

Thanks for your insight!

@Giacomo: I think this is a very reasonable trade-off. If the accounts grow large enough where Norbert’s gambit makes sense, you could always sell XAW, do the gambit, and repurchase US-listed foreign equity ETFs.

Thanks for the reply Justin and all of your hard work on the blog! I just had a quick follow up question. If I hold VCN, XAW and ZAG in both my RRSP and TFSA would it make the most sense to spread my asset allocation across the 2 accounts and hold XAW in my TFSA where it is more tax efficient (I think)? And therefore hold more proportion of ZAG and VCN in the RRSP?

@Giacomo: XAW would be just as tax-efficient in a TFSA as an RRSP (only individual U.S.-listed U.S. equity and emerging markets equity ETFs -such as ITOT, VTI, IEMG, VWO – would be more tax-efficient in an RRSP than a TFSA).

Technically, holding equities first in your TFSA (and then in your RRSP) would be expected to result in a higher ending portfolio value, but this is because you are taking on more equity risk from an after-tax perspective:

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-rrsps/

Hey Justin,

Shouldn’t savings be higher than 0.18% in the “Estimated Annual Tax and Cost Savings” table? When comparing the ‘Foreign Withholding Taxes’ white paper, the table in the appendix shows tax and MER savings amounting to ~0.3% on average. Am I missing something?

@Tyler: The white paper does not include any allocation to Canadian bonds (the more bonds you have, the lower the total percentage tax drag on the overall portfolio). I’ve posted a Foreign Withholding Tax Calculator, if you feel like crunching updated numbers on your own:

https://canadianportfoliomanagerblog.com/calculators/

Hi Justin,

Some time last year you published your new 3-or-5 ETF Model Portfolios, recommending XAW as the starting point to cover equity markets outside of Canada, mirroring the sample ETF portfolio from the Canadian Couch Potato.

What went into this decision to simplify the portfolio, despite slightly higher fees? Have you found that simplicity has its own advantages for a DIY ETF investor?

@Bill: Yes, there are huge behavioural reasons for keeping a DIY portfolio simple. You may notice that I’ve also started to include the 1-ETF Vanguard Asset Allocation solutions in the model portfolios section of my website (which is about as simple as it gets).

I also wanted to show that a 3-ETF (CCP) and a 5-ETF portfolio (CPM) have always essentially been the same thing (some DIY investors seemed to think that the CPM portfolio was better because it had more holdings).

Hi Justin,

In case you noticed a comment I made in reply to another blog post, I just wanted to say, thanks, that’s a helpful clarification on the approximate timeframe for the change. Looking at the date of yours and Bill’s comment, it looks like the change to a 3 ETF portfolio occurred in early to mid 2018 as I do see the 3 ETF portfolio in your June 30, 2018, semi-annual update.

I generally think that it makes sense.

Separately, with Vanguard’s two new single ticket ETFs, VCIP and VEQT, I guess the key difference between VEQT and, say, buying a single VAW is that you’ll have greater home country (Canada) and U.S. equity exposure.

Your Norbert’s Gambit videos are helpful, but I noticed you didn’t do one for your Scotia iTRADE account. Is that because Scotia iTRADE doesn’t offer a fee-free U.S. dollar RRSP? Buying U.S.-listed equity ETFs is quite compelling to reduce or eliminate the tax drag from the foreign withholding taxes in RRSP accounts and, from your videos, most brokers (yet) don’t seem to have a problem with the position journaling (I think Virtual Brokers might charge a fee now?). It’s too bad, really, Scotia iTRADE didn’t offer a(n) (admin) fee-free U.S. dollar RRSP (or Qtrade for that matter).

Cheers,

Doug

@Doug Mehus: Scotia iTRADE didn’t allow Norbert’s gambit in RRSPs when I initially filmed the other videos (they do now).

Hey Justin, I just wanted to say thanks for sharing these blog posts! Our portfolio was set up several years ago as VCN/VSB/VTI/VXUS. Sounds like we’re still on the right track :)

@Troy: You’re very welcome! Glad to hear you’ve maintained your investing discipline over the years :)

Will there be any similar posts that compare a 3 ETF vs 5 ETF portfolio in TFSA/RESP, and Taxable accounts? I would love to see a table similar to the one in this blog post but for other account types, in order to determine if XAW is ‘good enough’ for my Account size and allocation.

