Dan Bortolotti’s recent blog post raised a number of questions from his readers concerning the impact of foreign withholding taxes within a corporate account. This is a hot topic, as many successful professionals are choosing to save within their corporation. Couch Potato investors often allocate 40% or more to foreign stocks, so it’s important for them to grasp these tax concepts before implementing their own portfolio.

Foreign interest income vs. foreign dividend income

The taxation of foreign income is often lumped into the “interest income” category, but this is not entirely accurate. Foreign interest income (the kind that is generally not subject to foreign withholding taxes) is taxed in a similar manner to Canadian interest income in a corporation. So holding a tax-efficient global bond fund in your corporate account should be just fine.

Foreign dividend income, on the other hand, can affect the amount of corporate taxes that are refundable when dividends are paid to you as a shareholder. For Couch potato investors, this foreign dividend income is typically received on a quarterly basis from your US, international and emerging markets equity ETFs. Foreign dividends are not specifically the issue – it is technically the foreign non-business income tax credit that throws a wrench into the refundable tax calculation.

In order to better understand the taxation of foreign dividend income in a corporation, we’ll start with the calculation of Part I tax, and move to the calculation of the refundable portion of Part I tax. We’ll then follow the dividend income out of the corporation and into the personal hands of the shareholder in order to calculate the overall taxes paid. To make the math easier, we’ll use $10,000 as our foreign dividend income figure, and assume a 15% withholding tax rate on the income (or $1,500).

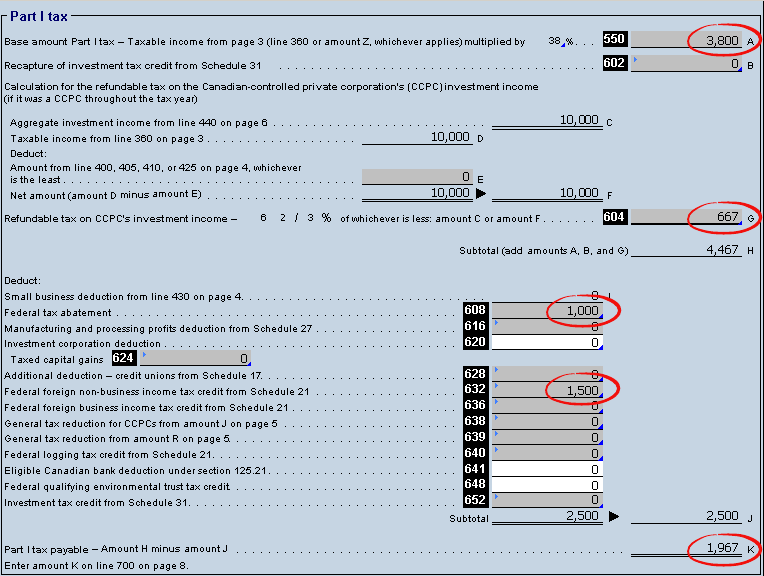

Part I tax calculation

Similar to the corporate taxation of interest income, there is a base federal tax amount of 38%, along with an additional refundable tax of 6.67% (this has been increased to 10.67% in 2016). A federal tax reduction of 10% is then applied, and the foreign non-business income taxes paid are offset by the foreign non-business income tax credit of 15%. This results in Part I tax payable of 19.67% (38% + 6.67% – 10% – 15%).

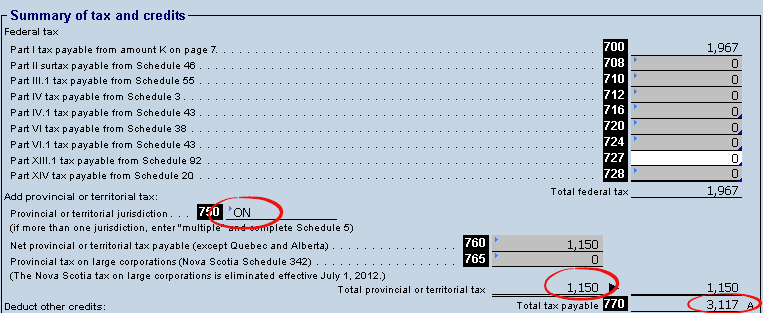

Once we include provincial tax of 11.5% (for an Ontario corporation), our total taxes payable increase to 31.17% (19.67% + 11.5%). As we had initially paid 15% foreign withholding tax on the dividend income, this amount should also be included in order to calculate our total taxes. This equals 46.17% (31.17% + 15%), which is the combined federal/provincial tax rate for passive investment income earned within an Ontario corporation in 2015 (this amount is increasing to 50.17% in 2016).

