It’s been four years since we released our white paper, As Easy as ACB. The paper provided investors with step-by-step instructions on how to track the book value of their ETFs, using the free online resource, Adjusted Cost Base.ca. We were the first to admit that the title of our paper was misleading – tracking your ACB is about as easy as reciting the alphabet backwards.

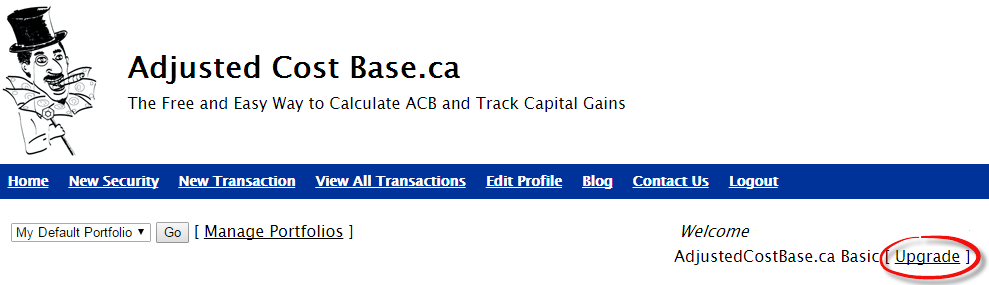

Adjusted Cost Base.ca has further simplified the ACB tracking process by offering an upgrade to their basic features for $49 per year. The main benefit for premium subscribers is the ability to import all phantom distributions and return of capital for their ETFs, saving precious time and possibly avoiding an overpayment of taxes.

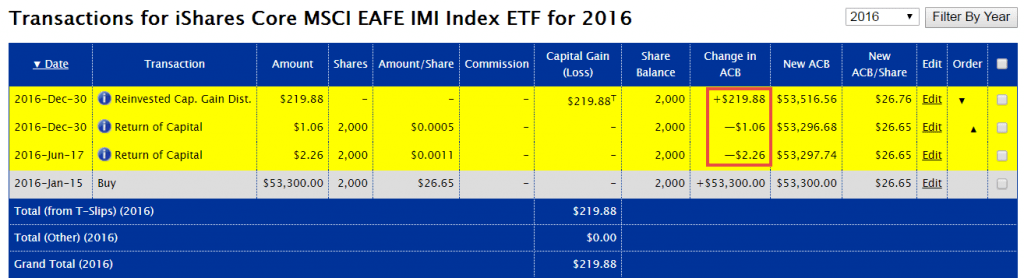

Source: Adjusted Cost Base.ca

The service allows you to import up to ten years of data (you can download any missing information from the Canadian Depository for Securities (CDS) website, using their tax breakdown service). If there were any unit splits (such as for the iShares Core S&P/TSX Capped Composite Index ETF’s 4-for-1 unit split on August 8, 2008), these will also need to be inputted manually.

At a premium

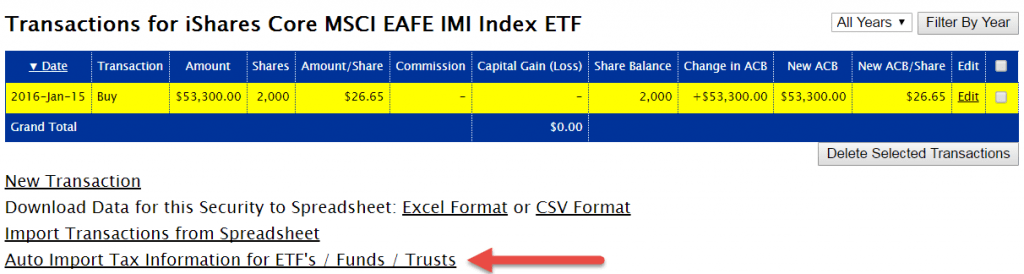

After upgrading to premium subscriber status, the process for importing ETF tax information was very straight-forward. To illustrate the steps, I’ve included an example below for the iShares Core MSCI EAFE IMI Index ETF (XEF). The example assumes that 2,000 units of XEF were purchased for $53,300 on January 15, 2016.

Step 1: Click on Auto Import Tax Information for ETFs / Funds / Trusts

Source: Adjusted Cost Base.ca

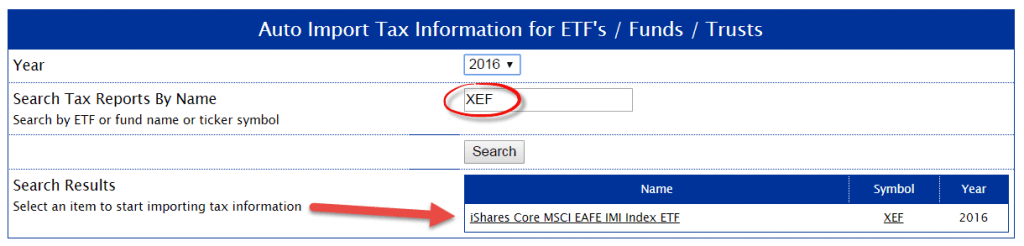

Step 2: Search for the ETF Tax Report

After choosing the 2016 tax year from the drop-down menu, enter XEF as the ETF symbol and then click on Search. Once the search results appear, click on the fund name.

