By definition, a model is something that emulates real life. No wonder even the best models need to be updated now and then. Take my model ETF portfolios, for example. With the first half of 2017 behind us, I’ve made a few tweaks to them for ongoing excellence.

The quick-take

As the word “tweak” implies, most of the changes are minor, such as swapping a few costlier funds for cheaper choices. There is one notable update I’m particularly fond of. You’ll now find several model portfolios, to reflect the varied tax- and cost-efficient realities within each of these account types:

- TFSA and RESP

- RRSP and RRIF

- Taxable

For example, certain ETF products may be more tax-efficient when held in one account type versus another. Now, no matter which account you’re trading in, you’ll have a model portfolio of ETFs that are best structured for the task at hand.

What else can I tell you? If you feel your ETF portfolio is already sitting pretty within your various accounts and this quick-take is all you need to know for now – that’s fine. If I’ve piqued your interest, read on to see the specifics.

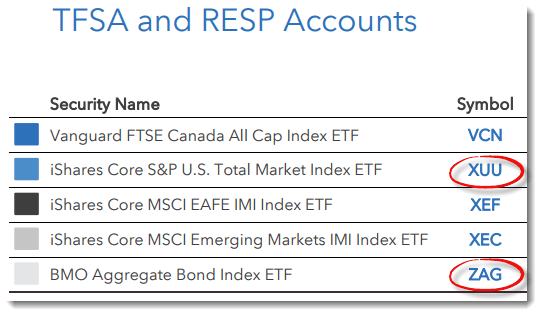

TFSA and RESP accounts

In this version of the model portfolios, I’ve replaced the Vanguard U.S. Total Market Index ETF (VUN) with the iShares Core S&P U.S. Total Market Index ETF (XUU). Relative fees are the driving force behind the change. Vanguard has maintained VUN’s MER at a now-pricey 0.16%, while BlackRock has steadily decreased XUU’s MER to 0.07%.

Vanguard also got the boot on their bond ETF for similar reasons. The BMO Aggregate Bond Index ETF (ZAG) has replaced the Vanguard Canadian Aggregate Bond Index ETF (VAB), due to its lower expected MER (0.10% vs. 0.13%).

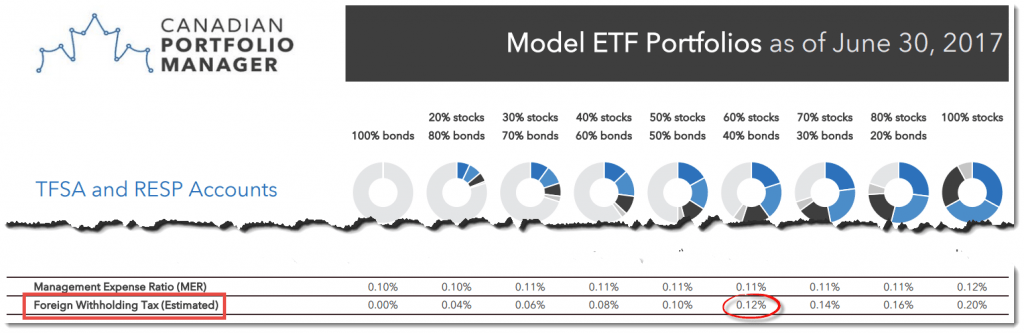

As there are no foreign withholding tax reductions for holding US-listed ETFs in TFSA or RESP accounts, I’ve used entirely Canadian-listed ETFs in this version of the model portfolios.

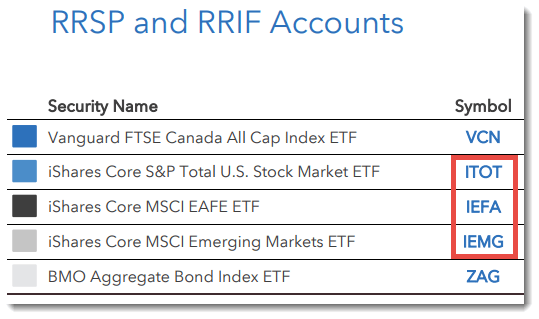

RRSP and RRIF accounts

Although the model portfolios above are suitable for smaller RRSP or RRIF accounts, investors with larger accounts can save $100s to $1,000s annually in foreign withholding taxes and product fees by investing in US-listed foreign equity ETFs. The caveat is that you must master the dreaded Norbert’s gambit strategy to cheaply convert your Canadian dollars to US dollars before purchasing the US-listed ETFs. Otherwise, most of the benefit of going foreign will be eroded by the brokerage’s steep currency conversion fees.

If you’re up to the challenge, I’ve created model portfolios using US-listed ETFs specifically for your RRSP and RRIF accounts. Please ensure that you fully understand the additional costs and complexities involved before placing these trades. Or, if you’ve decided life is just too short to jump through so many hoops, there’s absolutely no shame in using Canadian-listed ETFs. You’ll still be miles ahead of most investors who are playing the even more costly active investor’s game.