Part I Tax Calculation

Source: CCH Corporate TaxPrep Software

Source: CCH Corporate TaxPrep Software

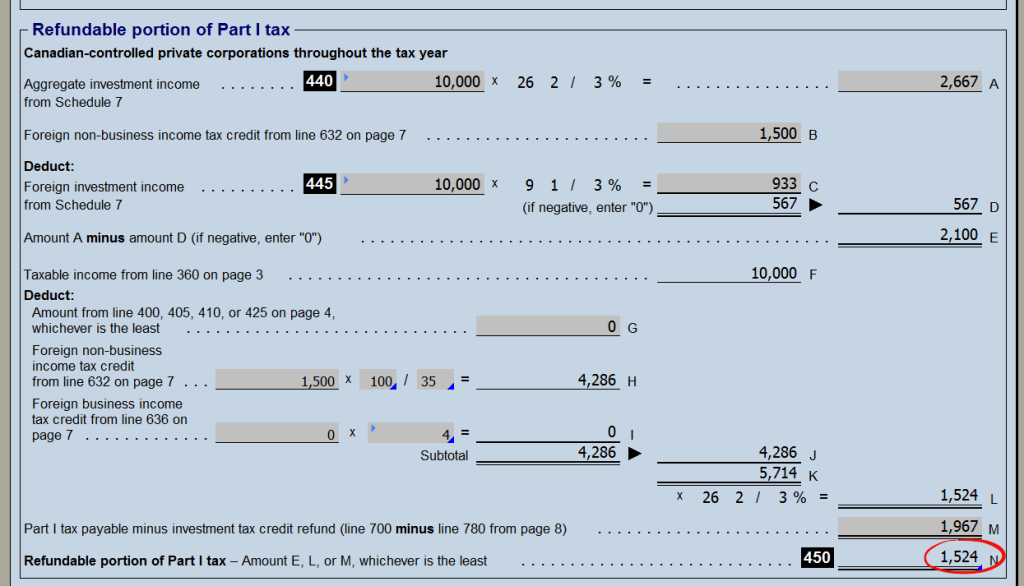

Refundable portion of Part I tax

A portion of Part I taxes are refundable when dividends are ultimately paid out of the corporation to the shareholder. For interest income, the refundable amount is 26.67% (increasing to 30.67% in 2016). In our example below, the tax refund is only 15.24% of the dividend income. As mentioned earlier, this difference is due to the foreign non-business income tax credit. The refundable amount of tax would change depending on the withholding tax rate levied on the foreign dividends (for example, if you held an international equity ETF that withheld 12% instead of 15%, the refundable amount would differ).

Refundable portion of Part I tax calculation

Source: CCH Corporate TaxPrep Software

Personal Tax Calculation

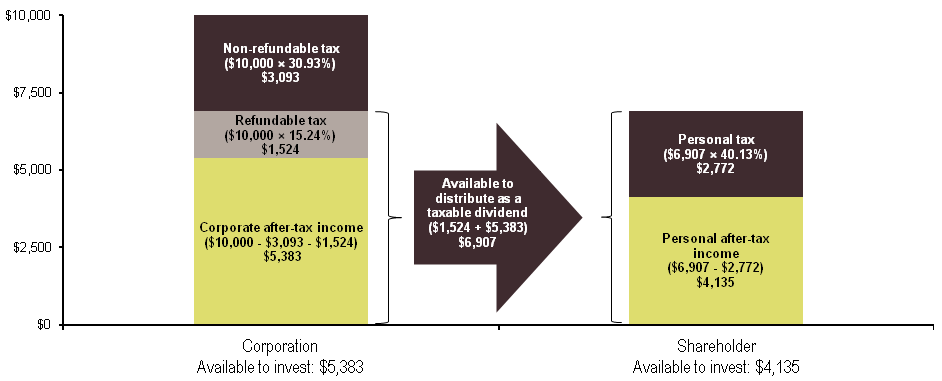

Of the $4,617 of total taxes paid on our $10,000 of foreign dividend income, $3,093 is non-refundable, and $1,524 is refundable when sufficient dividends are paid out to the shareholder. Since the after-tax corporate income is $5,383 ($10,000 – $3,093 – $1,524), there is currently $6,907 available to distribute to the shareholder ($5,383 after-tax corporate income + $1,524 refundable taxes).