@Mark: There’s no withholding tax benefit of holding a 5-ETF (vs. a 3-ETF) portfolio in a TFSA, RESP or taxable account, other than a slight fee difference (so XAW should be fine in those account types).

True, I would expect the TFSA to only have the fee difference.

For a taxable account however, in addition to the fee difference, would there also be a difference in the way income/gains/dividends are taxed? Or are they essentially the same or negligible?

Thanks Justin!

@Mark: The ETFs are trust structures, so any income/gains/dividends they distribute maintain their character for tax purposes (so there is essentially no difference in a taxable account).

Capital gains realized by XAW may be different than capital gains realized by yourself during rebalancing, however.

Hi Justin,

You discuss the benefits of a 5 ETF vs a 3 ETF portfolio, but can you provides some tips on how to effectively make that transition?

For an investor with part of their portfolio in a non-registered account, converting would incur capital gains for the sale of the 3-ETF funds. At what point is that worth it (especially if your current tax bracket is high)?

Thank you.

@Canadian Investor: The benefits presented in this blog post are for someone holding a Canadian-listed global equity ETF (like XAW or VXC) in their RRSP (there is little benefit from splitting up XAW or VXC in a taxable account, especially if you have significant unrealized capital gains on the holdings).

I would like to balance the 5 ETFs across two spouses with “a combined view” of RRSPs, TFSAs and non-registered accounts. Approximate combined RRSP values of 240,000, TFSA – 80000, and savings of 20,000.

Existing RRSPs and TFSAs are both split CAD/USD 60/40 in native currency ETFs. Non-reg is CAD only. We travel to the US and will retire with requirements for $US. I also have a pension that will cover 70% of retirement “needs”. Currently age 55

Which funds should be put into which buckets (RRSP, TFSA, non-reg) assuming I will draw down RRSPs first when I retire in 10 years. I have 5-10 years to contribute more now that the kids have flown the nest.

I don’t need specifics, but a preferred “account/fund” recommendation would be helpful. I am mindful of the effect of the 15% withholding tax on dividends in the TFSA.

Thank you

@david: Unfortunately, I cannot provide specific investment advice.

Hi Justin,

Thanks for what you do..so i just finished up my 100% stocks portfolio for my wife using QT in her RRSP but i just use the TFSA index funds for simplicity. Anyway, what are you thoughts of having 100% in stocks allocation? My thinking for us is that we will not really need the money until we retire. I’m 35 and my wife 34 and she has about 46k on her RRSP. we have no debt, except mortgage and have our emergency fund..so again these are my reasoning behind having 100% in stocks as per your model portfolio.

@Joel: It would appear that you have the ability to take risk, but do you have the willingness or the need to take this amount of risk? Your need to take risk is best determined by having a financial planner run projections for you to see whether you need to take that much risk with your portfolio based on your personal goals – it usually turns out that you don’t. Your willingness to take risk is trickier to determine, but from my experience, hardly any investors can handle the volatility of a 100% stock portfolio.

Thanks for the quick reply Justin, but really there isn’t any NEED to take this amount of risk except for a little more rewards in return. Maybe i’ll change her investment to 70/30 as she is more conservative. We really have no plans of taking out this money till retirement comes which is probably 20 years from now. Again we are using your Model ETF 100% stock but really because we are indexing they are very diversified just following the market and isn’t that reducing the risk? I also have my own RRSP about 140k and i will probably follow 90/10 from your Model. Thanks again!

Justin, is there a specific date/period in the year when you typically rebalance?

@Marc: I typically use Larry Swedroe’s 5/25 rule for rebalancing:

https://www.pwlcapital.com/en/Advisor/Toronto/Toronto-Team/Blog/Justin-Bender/August-2015/Should-I-Rebalance-My-Portfolio-Now

Justin, Thank you for the great information on your site. I just made the move from a mutual fund portfolio with a bank to 5 ETFs at an online brokerage. I wondered if there’s any chance of you adding a video for Norbert’s gambit at Qtrade? Also, I’m trying to understand the advantages of holding US listed funds in an RRSP. I understand that this is more tax efficient and has lower fees but the currency fluctuations can potentially dwarf any savings. I have worked in the US on and off since 2005 and am probably more aware than most of the impact of exchange rates. What am I missing? Whether you hold US cash or stocks it’s still affected by the exchange rate in terms of value is CAD. Is the idea just that you’re investing long term and will be withdrawing funds over a prolonged period of time? Many thanks

@Rob: I don’t have any plans to record a Norbert’s gambit Qtrade tutorial (I don’t have an account there, and am not planning on opening one – I have too many already ;)

Holding unhedged Canadian-listed foreign equity ETFs has the same currency exposure as holding US-listed foreign equity ETF (always remember that your currency exposure is that of the underlying stocks, not the currency in which the ETF trades).