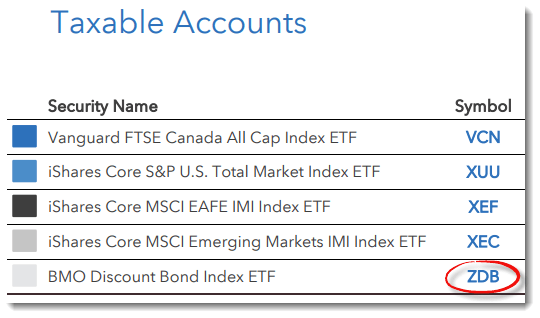

Taxable accounts

For taxable accounts, I’ve tinkered with the model portfolio by switching out a less tax-efficient bond ETF (ZAG) with the more tax-efficient BMO Discount Bond Index ETF (ZDB). In a previous blog post, I calculated the after-tax return for a taxable investor holding various plain-vanilla bond ETFs, and ZDB was the clear winner. ZDB also has an expected MER of 0.10%, so there’s no difference in fees.

Foreign withholding tax

It’s hard to manage your foreign withholding taxes if you’re not sure what to expect from them, so I’ve added an estimate for this overall tax drag on the various model portfolios. For example, the foreign withholding tax drag on a balanced portfolio held in a TFSA account would be about 0.12% (in addition to the MER of 0.11%). This should help eliminate some of the confusion that can otherwise arise.

A model on the move

So there you have it. Don’t feel as if you have to rush right out and make a flurry of immediate trades. If your portfolio is mostly optimized already, you may want to ride out these recent updates until you’re making changes anyway. But when you are ready for a change, these newest model portfolios should help you keep up with the latest in real-life pricing, products and performances.

Hi Justin, The information in your blog and white paper are quite erudite -can I seek some clarity because I am investing in Vangaurd ETF’s from India ( I am an Indian Citizen ,settled in India ,not domiciled in US and classified as NRA ,not domiciled in US)

My investments are in VT/VTI/VXUS/BND

Schwab deducts 25% withholding tax on dividends ( which I can claim in India because of Double Tax Avoidance Treaty, my tax rate in India would be >25-30%)[ W 8BEN filed]

Recently read information on Irish domiciled ETF’s and the fact that WT has a significant drag on returns. I did some calculations on back of the envelope and could not figure out – if buying into these Irish domiciled ETF’s with their higher ER, tracking errors,spread was worth the few (, 10 bps of saving if any)

Can you show me the way?

Thanks

Vineet

Vineet: I would recommend speaking with an accountant in India. I am only familiar with foreign withholding taxes from a Canadian perspective.

Is there somewhere where you have posted alternatives to each of the ETF’s you recommend in your main model portfolio? I have the same ETF’s in my RRSP and taxable accounts, but I have just read that the ACB has to be calculated across both accounts if they contain the same ETF’s. To simplify the ACB calculation, therefore, I would like to replace the RRSP ETF’s (VCN, XEC, XEF and XUU) with their closest equivalents.

@John: The ACB only needs to be calculated across multiple taxable accounts (the ETFs in your RRSP are not relevant for ACB tracking purposes). Feel free to use the same ETFs in your RRSP and taxable accounts.

If this is an issue for other investors (possibly because they have a taxable DIY brokerage account with ETFs and a taxable managed account with an advisor that uses ETFs), other suitable alternatives would be:

VCN –> XIC, ZCN or FLCD

XUU –> VUN

XEF+XEC —> VIU+VEE

Hey Justin,

What’s the advantage of using 3 individual ETFs (XUU, XEF, XEC) instead of XAW? I don’t mind rebalancing an additional 2 etfs and just want whatever is more profitable long-term

@Vic: Other than slightly lower fees, there is no advantage over using XUU/XEF/XEC instead of XAW (unless you are holding certain asset classes in certain accounts for tax-efficiency, then it might make sense to break up the equity regions).

Hey Justin. Thanks for replying. are xuu xef and xec all subject to withholding taxes? Are they all not recoverable in RRSP/TFSA but are recoverable in a taxable account?

Silly question but where do I go online to check the MER of an etf? E.g. I was looking at the MER for xec and it said 0.26% on https://www.blackrock.com/ca/individual/en/products/251423/ishares-msci-emerging-markets-imi-index-etf? That seems high and I feel like I’m looking at the wrong thing?

@Vic: XUU/XEF/XEC would all be subject to withholding taxes (unrecoverable in an RRSP and TFSA, but mostly recoverable in a taxable account). This is the exact same situation as XAW. Please feel free to try out the Foreign Withholding Tax Calculator on my blog, which shows the unrecoverable foreign withholding tax for each ETF across TFSAs, RRSPs and taxable accounts (the MERs are also included for reference):

https://canadianportfoliomanagerblog.com/calculators/

Sounds like you’re in the right place for the MER. XEC is around 0.26%. XEC only has a weight of around 10% in XAW, so this relatively high MER doesn’t have as much impact on the weighted-average MER of XUU/XEF/XEC.

Thanks Justin, forgot about the weighted average.

Since I’m starting out, I plan on maxing my TFSA/RRSP before contributing in a taxable account. The foreign withholding tax would be 0.23% according to your calculator in my TFSA/RRSP so it really doesn’t make sense for me to buy xu/xef/xec even if it’s a lower MER than xaw. Is that right?