If we assume that the distribution is in the form of a non-eligible dividend paid to an Ontario resident in the highest tax bracket, their personal taxes would be $2,772 in 2015 ($6,907 non-eligible dividend × 40.13% tax on non-eligible dividends). This would leave them with $4,135 of after-tax income ($6,907 – $2,772). I’ve illustrated the concepts in the chart below (adapted from Jamie Golombek’s 2014 article).

Foreign dividend income earned in a corporation in Ontario in 2015

Sources: Adapted from In Good Company: Retaining investment income in your corporation, Deloitte 2015 Top marginal income tax rates for individuals

The overall taxes paid on the $10,000 of foreign dividend income was $5,865 ($3,093 non-refundable corporate tax + $2,772 personal tax) or 58.65%, which is 9.12% higher than the top 49.53% tax rate in 2015 which would apply for an Ontario resident that earned the foreign dividend income personally.

This would suggest that an investor may be better off investing in foreign equities outside of their corporate account (i.e. in personal non-registered accounts, RRSPs, TFSAs, etc.). For investors who are comfortable with swap-based ETFs (such the Horizons S&P 500 Index ETF (HXS)), this may also be a suitable option, as the fund does not distribute foreign dividend income, and will therefore avoid foreign withholding taxes and the offsetting credit.

[…] The inefficiency of foreign dividends improves but is still pretty bad because reclamation of foreign withholding taxes reduces the RDTOH refund. I will cover this in more detail in the next post on corporate investment tax […]

Hi Justin. Great article. Wondering if you can answer a very simple question. My CCPC holds Apple and Microsoft stocks which both kick off dividends. Do I put those dividends on Schedule 3 (and check foreign dividend)? Or do they go on Schedule 7? I keep getting different answers and I’d like to figure this out once and for all. Thanks!!!

Hi Justin, this is a great blog. I am not sure if you can see my comments because it is 2021 now, but still try to discuss with you your calculations. As you said, the income is a foreign dividend income. Why do you put 10,000 in 440 on page 6? The aggregate investment income in part 1 of S7 doesn’t include foreign dividends. Is that supposed to be 0?

Hi Justin,

Thank you for this article. I had a couple questions:

1. Is dividend income from foreign assets held in a corp account subject to foreign withholding tax in addition to corp ineligible divided tax? i.e. if the combined provincial and federal CCPC tax rate is 50% and the foreign withholding tax is 15%, is the dividend first taxed 15% then additionally taxed at 50% leading to an effective tax rate of 57.5% while held in a corporate account?

2. Somewhat unrelated to this article, but a question about rule of thumb “best practice”. When you are trying to estimate taxes on certain assets in the future, do you use the current dividend yields or the 12 month trailing yield?

Thanks again for all the work you do on this site. Have learned a tremendous amount from you (and the rest of the PWL team).

Dan

@Dan:

1. No, the 15% withholding tax is not in addition to the 50% corporate tax on investment income.

2. I tend to use current dividend yields.

I was referring to you comments to D on aug 3rd. Tried to attach my comment to it…

Justin, just to clarify, given that Level 1 foreign dividend with holding taxes for developed and emerging markets are not recoverable at all in an RRSP or TFSA, I’m assuming you mean just US equities when you say, in the last paragraph, that you may be better investing foreign equities in a RRSP/TFSA rather than a corporate account?

@Grant: My statement is a very broad one, that doesn’t really provide any new information for investors. Depending on many factors (i.e. your tax rate, your account values, your specific holdings, your cash flow needs, future returns, whether you manage your asset allocation on a before or after-tax basis, etc.), you may want to consider holding foreign equities in an RRSP/TFSA rather than a corporate account (or not!).

Sorry I can’t provide any meaningful rules of thumb on this topic…there’s just too many variables to be worthwhile.

Thank you Justin for your website and blog and especially this article. You are doing a wonderful service for all Canadians and I am very appreciative of all the time it must take you to dive in to these matters and provide them at no charge to the public.

I have a question regarding taxation of corporate investments. When comparing your model portfolio to the Canadian couch potato portfolio, yours uses a combination of VUN/XEF/XEC while the former uses XAW for non-Canadian equities.