Source: Adjusted Cost Base.ca

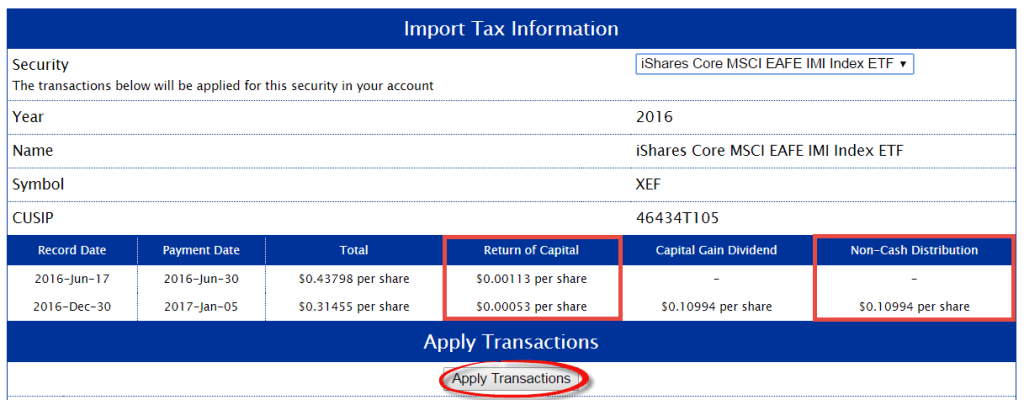

Step 3: Apply the Transactions

Once you’ve reviewed the return of capital and non-cash (phantom) distribution information, click on Apply Transactions. If you held the ETF during other tax years, repeat Steps 1 through 3, changing the tax year each time in Step 2.

Source: Adjusted Cost Base.ca

2016 results

The return of capital transactions have now been automatically included (decreasing the ACB by $2.26 and $1.06 respectively). The reinvested capital gains (phantom) distribution has also been included, increasing the ACB by $219.88. If the investor had forgotten to adjust their cost base for this non-cash distribution, they would eventually pay an extra $58.85 in tax (assuming an Ontario resident in the highest marginal tax bracket [$219.88 × 50% × 53.53%]). The additional cost of the premium service would have easily paid for itself in this scenario.

Source: Adjusted Cost Base.ca

Is it worth the extra cost?

As always, there will be a small percentage of investors that will cringe at the thought of paying $49 annually for information that is available for free online. Based on the feedback I receive from DIY investors, most of them will find this service to be totally worth the fee.

Thanks, that’s helpful.

Hi Justin,

I’ve been using the Canadian Couch Potato portfolio with the 4 TD e-series Index Mutual funds. I had mainly been using these 4 Index Mutual funds in registered accounts, but I’ve now started using them in a non-registered account. Do I need to be worried about tracking the adjusted cost base? I don’t want to realize 30 years from now I should have been tracking this… Thanks!

@Tara – The mutual fund company generally tracks the ACB for you in most cases.

Hi Justin,

What would this process look like for an advisor using Dimensional Fund Advisors mutual funds? It is my understanding that the CDS database only provides data for ETF’s. Is ACB tracking as big of a deal when using a mutual fund structure vs an ETF? If so, how would one go about this process? Thanks again for your time and your continued service to the DIY investing community.

@Carson Coghill – Mutual fund ACBs are generally tracked by the fund company. As long as you don’t hold the same mutual fund in multiple non-registered accounts, you should be able to rely on the fund company’s ACB.

Hi, I have been manually entering the data into adjustedcostbase.ca form for my etf’s in taxable accounts. I am getting the data from the CDS website. For buys, sells, drips (I avoid drips in taxable accounts), and reinvested non cash distributions I have been manually entering in the data. For ROC payments, is it ok to just enter the total from box 42 of my t3 slip and date it for dec 30 year end date? This way I can avoid entering 12 different ROC payments for the bond etf’s and 4 different ROC payments for the equity etf’s. It just saves time that way. I just want to make sure it is ok do take this shortcut. thanks TJ

@TJ – I would recommend following the process outlined in my video (linked below). T3 slip data can be incorrect, and if you sell units of your ETF mid-year, the ROC will not be properly reflected.

https://www.youtube.com/watch?v=84qCOhMuA8g

Very good article thanks for sharing energetic information. I really appreciate u . You need to work more to promote your website. I read blog on daily base.

Using CDSInnovations, I got VEQT’s 2020 T3.