@Vic: That’s correct! You may want to even consider one of the asset allocation ETFs if you’re just starting out (so that you don’t need to rebalance your portfolio, as the fund does this for you automatically). I talk about these funds (and foreign withholding taxes) in episode one of the CPM Podcast:

https://canadianportfoliomanagerblog.com/podcast-1-plain-and-simple-vanguards-asset-allocation-etfs/

Hey Justin,

I’ve been following your blog for just over 1.5 years and noticed that some of the fund allocation percentages are different than in last year’s portfolios. For example in your Sept 2017 80/20 stocks/bonds TFSA portfolio you recommended 27% XUU, 20% XEF, 6% XEC. Now (March 2019) you recommend 29.9% XUU, 16.8% XEF, 6.3% XEC. Does this mean one should change their portfolios to match this years allocations? Thanks.

@Ian: The new percentages of XUU/XEF/XEC are just the underlying market cap region weights of XAW (they are there in case investors want the same exposure as XAW, but perhaps want to hold XUU/XEF/XEC or ITOT/IEFA/IEMG separately).

At PWL, we tend to just split the Canadian, U.S. and international/emerging markets allocation 1/3, 1/3, 1/3 – here’s a version which you may be more accustomed to seeing:

https://www.pwlcapital.com/resources/toronto-team-model-etf-portfolios-2018/

Over the long term, it likely won’t make a significant difference which option you choose.

how about VXUS to replace IEFA and IEMG? lower fees, VTI for USA and then VXUS? VTI seems like good value aswell, only thing being these are in USD so they’d have to be held in RRSP for best results. but curious why I dont see VTI or VXUS anywhere as its very similar

@Ben: A VTI/VXUS combo is also a good choice. VXUS does include Canadian stocks, so you would be further overweighting Canada in your portfolio, relative to using IEFA/IEMG.

You could also use a single fund, VT, which is similar to the VTI/VXUS combo.

I am new to investing but not fearful of the “complexity” of your 5 ETF model vs the 3 ETF model. I suppose my only question becomes what you would consider the dollar value threshold to bother with the money saved with your 5 ETF model. As an example, I will be getting my feet wet with a $25,000 initial investment into my RRSP, but raise that value to around $150,000 within a year split between my RRSP and TFSA.

@Ari: The cost savings would be dependent on the value of your portfolio, how much you have invested in each account type (RRSP vs. TFSA), which asset classes and ETFs you’re holding in each account type (your asset location), if you’re using U.S.-listed foreign equity ETFs in your RRSP (to reduce foreign withholding taxes), whether you’re using Norbert’s gambit to convert your CAD to USD, how often you’re adding money and placing trades, the cost of your trading commissions, if there’s any sampling error (from your imperfect copycat XAW portfolio), etc., so it’s difficult for me to provide you with a rule of thumb. Bigger is always better…I doubt I’d even think about using a 5-ETF portfolio until at least $100,000. I’d even consider a 1-ETF portfolio (rather than 3) to start things off (you can always switch at a later time):

https://canadianportfoliomanagerblog.com/model-etf-portfolios/

The FWT and MER cost savings from using ITOT/IEFA/IEMG is around 0.39% in an RRSP (relative to XAW), so that should assist you in determining whether you feel it’s worth the complexity in your particular situation. You can also check out my Foreign Withholding Tax calculator, to test out different scenarios:

https://canadianportfoliomanagerblog.com/calculators/

Good food for thought.

But this leads me to my next “stupid” question. considering the fact that i will be putting in around

$150,000 within the next year, I still have the most basic question that I can’t decide on…Questrade or TD direct investing…I am already with TD, so transfers and tracking would be easy…along with the fact that I feel secure with their organization, however, since my intention is to simply buy ETFs, hold, and rebalance yearly, it feels like I could save a little bit of money with Questrade, for no real benefit lost.

The only reason I ask the question is since every article i read or video I watch seems to suggest that Questrade is better for beginners (which I am) with portfoios in the $5,000 to $10,000 range to start off…larger sums seem to gravitate to banks…am I reading the industry incorrectly?

@Ari: If you won’t be trading much, going with TD Direct Investing would be a reasonable choice (the main downside of TD is higher trading commissions). I think their platform is easier on the eyes (relative to Questrade), and if you are already comfortable with TD, it seems like a good match.

Hello,

I was wondering where is the model portfolio for RESP’s?

@Steve: They’re available on page two of my CPM Model ETF Portfolios – https://canadianportfoliomanagerblog.com/model-etf-portfolios/

Hi Justin,

I noticed your Model ETF Portfolios looked more streamlined, focusing on the three Canadian-listed ETFs that your PWL colleague Dan Bortolotti uses in his Canadian Couch Potato model ETF portfolios. You still have the slightly different ETF portfolios depending on the type of non-registered and registered accounts, which is helpful and appreciated, but I definitely noticed that you’ve paired down from five to three ETFs. Do you know when you made the change and did you blog about it? I couldn’t find an entry.

Cheers,

Doug

@Doug: The CPM and CCP model ETF portfolios have been nearly identical for years (I was just rounding the US/Intl/EM figures – I still post a similar portfolio on the PWL website). Whether you use a 3-ETF or a 5-ETF makes little difference (unless you want to optimize withholding taxes in RRSPs):

https://canadianportfoliomanagerblog.com/cutting-up-a-3-etf-portfolio-into-a-5-etf-portfolio/

Hi Justin,

What’s your opinion on 70/30 is the new 40/60?

https://www.theglobeandmail.com/investing/personal-finance/retirement/article-simulation-suggests-boosting-stock-portion-of-portfolio-to-70-per-cent/

Thanks!