You have commented previously that VUN/XEF/XEC may be more tax-efficient for corporate investments than XAW. I am wondering if you can expand upon this. Specifically, how much difference is there? Does the difference apply when a corporate account is much larger than personal investments? Does the difference more than make up for the simplicity of XAW vs 3 ETFs?

I think this is important as many professionals with corporate accounts want to use a simple strategy for their holdings with minimal tax implications. Again thank you for your amazing contributions to Canadian investment advice.

@Hari: I’m so glad you’ve found the blog to be useful. I’m planning on releasing a number of corporate taxation blogs in the next few months, so these should be of interest to you as well.

If you are only investing within your corporate account, then using XAW or a combination of VUN/XEF/XEC would have similar tax implications. However, if you also invest within a personal non-registered account (or possibly RRSPs or TFSAs), it may make sense to hold certain foreign equities in these account types (because of the tax-inefficiency of receiving foreign dividends within a corporate account). Each investor’s situation is unique, so you should be working with your accountant and advisor to find the best solution.

Hi Justin,

I was just wondering if you ever ended up releasing the corporate taxation blogs that you mentioned in your reply to Hari’s comment?

Stephanie

Justin, wrt to the comment by Jaz about “capital gains harvesting”, am I correct in saying that you should not harvest capital losses in a CCPC, but instead harvest capital gains, then immediately re purchase the same security? This is assuming you need to take money from the corporation to live on, as capital gains tax paid inside the corporation (with no tax payable when money is withdrawn from the capital dividend account), would be less than that due from withdrawing money either as dividends or salary.

@Grant: It would depend on each investor’s individual situation. For example, if you consistently harvested gains during your pre-retirement years, and then had to take out all ineligible dividends in retirement, you may have additional OAS clawback (whereas you may have been able to avoid this if you carried the unrealized capital gains forward and realized them after age 65).

Thanks for the RRSP reference – very interesting. It kind of turns on it’s head the conventional wisdom of bonds in tax protected accounts and stocks in taxable (corporate or personal), with the focus being on expected return, rather than immediate tax efficiency, assuming a reasonable time horizon. I like the description of the RRSP as just being a double TFSA, with one of the RRSP halves being owned by the government, the result being that half of the RRSP you own is taxed neither during it’s growth nor when the money is taken out of the RRSP.

Thank you for trying to clarify this tax treatment of foreign dividends. I have been struggling with this issue as well, being alerted to my possible errors by the same Golumbec article you quote. But after staring at your tax software image for an hour, I still don’t understand it. https://www.canadianportfoliomanagerblog.com/wp-content/uploads/2016/08/ForeignIncomeCorp-1024×586.png

Could I ask you to look at my spreadsheet and try to reconcile it to yours? It is the TaxRates tab of http://members.shaw.ca/PublicAccess/taxIntegration.xlsx where I have used red type inside the box with the ?????. My numbers are the 2016 updates you mention so there will be a 4% difference in some rates.

I presumed that the 11.5% reduction in RDTOH that Golumbec mentions continues after the 2016 rate changes. That would create a small difference from your number ….. your 15.24% plus 4% increase = 19.24%, versus 19.17% per Golumbec.

But really it is where that 11.5% reduction comes from, that I don’t understand. Logically I would postulate that since the 15% forTxCr reduced the 38.67% Federal Tax Rate by 15/38.67 = 38.79% …. then the RDTOH would also be reduced by 38.79%.

The basic RDTOH 30.67% * (1 minus 38.79%) = 18.77%.

But that is different from your 19.24% and 19.17% numbers.

The calculation you show from the tax software $4,286 (H) uses a multiple of 100/35. Do you know where that multiple comes from? The line is labeled “ForIncTxCr” which I would have thought would be the straight $1,500 … not that grossed up number. Don’t understand it at all.

Any ideas?

@Retail Investor: It sounds like it’s just a difference in some of the tax return figures (due to the tax return changes in 2016). For example, in addition to the 26.67% figure increasing to 30.67%, the 9 1 / 3% figure has changed to 8%. The 100/35 figure (which is automatically part of the tax return) has also changed to 100/38.67. If you follow all of the updated figures through the refundable portion of Part I tax from my example, you end up with a refundable portion of 18.77% for 2016 (not 15.24%).

Thanks for letting me know the RDTOH is now 18.77%. Last year its calculation did not make sense. But now it is exactly what I postulated as reasonable.