For example, XUU from my model ETF portfolios has exposure to the US dollar (even though it trades in Canadian dollars). It’s US-listed sister ETF, ITOT, also has exposure to the US dollar (but it trades in US dollars). All else equal (ignoring other costs), if you converted your Canadian dollars to US dollars, bought ITOT, held it for 10 years, sold it, converted the US dollar cash back to Canadian dollars, you would be in a similar situation than if you had just purchased XUU with your Canadian dollars (except that in an RRSP account, you do not have the cost of foreign withholding taxes, which is about 0.30% per year).

Justin, thanks so much for all your hard work on this blog.

It seems like IEFA isn’t available to trade on TD Direct Investing (I assume this is due to the move to BATS). What do you think is the best alternative to IEFA?

Alternatives I’ve looked at so far:

VEA – Fees are okay, but it includes Canada

EFA – Higher fees, less diversified, probably defeats the purpose of using the US holding in the first place.

XEF – Higher withholding taxes (if I understand correctly)

Is there some alternative that I’m missing or do you know why I wouldn’t be able to fine IEFA on TD?

@Ted: I’ve heard of this issue as well at TD Direct Investing – you could give them a call and request that they add it to their trading platform (it sounds like an error on their system). XEF is just as tax-efficient as IEFA (although slightly more expensive), so this would be the easiest alternative.

Hi Justin,

Can you explain how XEF is just as tax-efficient as IEFA? Does it not matter that XEF is a Canadian listed ETF?

By the same logic, is XUU just as tax-efficient as VTI?

@Jennifer: I’ve written about how XEF is similar in tax-efficiency as IEFA when held in an RRSP account (XEF is actually more tax-efficient than IEFA when held in a TFSA or taxable account): https://canadianportfoliomanagerblog.com/foreign-withholding-taxes-in-international-equity-etfs-revisited/

Unfortunately, holding a Canadian-listed US equity ETF (like XUU) in an RRSP account is not as tax-efficient as holding a US-listed US equity ETF (like VTI): https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf?ext=.pdf

Justin, thanks for your hard work on the blog. First post so i’m cramming it all in, apologies.

RRSP is 80/20, 150k. To minimize withholding tax and add a balancing lever (FWIW), I’ve looked at the CAD listed Vanguard ETFs that hold international stocks directly, and split XEF into Asia Pacific and EU with VA and VE. I used VEE vs XEC to avoid Korea double up. I’m using Questrade so US dividends (e.g. from VTI) stay USD to buy more VTI, but i have yet to do Norbert’s (and really should). So here are my questions:

1. As VE, VA are more thinly traded with a higher spread than XEF, am I just wasting time with this especially given I have to convert to buy VTI anyway? If i can avoid trading for years then the spread wont matter much but that will change if I have to sell. So far, I rebalance with new deposits but that will get harder as the portfolio grows.

2. Have you considered / advised on foreign ownership issues (e.g. CRA, or ‘closer ties’ for snowbirds) when the total US assets owned gets jacked up by using US listed ETFs? Maybe this is a non-issue? For clarity, I am 36 with a long horizon, the closer ties issue is for my retired parents. I will assume that non-reg should hold CAD listed?

Thanks!

@Shane:

1. I don’t see any reason to split up your international equity ETFs into VA and VE (instead of just using XEF or VIU): https://canadianportfoliomanagerblog.com/split-the-eafe-for-better-returns/

2. Unless your parent’s estate is expected to be above $5.49 million USD, they likely have nothing to be too concerned about: https://www.forbes.com/sites/ashleaebeling/2016/10/25/irs-announces-2017-estate-and-gift-tax-limits-the-11-million-tax-break/#210e8bb93b70

However, if they have significant non-registered assets, the only benefit of using US-listed (rather than Canadian-listed) foreign equity ETFs is slightly lower product fees (I tend to use only Canadian-listed ETFs in non-registered accounts).