@marc: Investors should largely ignore online advice on asset allocation. How much risk someone should take with their own portfolio is dependent on their willingness, need and ability to take risk.

Hi Justin,

Looking at your June 30, 2018 Model portfolio for TFSA, I noticed that the 20-year Annualized returns for portfolios with 20%, 30%, 40% and even 50% bonds have outperformed the ‘riskier’ portfolio of 100% stocks. (Simmilar results in your RRSP and Taxable model portfolios). However I see a lot of young investors with long timelines ignoring bonds expecting greater returns from a 100% stock portfolio.

I suspect the better returns are due to being able to rebalance – selling high and buying low – something which a 100% stock portfolio cannot do. Though I rarely see ‘rebalancing’ touted as a reason to keep bonds in a portfolio. Am I onto something here? Why do you think that the portfolios with bonds have had better returns than the portfolio without?

@Mark: As you mentioned, over this 20-year time period, there was a benefit from rebalancing a portfolio with bonds, versus an all-equity portfolio (this is not always the case). It was also a decent period for bond returns, as yields decreased substantially over that time period.

It’s always interesting to see updates to your model portfolios. On balance, I think these are all positive changes. I’m just sort of wondering, why bother to leave a single Vanguard fund (VCN) in your portfolios? What, if any, major characteristics do you prefer over it to, say, XIC from iShares or even a synthetic ETF like HXT from Horizons? I realize that XIC tracks the typical S&P TSX Composite Index and, I think, VCN tracks the FTSE indices which, in global markets, can make a difference as I understand there are differences in terms of how South Korea is classified in MSCI and FTSE, but that’s probably getting into the proverbial weeds a bit.

Also, I’d like to hear your thoughts on synthetic, total return-based ETFs from Horizons, which is doing some really innovative things, I think, if you ex out their BetaPro fund business. I don’t really have any concerns at all with respect to counterparty risk and my concerns with respect to the federal government eliminating tax efficiency on swap-based ETFs is mitigated more now that I know how widely these total return indices are used. Scotiabank Pension Plan, of which my mom is a deferred plan member, uses an OMERS Real Estate Total Return Index swap for its real estate exposure and, I’d imagine, even CPPIB either uses or markets their own total return swaps based on their portfolio. I should look into that.

Cheers,

Doug

@Doug Mehus: XIC and VCN are arguably substitutes for one another – feel free to use either. The South Korea FTSE/MSCI differences would have zero impact on a Canadian equity ETF. HXT has a more tax-efficient swap structure and only includes large cap stocks.

As it stands, the Horizons swap-based ETFs are more tax-efficient than their plain-vanilla counterparts. Depending on whether the government disallows this structure in the future, it could end up being a less tax-efficient structure for investors who may be forced to realize all capital gains within a single year (the tax impact of this very real possibility will be dependent on each individual investor’s situation).

In an RRSP using US-listed ETFs, would it be a good idea to have some of the bond allocation in an ETF like iShares AGG (US-listed US aggregate bond ETF)? I’m think this so that that rebalancing could happen between bonds and international stocks without the need for currency conversion. Also, AGG currently seems to have higher yield and lower expenses than ZAG. This could provide a bit of international bond exposure too.

@Peter: Generally, your bond allocation is meant to reduce the volatility of your portfolio. When you invest in an unhedged bond ETF (like AGG), you are subject to additional currency fluctuations, which can make the portfolio more risky than intended.

http://www.etf.com/sections/index-investor-corner/swedroe-dont-exclude-emerging-markets?nopaging=1

To clarify my previous comments, Larry Swedroe states in the above link that a market cap allocation to emerging markets (about 1/8 of total equities) is a good starting point.

https://www.vanguardcanada.ca/advisors/mvc/loadImage?country=can&docId=12396

When I calculate emerging markets exposure in Vanguard’s Growth ETF Portfolio, it works out to 7.625% of total stock exposure.

In your model portfolios, emerging markets are around 8% of stocks. That’s very similar to Vanguard, in their asset allocation funds.

David Swensen recommends around 14%. Larry Swedroe says the market cap (around 12.5%) is a good starting point.

In 2013, Campbell Harvey stated

“strategic allocations somewhere in between market capitalization weights and GDP weights are easy to defend.” At that time, that would have meant somewhere between 10.8% and 40%. He pointed out that the 10.8% is free float market cap. For total market cap, it would have been 20%.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2344817

Is this reason for you and Vanguard having a lower EM exposure the fact that Canadian stocks have a higher correlation to EM stocks than US stocks have with EM stocks?

@Park: In my model portfolios, the equities are first split 1/3 Canadian stocks and 2/3 global stocks:

https://canadianportfoliomanagerblog.com/ask-bender-canadian-stocks-vs-global-stocks/

https://canadianportfoliomanagerblog.com/ask-bender-canadian-stocks-vs-global-stocks-part-ii/

Of the 2/3 global stock component, the emerging markets are roughly market capitalization weighted:

https://canadianportfoliomanagerblog.com/where-does-your-global-stock-etf-weigh-in/

Please keep in mind that David Swenson and Larry Swedroe are US investors, so their rules of thumb do not necessarily apply to a Canadian investor.