Thanks Justin (and national treasure) for a very interesting and useful article.

One of the disadvantages of holding equities in an RRSP (as opposed to bonds), is that when you withdraw the equities from the RRSP you are converting the higher expected capital gains (compared to bonds) into regular income. Thus paying more taxes than if the equities where held in a non registered account. With RRSP withdrawals you also have less control over the timing of realizing those gains.

Just to clarify, not that I have run the numbers, but are you saying that the onerous treatment of foreign dividends in a corporate account is more important than the issue of converting capital gains to regular income in an RRSP?

@Grant: Technically, your portion (not what you owe the government) of RRSP income earned is tax-free (similar to a tax-free savings account).

Over the years, I have become less convinced that there is an “optimal” asset location decision for everyone. I feel that it generally makes more sense to control what we do know (for example, international ETFs generally have the highest dividend yield, foreign dividend income has a tax drag in corporate accounts, premium bonds are tax-inefficient, etc.).

Some decent RRSP taxation information can be found here: http://www.retailinvestor.org/RRSPmodel.html

Thank you for your linked reference to my site where I have been thumping the drum regarding RRSP false claims since 2009. For your first point to Grant above (about profits being tax-free) to be appreciated, IMO you absolutely must clarify that you mean the profits are not taxed on withdrawal either. Without being explicit, readers will never appreciate the difference between what we are saying and what the rest of the experts are wrongly claiming. They will never learn to distinguish between false arguments based on the ‘profits are taxed on withdrawal’ idea, and those arguments based on the ‘profits are never taxed, not while in the account and not on withdrawal’ idea.

Thanks for the article, Justin, I have been following you for years and consider you to be a national treasure!

Quick question: how do REITs (incl. REIT ETFs) fit in “RRSP vs corporate” allocation?

Right now, all my bond and REIT ETFs are in my RRSP and TFSA. However, for bonds that may be changing based on your analysis above. What about REITs – where are they more tax efficient (or more appropriately, “less inefficient”)?

Thanks again, for everything!

@McBane: Wow, I’ve been called a lot of things in my life, but “national treasure” has definitely not been one of them – thank you though! ;)

Canadian REITs should be fine in a corporate account (although I tend to hold them in the RRSP account, as a significant portion of their income can be taxable as interest). Foreign REIT ETFs would have similar issues, such as the corporate tax-inefficiencies described in the article.

just to clarify, you aren’t advocating that CCPC owners take money out of the corp just to invest in their personal RRSP for the tax advantages on foreign equities in these accounts – I wouldn’t imagine that the income tax on the extra money pulled out would be far greater than the tax savings. Deferring the income tax as long as possible seems to make more sense than saving a little tax on the investments right?

@sleepydoc: The article is more about asset location to reduce the tax-inefficiencies of foreign dividend income in a corporate account, not about the tax-efficiency of withdrawing funds from the corporation. However, it may make sense for corporate investors to pull additional dividends/salary out of the corporation to invest in their RRSPs or TFSAs: https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2015-07-30_PWL_Felix_A-Taxing-Decision_Hyperlinked.pdf?ext=.pdf

Thank you very much, Justin!

Hi there,

This isn’t about the above article, but I couldn’t find where else to post a q for the model portfolios…

Currently, the models are displaying for me with funny codes where I had expected to see a designation such as aggressive, balanced, etc. Each column is instead labelled with something like 70FI-30EQ. As it’s a PDF, I don’t think it’s my browser.

Is this code something I should recognize, or a glitch in the presentation? Thanks! :)

@Joon: The codes are short form abbreviations – for example, 70FI-30EQ = 70% fixed income (safer), 30% equities (riskier). As you move to the right of the model portfolios, each one becomes more aggressive by increasing the equity component by 10%.

Justin, great post!

What do you think of using Purpose Investment’s corporate class ETFs (e.g, PUD, PID, etc.)

How would it impact the effective tax rate on foreign dividend income?

@Elec: I quickly checked the 2015 distribution breakdown information for PUD/PID on the cds.ca website, and they both had distributions of foreign non-business income (box 25) and foreign non-business income tax paid (box 34), so holding these products would not be expected to avoid the tax issue in a CCPC.

Congratulations to yourself and Shannon as well – I just read her email after yours….

Cheers!