@Justin,

A little bit off-topic: Is there a way that I can follow the comments on your blog, especially when I post a comment? I have learned a lot from them, but today I need to put it on my calendar to check if there are any new comments or anwsers to my questions.

@Bruno: My web developer (Merian Media) just added this feature – let me know if it works when you have a moment.

Hi Justin,

Would you be able to explain when (if) it would be wiser to put equities into a TFSA and bonds into a taxable account, when these are the only options ( noRRSP)

Thanks

@Ros: You generally want to keep your highest growth assets (equities) in your TFSA first, holding your tax-efficient bonds in your taxable account.

My take on the situation is this: The three options in an RRSP for US and International exposure are: VT, ITOT+VXUS or ITOT+IEFA+IEMG. VT gives you a slightly higher total MER and slightly fewer holdings than the other two options, so it isn’t as good, although it’s simpler. ITOT+VXUS has almost the same MER as ITOT+IEFA+IEMG and similar amount of hodlings. So simpler is better – less money lost on extra transactions, bid/as spreads and rebalancing. Also, your stock allocation would be easier to calculate: 1/3 VCN, 1/3 ITOT, 1/3 VXUS. The only disadvantage of VXUS vs IEFA+IEMG is that VXUS has some Canadian exposure, but when you take into account that VXUS is only 1/3 of your stock allocation, the extra Canadian exposure would be about 1% which should not have any noticeable effect on your performance or risk. This is probably really overthinking an insignificant decision, but for the RRSP, I prefer the 4 ETF portfolio – ZAG, VCN, ITOT, VXUS.

@Joey: Thank you for your thoughts. Years ago, we would build our client equity portfolios in a similar fashion (1/3 XIC, 1/3 VTI and 1/3 VXUS). As you mentioned, any investor that chooses a 4-ETF portfolio instead of a 5-ETF portfolio is still expected to have very similar returns.

About the Norbert’s Gambit: The Canadian $ seems to be heading lower by the day. So, I am wondering if I should wait until it regains some grounds versus the US $. If I can save another 3-5% on the Gambit scheme, then should I wait before doing it?

@Peter: If you need US dollars now (whether it’s for spending purposes, or for purchasing US-listed ETFs), then I don’t see any reason to wait. The Canadian dollar could go up relative to the US dollar in the short-term or down (no one knows for certain).

This is a misconception. You are not buying USD, you are buying stocks with USD. Whether you buy the Can ETF with CAD or the US ETF with USD, the value of the stock is taken into account with the currency exchange, so it makes no difference. The only difference is if you decided to hedge. There’s no reason to wait.

Great post Justin, thanks for the effort of creating such quality information. Way back I set my wife’s rrsp (age 45) with vti and vxus. Now 100k each. Do you think it’s worth the switch to itot iefa iemg? I’m not a fan of extra Canadian equity in rrsp space either.

@Phil: You’re very welcome!

I don’t think it’s necessary to sell VTI/VXUS and buy ITOT/IEFA/IEMG. Your Canadian equity allocation in VTI/VXUS is only about 3.35% (or $6,700 out of $200,000). You’re already benefiting from the lower foreign withholding tax rate by investing in US-listed ETFs within your wife’s RRSP account, so you have 99% of the tax and cost benefit already.

If you do decide to make any changes, please ensure that VTI and VXUS are being held on the US dollar side of the RRSP account (and not the Canadian dollar side), or any sales could force a currency conversion back to Canadian dollars at the bank’s high FX rates.

Thanks, Justin, for clarifying the EM ratio for the Vanguard VT option to XAW. I was aware of the Korea aspect between Vanguard and iShares indexes, but had tried to cobble together the overall EM content from a breakdown that just showed European and Asian EM for the Vanguard (where the 5.6% total came from). The more detailed breakdown I later found properly split off the Korea 1.7%.

With the 3.2% Canada in VT that makes the XAW elemental ratios you developed very close to the regional breakdown of VT, which on 9/30 is 52.1% USA, 33.7% International (w/o Korea) & 11.0% EM (including Korea). So using VT would be taking that 3.2% away from International (in XAW) & adding Canada, when the two choices are matched.

Rather than doing the 5-ETF blend, and adding 3 new USD ETFs with ITOT, IEFA & IEMG, I will consider just replacing my XAW with a single one (VT), now clearly knowing the regional differences.