In a taxable account, is ZDB still the winner after-tax since VAB dropped its MER to .08?

@scott: The small fee difference between ZDB and VAB is not expected to make a noticeable difference to any after-tax return comparisons.

Hey Justin,

Great stuff on here, What do you think of the Vanguard Multi Asset ETF’s, VCNS, VBAL, & VGRO? Seem like interesting products somewhere between full passive and robo-advisor.

@Ian: I’ll be releasing a blog with my comments/analysis this week. My colleague, Dan Bortolotti, will likely be releasing an article on the new ETFs tomorrow: http://canadiancouchpotato.com/

Hi Justin,

I’m a bit late to the DIY party as I’ve been a sucker of mutual funds the last decade. I’m 35 though so hopefully still have time to make up for the hefty fees I’ve been paying. I am impressed at and thankful for the amount of resources you’ve posted here, available to anyone.

My question to you is about currency risk. You advise trading US listed ETFs in RRSPs because of favorable taxation. Can you help me understand the currency risk implications, especially when heftier sums are accumulated? On one hand I’d think USD is safe over the long haul, but that 15% taxation can also get eaten up pretty quickly with currency fluctuations.

Also, is it accurate to say that VTI would be an example of a currency hedged ETF?

Again, many thanks for your huge role in educating the masses.

@Dan: Holding a Canadian-listed US equity ETF (like VUN) is equivalent to holding a US-listed US equity ETF (like VTI). Neither is currency-hedged – so the currency fluctuations are equivalent (once you assume the US-listed ETF is eventually sold and the US dollars are converted back to Canadian dollars).

Hi Justin – great info all, thank you. I’m reaching that “almost overwhelmed” stage, so I’ll keep it to one question. What would a model portfolio ETF portfolio look like for an incorporated business, mostly as relates to tax efficiency? When I left my employer a couple of years ago, I did incorporate, and the money in there is now enough that I need to think a bit strategically. I have maxed out RRSP’s and TFSA’s as well, and a bit of taxable (not much). When learning about incorporation, a common phrase was that “a corporation is an individual entity, just like a person”. Except now I have to think about to invest within that entity efficiently, and ultimately how to invest across all of them efficiently.

I know that the potential for complexity exists with this question (e.g. understanding investment income vs. active business income, as well as the impact of the recent legislation changes), but I’m hoping it can largely be cut through, with a focus on accumulating tax efficiently in the corp. I think we can keep wIthdrawal strategy separate.

Thanks in advance for any thoughts.

@Mike W: A model ETF portfolio for a taxable corporate account would look very similar to my taxable model ETF portfolio: http://www.canadianportfoliomanagerblog.com/model-etf-portfolios/

You could also consider the Horizon’s swap-based ETFs, if you’re comfortable with their structure.

I generally hold a 100% equity allocation in my TFSA accounts, and then hold any remaining equity allocation in the personal and corporate taxable accounts (Canadian equities in corporate taxable and foreign equities in personal taxable, if possible).

There are many thoughts on the asset location decision and in the end, it probably doesn’t matter much.

Hi Justin,

Great site with lots of helpful information.

I find myself in a situation where I need to push through my personal barrier caused by reading too much media (It is the wrong time to invest due to 2nd longest bull market in history, big crash coming, etc. etc.)

I sold off my business and am sitting in about just over $1,500,000 soft assets at the moment. My financial info is as follows:

RESP: $16000

RRSP: $$280,000

Business Account: $500,000

Personal: $750,000

I also have a paid off mortgage and vehicles ($650,000+ hard assets).

I am looking to live modestly off my investments (taking out about $30,000 per year), leaving as much as I can for compound growth.

I would greatly welcome your advice on what to invest in, and in which accounts, for maximum tax efficiency, as well as whether I should purchase a small amount over the next few years, or be more aggressive and buy more today.

@Jason: I do not provide personal advice on this blog, but there are many articles I have posted which should help you.

Justin,

Let me start by saying thanks for your ongoing knowledge and guidance with your blog. With your update, I was surprised to see ZDB appear in the taxable account model portfolio, when you have been a champion for BXF for its optimal tax treatment. Is this change a result of better performance with ZDB, or low trading volume of BXF leading to illiquidity?

I am in the fortunate position where I cannot fit all of my bond allocation (roughly 15% of my portfolio) into my TFSA/RRSP because of a DB pension plan that limits my contribution room. As a result, my RRSP contains a combination of ZAG/VSB, and I hold another fixed income portion in a taxable account in BXF.

Would it make sense to swap ~$30,000 between BXF and ZDB in a taxable account every so often (especially as interest rates rise), with the added benefit of tax-loss harvesting? My account is with Virtual Brokers, so I would only pay for sale trades under the current fee structure.

Thanks for your time, and continued expertise!

@John: I’ve written about ZDB’s tax-efficiency before: https://canadianportfoliomanagerblog.com/dont-discount-zdb-just-yet/

If you want tax-efficient short-term bond exposure in your taxable account, BXF or GICs may be appropriate. If you want tax-efficient broad-market bond exposure in your taxable account, ZDB or HBB may be appropriate.

Hi Justin,

I have one more question!

I have max amount of TFSA and non-registered account to invest.