@Kulvir: Thanks, again! Now there’s going to be another Bender writing investing blogs ;)

Really Helpful Justin. Thanks! Also a great link to how taxation of investments work in a CCPC. This is not easy to find information and the article is great. There must certainly be a number of Coach Potato investors who invest within a CCPC and not enough information that is easily accessible out there to guide those of us that are (still) comfortable with being self – directed. . Thanks Again!

@Kulvir: I’m glad you liked the article! (I’m a big fan of Jamie Golombek’s work as well). It’s definitely much harder to be a DIY investor who also has a corporate account (compared to just investing in an RRSP or TFSA).

wow! thanks so much for the quick response! you are a goldmine of information!

Dear Justin,

Thank you so much for this useful post for professionals who save money within their CCPC coporate accounts.

I am so grateful. I am sure there are a lot of small business owners, dentists, lawyers, doctors, and other professionals who will find this useful.

It is really a shame that there isn’t a lot of references on asset location or model portfolios for people who have RRSP, TFSA AND corporate accounts.

My friends and I are avid readers of your posts. So just a few questions :

1) Let’s take for example a person who as an RRSP, TFSA AND a corporate taxable account, but no personal taxable account. His coporate account has grown to a size which is three times bigger than his maxed out personal registered accounts ( a not so uncommon situation for successful business owners who often have no more RRSP or TFSA room). He is 30 years until retirement and has decided on 25% fixed income for now. He has been fortunate enough to rebalance quarterly with new contributions only without needing to ever sell anything to rebalance.

From what I gather from your last posts, the optimal strategy for this person would be to put as much international equities in RRSP first, then fill up the TFSA. And to put fixed income, canadian equities and US equities all in the corporate taxable account.

2) Since this person doesn’t need liquid fixed income and will not touch the money until retirement, would it make sense to put all the fixed income in laddered GICs instead of ZDB?

3) You talked about using Horizon’s HXS for the US equities component in the corporate account. But you also mentionned in the past about the risks with swap structure and counterparty and that it’s likely only a matter of time before this structure is shut down. Would you just bite the bullet and buy VUN ? Or you would put a certain percentage in VUN and another percentage in HXS to mitigate the risks of HXS? What percentage of HXS would you be comfortable with? 15% 25%? 50%?

4) The same questions for Horizon’s HBB.

5) Would you keep for this person a certain amount of fixed income/bonds in the RRSP/TFSA in case for rebalancing purposes in case there is a major fluctuation in the makets?

Once again, thank you so much for your excellent blog. We were eagerly awaiting your post on corporate accounts to ask these questions!

@D: I’m glad you liked the article. Please remember that only basic assumptions were used, so you and your accountant should crunch the numbers based on your personal situation. In regards to your questions:

1. When an investor’s taxable accounts grow much larger than their registered accounts, the asset location decision becomes much less important. I personally choose to place international equity ETFs in the RRSP first (since it has the highest dividend yield). I evenly spread Canadian, US, and international stocks into the TFSA (since I don’t know which asset class will outperform over 30+ years). Then, I would put the remaining asset classes in the corporate account.

2. I tend to favour a 5-year GIC ladder relative to ZDB (if liquidity is not required). A ladder of 1-5 year GICs at RBC Direct Investing has an average yield of 1.73%. ZDB has a yield-to-maturity after fees of 1.72%.

3. I am currently using VUN or XUU when I have to hold foreign equity ETFs in a corporate account. HXS has risks that I am not personally comfortable with (if you feel differently, it is an option for sure). Aside from the counterparty risk, there is the risk that CRA may shut down the structure. If your holding in HXS is significantly up in value, you may be forced to realize a large unexpected capital gain (which may take away some or all of the deferral benefit you had received in the past).

4. The additional benefit you are expected to receive from HBB’s tax-efficient swap structure is pretty minimal. If yields were higher than 1.72%, it may be worth the additional risks. I’ve been sticking with laddered GICs (staying within the CDIC limits) for now.