Thanks also for the article on the DRIP lesser-than-expected benefits with BMO IVL not having USD DRIPs. From your calculations, the MER and tax impact will save me a grand in the RRSP holdings we now have. Norbert’s Gambit here we come!

@Davie215: Your decision to use VT instead of ITOT/IEFA/IEMG seems like a very reasonable alternative. Best of luck with the gambit at BMO InvestorLine! (be sure to watch the tutorials first ;)

Hi there,

In my spousal RSP, I have VSB ($25k), XAW ($10k), XWD ($53k), VOO ($14k), VTI ($10k) and VXUS ($18k).

Is it worth it to simplify with the 3- or 5-ETF model? I trade with RBC DI, so there are small trade fees.

Thanks for any suggestions.

@Rob: Simply switching from XWD (MER of 0.47%) to XAW (MER of 0.22%) would save you about $133 per year in product costs ($53,000 x (0.47% – 0.22%))…which could pay for 13 trading commissions at RBC Direct Investing each year (XAW includes emerging markets, whereas XWD does not, so please ensure that you are comfortable with the difference).

If you instead switched XWD and XAW to all US-listed foreign equity ETFs, I would estimate that this could save you an additional $220 per year in foreign withholding taxes and product fees (for annual total cost savings of over $350).

Please ensure that you are using the Norbert’s gambit strategy to convert your CAD to USD, or you could end up in a worse situation (due to RBC charging you FX fees).

XAW and XWD are redundant. VOO and VTI are also redundant, plus you have no Canadian exposure except a small amount in VXUS. I’d recommend selling XAW, XWD and VOO, converting it into US and just having VTI + VXUS. You could also put some money into XIC/ZNC or VCN for some Canadian exposure. In the end it would be something like VSB, VCN, VTI and VXUS.

Hi Justin,

Another great breakdown. Like @Joey, after consolidating my ETFs, I’m loather to add 3 new ones, but with the max XAW holdings in our newly-formed RRIFs, the tax and cost savings makes enormous sense, as does considering VT as a solution. I know the MER differential would go from 0.06% to 0.11%, which reduces the 0.23% cost/tax benefit when considering only the XAW (foreign) elements.

Would this mean (roughly) only about 0.16% net total benefits in a RRSP/RRIF for the foreign components of a 100% equity mix?

I noticed the 3.2% Canada in VT, but the USA ratio is similar to the XAW fraction. The total emerging markets looks like about 5.6% overall when the geographical breakdown gives Europe and Asian values to them.

I also like the sweeping of distributions into XAW, as BMO IVL does not allow DRIPs for USD-denominated securities. I’ve done Norbert’s gambit there on taxable accounts, and been able to trade for the replacements without waiting for the lag of settlement — keeping fully invested without any market impact while funds in limbo.

@Davie215: The 0.23% cost/tax benefit for a 100% equity portfolio is based on 67% portfolio allocation to global equities. If you use VT instead of ITOT/IEFA/IEMG, the product cost difference of 0.05% (0.11% – 0.06%) would also have to be multiplied by 67% to calculate the reduction in savings. This would only be expected to reduce the cost/tax benefit from 0.23% to 0.20% for a 100% equity asset mix (0.23% – (0.05% x 67%)).

Vanguard currently shows VT’s emerging markets exposure of about 9.3% (not 5.6%). As Vanguard ETFs follow the FTSE indices, and iShares ETFs follow the MSCI indices, an additional adjustment must be made to compare the two. FTSE considers Korea to be a developed market, while MSCI considers it to be an emerging market. In order to make VT (which excludes Korea as an emerging market) comparable to XAW (which includes Korea as an emerging market), we need to add the weight of Korea to the 9.3%. Korea currently makes up about 1.7% of the FTSE Global All Cap Index (which VT follows), so the total emerging markets (based on MSCI’s methodology) is about 11%.

The benefits of being able to automatically reinvest the dividends from your ETF securities (i.e. DRIP) is likely exaggerated (as long as you invest the cash at least once each year): https://canadianportfoliomanagerblog.com/the-drip-myth/

Justin, Great article. Not sure yet if this scenario makes sense for my financial circumstances but will certainly have my portfolio advisor look into this on my behalf. This is exactly the sort of stuff he loves to do.

@Gordon Kirk: He sounds like a real nerd! ;)

Hi Justin,

Thank you for your sharing your expertise.