Could you please help me how to combine those funds which I am interested in and your picks? Or if you have better suggestion, will be much appreciated.

HXT, XAW, XUU, VFV and ZAG

@Sakura: I’ve posted my suggested portfolios already: http://www.canadianportfoliomanagerblog.com/model-etf-portfolios/

Your ETF picks seem redundant. For example, 53% of XAW is US equities, and 100% of both XUU and VFV is US equities.

Hi Justin,

Thank you for your great advice.

I have a question. When you say, ” US-listed international equity ETF”. even I buy Vanguard Canada products for example, say, VFV compared with VOO, the tax withholding will be put on because the holdings are US companies? Or you are suggesting to buy VFV over VOO because it sells in Canada?

Thank you for your advice!

@Sakura: If you hold VFV instead of VOO in an RRSP account, foreign withholding taxes will apply (holding VOO in an RRSP account avoids this tax): https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf?ext=.pdf

Hi Justin,

I love your site and have benefited greatly from it. In my own accounts I hold iShares. I have simply followed Blackrock’s core model portfolios.with the addition of a few other, more specialized ETFs just to make things interesting: REITs, high-yield bonds, emerging market bonds etc.. For my wife’s accounts, however, I have recommended a Vanguard 7 ETF portfolio, a 3 ETF Canadian Couch Potato portfolio and your model portfolio. She is new to passive investing. At my encouragement, she sold her mutual funds offered by a major Canadian bank. Her average MER was over 2%. Even though the bank offers index funds, it was virtually impossible to buy them because her advisor was so opposed to the idea. I note with interest that some advisors suggest portfolios that are much more complex. I was surprised to see that the BMO model portfolios often contain 14 or 15 ETFs. Is there any evidence that these portfolios will perform better than a simple one with 3 to 5 ETFs? Is it simply because people prefer complicated? Is there any reduction in risk with a greater number of holdings?

@David: I don’t know of any evidence that would suggest that a complicated portfolio is better than simple portfolio. I have, however, witnessed countless investors who have bogged themselves down in the investing minutiae. This causes them to either derail their entire plan, or fail to take any action at all and just sit in cash.

Hi Justin,

I have a $500,000 portfolio with maxed TFSAs and RRSPs. and ~30% taxable. My registered accounts are with a brokerage, currently exclusively Canadian and America equities, so I purchased bonds and international ETFs in my taxable accounts. As I bring it over to fully self directed this year, could I benefit from one of the model portfolios or should I get an advisor for active management? Thanks! Jeremy

@Jeremy: If you’re considering an advisor, I would suggest avoiding any that recommend an active (i.e. stock-picking or market timing) investment strategy. You should look for an advisor that advocates passive management, diversified, low-cost tax-efficient investing, combined with financial planning. Don’t pay more than 1% plus tax for this type of wealth management service (perhaps you can negotiate lower if you’re saving a substantial amount in your portfolio each year). Ideally, try to get your all-in portfolio management and financial planning costs to 1% per year or less.

If you’re going the DIY route for now, please refer to these blog posts for some ideas:

http://www.canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

http://www.canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

Hey Justin,

I’m a noobie getting into ETF’s, couch potato investing in general.The question I have is, Are the way your portfolios are set up as shown going to be tax efficient? I have read some things about “Asset location” to make your investments more tax friendly.(ie Canadian Equities in TFSA, US equities and bonds in RRSP) Seems like this would be more of a headache to rebalance? I am planning on following your RRSP portfolio since I have alot of room left in my RRSP. Is this the right thing to do? Just follow the portfolio as laid out and put the said ETF’s into the RRSP?

Thanks

@Ian: It depends on whether you are investing in various account types, other than an RRSP (such as TFSAs or taxable accounts). If you are dealing with multiple account types, please refer to my asset location blogs for helpful tips and examples:

http://www.canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

http://www.canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

Hi Justin,

Thanks for your awesome work. I’m a first time investor and it will be very helpfull for me. :-) I’m looking at your model ETF portfolios updated on sept. 30 2017. I just opened a TFSA and I see all five assets you suggest have done very well since September (VCN, XUU, XEF, XEC and ZAG) I’m feeling it won’t last forever, though. Should I still go with that or is it better to wait for your next model ETF update. Cheers and thanks again!

@Olivier Simard: I’m not planning to make any changes to my model ETF portfolios in the new year – if you’re feeling uncomfortable about investing, you should read more about passive investing before jumping in (I’ll send you an article by email to get you started).

Hi Justin,

I hold 60 VTI in my RRSP

I just noticed you recommend ITOT instead.

Can you tell me the difference other than 0.01% MER

With Questrade it would cost me about $5 to switch, worth it?

@Shea: VTI is almost identical to ITOT – I would just leave it as is (there’s no need to switch it for such a small difference in cost).

Hi @Justin,

Thanks so much for putting this all together, it is extremely helpful! I have a question on how to apply your approach to multiple accounts. I have 4 accounts that I would like to use your balanced portfolio across (RRSP, TFSA, LIRA and tax paid). Is it best to create your model portfolios for each type of account or split each allocation as much as possible into each account to simplify balancing in the future and improve tax efficiency? As one approach / example, does it make sense to hold all bonds from my mix in my TFSA because they are the least taxed there compared to all other accounts and buy Canadian equity in the tax paid account because it is most effectively taxed there when compared to the other asset classes that will take room in my tax sheltered or deffered accounts?