What lines would I be entering into Adjustedcostbase.ca’s options of…

Return of Capital

Capital Gains Dividend

Reinvested Dividend

Reinvested Capital Gains Distribution

My brain tells me I’d have to enter 0.46162 as “Return of Capital” and then the # of shares I have, but I’d like to confirm – seems too simplistic given all of the options and rows listed.

I read through Adjustedcostbase.ca’s Phantom Distributions and Their Effect on Adjusted Cost Base article but what shows on their example T3 doesn’t match VEQT’s.

Thanks in advance.

@Bileth – the “0.46162” figure is the total cash distribution. The return of capital figure is further down on the spreadsheet – it is 0.00764 per unit for VEQT for the 2020 tax year.

Hi Justin, I recently purchased zsp and xiu in my non registered account and am beginning to pursue tracking my acb. However I was unable to enable macros when trying to open cds.ca for each ETF on my laptop. Do I need a desk top and/or special excel program to enable macros? As well, will the ETF web site provide me with any annual rocs or distribution data (versus relying on a T3 in March ’22), from which I can create my own excel spread sheet?

Candace

PS

Alternatively if I purchased the $49.00 version of adjusted cost base , will I still need to enable macros to import data?

@Candace Dolny – Try these steps to enable your macros in Excel:

https://support.microsoft.com/en-us/office/enable-or-disable-macros-in-office-files-12b036fd-d140-4e74-b45e-16fed1a7e5c6

The ETF websites should not be relied on for this data, as they can sometimes be incomplete or inaccurate (so cds.ca is the best resource). T3s should not be relied on either (I’ve even found errors in the brokerage reporting on T3s).

If you purchase the premium service from adjustedcostbase.ca, you won’t need to worry about macros ;)

Why do you use the date of settlement instead of the date of purchase? The price of a stock or ETF most likely will have changed two business days later when the trade settles.

@noob – If you purchase an ETF, the cost is the price you paid when you placed the trade.

The settlement date is used for foreign currency transactions (to determine the date of the FX rate).

Hi Justin,

Regarding Mark’s question dated April 18,2019 at 3:44 pm (above)

I looked everywhere without success for your reply to Mark’s question as this would help me greatly.

Would appreciate your recommendation on this.

Thank you

@Gisele (and Mark): Although the brokerages have improved their return of capital updates, I would recommend investors still track their own ACB (using the cds.ca website and process outlined in our white paper, or via adjustedcostbase.ca’s service). The reinvested distributions must also be obtained from the cds.ca website – the T3 slip does not contain this information.

I recently caught a large reinvested distribution brokerage reporting error on ZDB which impacted many of our PWL clients (the T3 slip is currently being amended), so you can never rely on any brokerage to do this accurately every year.

Hi Justin,

I’ve read the Whitepaper on tracking ACB. With a Couch Potato / CPM model portfolio (ZDB/VCN/XAW), the two things to worry about are Return of Capital and Reinvested Capital Gains.

At tax time, my brokerage provides a T3 Summary with Return of Capital broken down by ETF. This seems pretty clear. Any reason why this number cannot be trusted? Then all that is left to do is figure out Reinvested Capital Gains. Is there any way to calculate that using the T3 summary as well, or is the CDSinnovations.ca database the only way to determine accurately? Or can reinvested capital gains be accurately calculated from the T3 Summary as well?

Just curious as there are certainly thousands of investors in these ETFs and I would imagine only a very small portion of them are tracking reinvested capital gains correctly.

Thanks!

Hi Justin,

With the bank of Canada daily noon rate change this year, what should I be using instead when doing the ACB calculations (daily exchange rate or Canadian Effective Exchange Rate (CEER)? The daily noon rate is only up to date until April 2017. Do I then also need to go back and update my transactions to use the same exchange rate method?

@SterlingF: For any 2017 transactions, use the daily exchange rate lookup: https://www.bankofcanada.ca/rates/exchange/daily-exchange-rates-lookup/

You may note that the average of these 249 daily rates during 2017 equals the 2017 average annual rate of 1.2986.

The new exchange method is not available pre-2017, so you do not need to go back and update your past transactions.

Not sure about other discount brokers or even when it started, but TD DI calculates automatically ACB in “average cost” field. For a Canadian preferred share in US$, AX.PR.U, it subtracted automatically the ROC part and I did not have it for the full year.

@dodoi: I would be even more skeptical of the ACB of US$ securities at any Canadian discount brokerage (most of them are totally incorrect). DIY investors need to learn how to track their own ACB (you can’t trust your brokerage, and they may not have all the information necessary to accurately track it).

Justin, I agree, it’s totally worth the annual fee. Not only does it save a lot of time, but eliminates the possibility of mistakes when entering the data manually.

@Grant: Was the return of capital zero point zero zero zero five zero cents per share, or zero point zero zero zero zero five cents per share? ;)