5. I do tend to keep a portion of the fixed income in liquid tax-efficient bond ETFs like ZDB or BXF (in your example, I would likely hold these in the corporate account). My rule of thumb is as follows (feel free to adjust it to suit your requirements): Assume that your equities drop 50% in value in a terrible market crash. Then calculate the minimum amount of liquid bonds you would need to sell to rebalance back to your target asset mix. For example, assume you hold a $1,000,000 portfolio with 60% allocated to equities and 40% allocated to fixed income (or $600K equities / $400K fixed income). If equities fall by 50% (or $300K), your portfolio would now be worth $700K. In order to rebalance the portfolio back to its target asset mix (which would now be $420K equities / $280K fixed income), you would need to sell $120K of liquid bonds. In this example, you would need the following allocations:

Original portfolio:

12% tax-efficient bond ETFs ($120K)

28% GICs ($280K)

60% equities ($600K)

New portfolio after market downturn and rebalance:

0% tax-efficient bond ETFs ($0K)

40% GICs ($280K)

60% equities ($420K)

Justin,

I am trying to understand your reply #2 to D above regarding HXS.

Whether HXS capital gains in a CCPC is realized today or later the tax on it would be the same (i.e. highest rate). So if CRA disallowed the structure in the future would there really be a risk?

Thanks for your and Dan’s fantastic blog (they are always a must read for me).

@ND: If you held HXS and CRA disallowed the structure in the near future (and you had to pay full tax on a large capital gain), you would have less after-tax money in your CCPC to invest, relative to if you had simply held a plain-vanilla US equity ETF (which was not forced to realize a capital gain). It’s really the deferral benefit that you could possibly lose out on.

@Justin: If you held HXS in a CCPC and CRA disallowed the structure, you could always “cash-out” the capital gains out of the CCPC, taking out dividends, and leave more active business income inside the CCPC, taxed at a more favourable tax rate. What do you think?

http://www.financialwisdomforum.org/forum/viewtopic.php?p=238019#p238019

” (…) But if this example is correct, there is a corollary. You are better to realize capital gains as you go rather than deferring them (again ignoring frictional costs). Your tax savings from not taking the dividend from active income (or salary) will exceed the tax you pay on the capital gains. You can then use that tax savings to reinvest in the same ETF at a higher ACB. (Capital gain harvesting! And you don’t need to worry about the superficial gain rule!) Of course, you’ll have nothing to offset your capital losses if when you wind up the company any of your ETFs are in a loss position. “

@Jaz: This would definitely be an option as well.

I’m confused with this article which makes placing foreign investments in the corp account not a great option from a tax perspective. However you’ve also previously written white papers on foreign withholding taxes in 2014 and 2016 (which didn’t include corp account) which shows that the foreign tax drag is highest in the RRSP and TFSA accounts, followed by the corp account (can you also comment on why the numbers are lower in your 2016 report and why you didn’t include corp account…what changed?).

Are you saying that even despite the foreign withholding taxes being a greater drag in the RRSP/TFSA accounts, once our Canadian tax system gets a hold of them we still come out ahead by holding foreign equities in RRSP?

@AZ: In the 2014 foreign withholding tax paper, we tried to include an estimate of the corporate refundable tax drag by lumping it in with foreign withholding taxes. In our 2016 FWT update, we decided to exclude corporate accounts in the discussion, as the foreign withholding tax implications are similar to personal non-registered accounts (I wanted to separate the impact of “foreign withholding taxes” in a corporate account with the impact from the “corporate refundable tax drag”, as they are not the same thing).

In this blog post, I am discussing the lesser known corporate refundable tax drag from foreign dividend income (not foreign withholding taxes).

Re #1, isn’t this contrary to your white paper “Asset location for taxable investors” which did an analysis that still found fixed income in RRSP better than in a taxable account spanning a decade that included recession and very low interest rates?

@AZ: This blog post is not saying that you must hold equities in an RRSP vs. a corporate account. It is explaining that there is an additional tax drag from foreign dividend income when this income is earned in a corporate account – this may run contrary to other tax analysis, and this is usually the case when dealing with the various portfolio tax decisions investors must make.

In practice, the main asset location decision (i.e. whether to hold equities/fixed income in RRSPs/taxable accounts) is difficult to optimize without knowledge of the future income/returns/contributions/withdrawals/tax loss selling strategy, etc. Even if you were able to optimize it, it would have the most benefit for someone with 50% invested in an RRSP and 50% invested in a taxable account (which is rarely the case). Once the mix changes, any potential benefit of the decision is reduced.

AZ, have a look at the link Justin provided in his comment below on Aug 9th at 11.14am about RRSPs including asset location. It challenges some of the conventional wisdom on this topic.

Hey Justin, I’ve read all of your posts, more than once. I think this is one of your most valuable responses pertaining to my situation. Thank you for this.

@Phil: You’re very welcome :)