@Mark: I’ve posted asset location scenarios on the following blog posts that may be helpful:

http://www.canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

http://www.canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

Justin,

I am trying to determine where my wife’s RDSP fits in, is it more akin to RRSP (which is my conclusion) or is it more like TFSA/RESP. Trying to determine whether to hold the ETFs as USD or CAD equivalents. Timeline is 15-17 years.

@ZJ: The RDSP would be similar to a TFSA/RESP (the foreign withholding taxes are still levied, even if you hold US-listed ETFs). So I would just hold the Canadian-listed versions of the ETFs in the RDSP account.

Hi Justin,

Thanks for putting this up. I moved to Canada one year back and I haven’t started investing anywhere. I have 40K in my savings account. Plus I am planning to invest 5k every month. I’am slightly confused what approach to follow.

1) Follow your model ETF portfolio – Taxable + TFSA. I haven’t opened an RRSP. I might move back in 8-10 years and I am not sure if investing in RRSP makes sense

2) Maintain a Mawer portfolio – they have low cost mutual funds

3) Approach a Financial Advisor

Thanks

Paul

@Paul: The DIY approach (if implemented properly) is always going to be the cheapest (and likely most tax-efficient) option, but that doesn’t mean it’s the right one for you. At your asset level, it may be difficult to find an “index-friendly” advisor – you may be better off seeking out a fee-only financial planner and investing on your own.

The Mawer balanced fund approach (or even the Tangerine balanced fund) would also be decent options if you don’t want to do-it-yourself.

Thanks Justin. I think I’ll go with DIY approach.

Hi Justin,

I just recently became a Dad and one of my first thoughts was that I should be setting up an RESP. We have started to make contributions but obviously the account is still rather small. What would you recommend as the minimum amount before starting to invest in the ETFs. Currently we have about $1400 in the account.

@Ted: Congratulations! Glad to hear you’ve taken steps to open an RESP account. Which brokerage are you using and how much are you expecting to save each year? (I’m assuming that your brokerage doesn’t offer commission-free ETF trades?)

Hello Justin,

I currently own Vanguard U.S. Total Market Index ETF (VUN) in both my RRSP & TFSA. You recommend iShares Core S&P U.S. Total Market Index ETF (XUU). Should I sell VUN and buy XUU’s to get the lower MER 0.07%.? I am new at this any information would be helpful.

Thanks,

Joe

@Joe: I don’t think that’s absolutely necessary. I would expect that Vanguard Canada will lower VUN’s MER shortly (as it is over twice as much as XUU). For my clients, I’m continuing to hold VUN, but implementing new portfolios using XUU.

Hi Justin, I’ll add my thanks to everyone else here for all the work you do and freely offer up to DIY folks on this site. You’re right – it generates a great deal of good will for you and your company, an indicator being that I just advised my sister who is looking for an advisor to look you up.

A small question: you say in the blog that ZAG has a lower “expected” MER of .10%. I clicked on the link and BMO is listing ZAG with an MER of .14%, and CIBC IE is also quoting it as .14%. Am reading something wrong? Were you expecting it to change soon? It doesn’t seem to have… In fact, looking at the comments section, I’m wondering whether you initially expected the MER to be .07%, but then changed it to .10%?

I noticed this because I’m trying to develop a DIY portfolio for my partner who has just started his RRIF, and was looking again at your models: I’m 60 and when I retire in 5 years we’ll be depending on his RRIF & CPP/OAS until I reach 70 when I’ll take my own CPP/OAS and convert my RSP to RIF. He’s doing 60% FI in his RRIF. From that I’ve purchased a HISA for current year and am about to make a GIC ladder for his withdrawals for the next 5 years, but am uncertain what to do about the subsequent years: For 10 years out, should we be looking at ZAG/VAB, or a short term bond fund, and use them over time to do another 5 yr GIC with each passing year? Is there a better alternative for these circumstances? I was looking at the Westmacott white paper on retirement portfolio design, but it’ll take some time to do those calculations…

@Jean: Thank you for your kind feedback :)

BMO reduced the management fee on ZAG and ZDB to 0.09% last year, so it usually takes a full calendar year to see this reflected in the official MER (which I would expect to be around 0.10% with taxes): https://beta.theglobeandmail.com/globe-investor/funds-and-etfs/etfs/bmo-cuts-annual-management-fees-by-more-than-50-on-some-etfs/article30468936/?ref=http://www.theglobeandmail.com&

I think your suggestions sound prudent. For my retired clients, I generally include an investment savings account with 1-2 years of cash flow needs, along with a 1-5 year GIC ladder for a significant portion of the fixed income (as the GIC yields are similar to the yields on an arguably more risky broad-market bond ETF). I then invest the remainder in a broad-market bond ETF (this provides additional liquidity for unexpected calls on capital or rebalancing opportunities, as GICs cannot generally be sold). If your partner is more conservative, you could consider a short-term bond ETF for this portion. During good stock market years, you’ll also be selling equities and using the proceeds to top-up your cash and fixed income allocations (providing some additional liquidity).

Have you ever done work on what funds work for Canadians who are also US citizens? There are some complicated issues (I think).