Question: if I have a 100k 3ETF portfolio, should I consider rebalancing costs before moving to a 5 ETF model? I mean, using XAW does not make me save in rebalance fees?

I am specially concerned with the small portion of IEMG that will probably require more atention for rebalancing.

Thanks!

@Bruno: You would have to consider rebalancing costs when deciding on whether to use a 3-ETF or 5-ETF portfolio. However, if you are using a low-cost brokerage (like Questrade), you should only have to pay commissions when you sell a portion of the ETFs (which is not expected to be a frequent event – generally once every 1-3 years).

Remember that XAW is market-cap weighted (and your purchases of ITOT, IEFA and IEMG will also be a similar market cap when you initially purchase them). As markets go up and down, you will not have to rebalance within the 3 foreign equity ETFs (if you are just trying to keep the same weights as XAW).

Another option would be to invest the bulk of your global equity allocation in the three foreign equity US-listed ETFs (ITOT, IEFA and IEMG), but purchase XAW with any new cash that you deposit (so that you don’t have to keep implementing the Norbert’s gambit on small amounts of cash.

@Justin: I think I read the last 2 paragraphs 3 times to understand (:laugh:) I understood that if I rebalance once a year or if I am in accumulation phase, it does not matter the volatility of emergent markets (IEMG).

Question: Why did you warn about implementing Norbet Gambit using large amounts of cash? In my case, I use Questrade. I am assuming even with small amounts I will be able to do NG in reasonable prices, because I will not pay commissions to buy ETFs. Wrong assumption?

@Bruno: Depends on how small the trades are. For a few thousand bucks, that shouldn’t be an issue. For a few hundred bucks, the cost of the sell commission could outweigh the cost of the brokerages FX rates.

Started investing in 2017 with the 3 fund portfolio and I tend to invest CAD$1,000 every two weeks. My portfolio still small, but now that I’ve gotten the hang of investing (via Questrade), I’m looking to maximize portfolio efficiency going forward. This article convinced me that the 5 fund portfolio is the way to go. Questions for you:

1). Per your Oct 31, 2017 response to Bruno’s question and given my average $1,000 biweekly trade, would you consider it worthwhile to implement Norbet Gambit?

2) What does one do with current XAW holdings? Should I sell and convert the cash into the recommended 5 ETFs or is it better to keep my current XAW stock and only put new cash going forward into the 5 fund portfolio? Apologies if you already answered this elsewhere. Thanks.

@alana: Implementing Norbert’s gambit on anything below $3,000 CAD is likely not worth it (but you would have to contact Questrade for a quote and determine which option is cheaper).

If XAW is held in an RRSP account, it could be worth it to sell the holding, implement the gambit, and repurchase US-listed foreign equity ETFs. Remember that there is always a risk that foreign equities increase in value while you’re waiting for the gambit to be processed (prior to buying your US-listed ETFs).

If your account is small, you may want to consider just sticking with XAW for now.

Hello I hope I am not missing something totally obvious but why are we buying is listed ETFs? Is there any advantage to going 5 vs 3 with all Canadian listed ETFs? Thank you for any clarification.

@Maury: Holding foreign equity US-listed ETFs within an RRSP account saves you money on foreign withholding taxes and product fees: https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf?ext=.pdf

If you split XAW up into it’s underlying US, international and emerging markets equity ETFs (using the Canadian-listed ETFs XUU, XEF and XEC instead), this would reduce the product cost of your global equity allocation from 0.22% to 0.14% per year.

Justin, did you consider in your calculations DLR/DLR.U’s MER of 0.45%?

I was reading about DLR/DLR.U, and my understanding is that it’s an ETF with a MER of 0.45%. If this is the case, doesn’t this mean when you sell, you would be charged this management fee? if so, how is this better than just holding the 3-ETF Portfolio ?

@Muhannad: The MER figure is if you hold the ETF for a full year. You’ll only be holding it for a few days, so the cost is more like 0.0037%, not 0.45%.

Can’t you just buy VT and keep it a 3 ETF portfolio or ITOT and VXUS to make it a 4 ETF portfolio?

@Joey: Those would both be viable options. VT includes a 3.2% allocation to Canada (while XAW does not) and has an MER of 0.11% (while ITOT + IEFA + IEMG have a weighted average MER of 0.06%). ITOT/VXUS also includes an allocation to Canada, but it’s expense ratio would be similar to ITOT/IEFA/IEMG.