@Mark: I haven’t written anything on the topic, but you may want to check out articles from this firm: https://cardinalpointwealth.com/cross-border/free-white-paper-new-pfic-rules/

Justin,

I understand that ETF are more tax efficient compared to actively managed mutual funds. Since I still hold some of my registered/taxable investments in mutual funds, is there any information/site you can share to determine the tax efficiency of a given mutual fund?

Thanks,

Silva

@Silva: Morningstar provides tax cost ratios (which are similar to MERs, but for taxes paid) for most mutual funds and ETFs. A smaller tax cost ratio equals a more tax-efficient fund (all else equal): http://quote.morningstar.ca/QuickTakes/fund/Taxanalysisnew.aspx?t=F0CAN05MUH®ion=CAN&culture=en-CA

Please also feel free to refer to our white paper on the subject of after-tax returns: https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2014_Bender-Bortolotti_After-Tax-Returns_Hyperlinked.pdf?ext=.pdf

Thanks Justin! All this information is very helpful.

Can you please explain what Jamie Golombek is referring to as Deferred capital gains option in the page 5 of the article below?

http://jamiegolombek.com/media/RRSPs-for-business-owners.pdf

Does the buy and hold strategy of your ETF portfolio with 70/30 equity/fixed in a corporation investment account fall under this deferred capital gains criteria?

@Silva: Deferred capital gains would be an investment that paid no annual taxable income (i.e. dividends or interest). When you sold the investment, you would pay tax on only 50% of the gain.

An example would be a 100% allocation to a swap based product, like the Horizons S&P/TSX 60 Index ETF (HXT). Another example would be a holding in a stock that doesn’t pay dividends, like Berkshire Hathaway.

Hello Justin, how come BMO’s ZCN hardly gets any attention? Both ZCN and VCN have the same MER at 0.06%. What does VCN have that ZCN doesn’t?

@Lester: I’ve recently written about how broad-market ETFs from various product providers can be used interchangeably: https://canadianportfoliomanagerblog.com/how-to-build-an-etf-portfolio/

Hey Justin,

Just wanted to thank you so much for creating this website and constantly updating it. It’s a fountain of information for us DIY’s. Although this question most likely sets me up for a large tongue lashing, would the Taxable Model ETF portfolio be suitable for a leveraged portfolio?

Thanks again and take care

@Joe P: If you’ve decided to borrow to invest in a non-registered account only, then the taxable model ETF portfolios would be most suitable for this account type.

Thanks Justin. We also invest in our RRSP’s, TFSA’s and our kid’s RESP’s. Our leveraged portfolio is just another part of the equation. Thanks again for all the FREE information. All the best.

@Joe P: You’re very welcome! :)

Hi Justin,

Thank you for your model portfolio update. I had a question about RESP’s. Would it be best to consider using XAW in this account along with a canadian ETF and ZAG? I am not sure for a 10 year time frame, what would be the best way to go regarding allocation or if it would be best to consider the 5 ETF approach in this account…..I don’t know how one goes about really re-balancing if you had a 70/30 or 80/20 split and you lets say for simplicity, utilized the 2500 contribution and waited until the grant came in, to then buy more shares- this would be for an account that does not have access to free buys like at Questrade. I would appreciate your thoughts. The RESP account has about 50K in it.

@Sue C: I typically use ZAG/VCN/XAW when I implement RESP accounts for clients (or smaller portfolios).

When a new $2,500 contribution is made, I generally top-up VCN and XAW first (assuming that the grant has already been added to the portfolio when calculating the purchase figures). I’ll leave any amount remaining in cash until the grant arrives a month later. Once the grant is paid into the account, I’ll top-up ZAG.

Hello Justin, Horizon ETFs are advertised as being tax-efficient. Have you considered these for your taxable accounts and if so, can you share some insight as to whether they would be equivalent, better or worse then your proposed options.

Thanks,

Pascal

@Pascal: I typically don’t use ETF products that I feel the government will do away with in the short-term (I include swap-based ETFs in this category). Depending on your tax bracket, the type of account you’re investing within, and future government tax proposals, these products may or may not be more tax-efficient after all costs.

Hi Justin,

Thank you for all your posts. Being new to self investing, your blogs have been very helpful.

I’m in the process of building your taxable model portfolio in a corporation investment account. I noticed that trading volumes and number of holdings of ZDB is far less than ZAG. ZDB also doesn’t track closely against the index like ZAG. Is that something I should worry about?

Regards,

Silva

@Silva: Although ZDB is less diversified than ZAG (as it’s tough to find bonds that are trading at par or at a discount to par these days), both ETFs hold approximately 70% in government bonds (federal/provincial), so the lack of diversification is mainly in the 30% corporate bond allocation. However, BMO does a decent job of spreading up the corporate bond allocation between issuers (so I don’t see large issuer risk here).

I wouldn’t be too concerned with low trading volumes on ZDB – just use limit orders and place them directly on the current ask price when you’re buying. If the bid-ask spreads are extremely wide, you could just wait a day or two and place your trades when the spreads have tightened.

As for the tracking error to the index, I believe it is because BMO manages ZDB to more closely approximate the risk/return metrics of the universe bond index (instead of following the discount bond index) – I’ll check with BMO and update my comment when I receive an answer.

Update: Comment from Kevin Prins of BMO ETFs

You are correct. A better comparison would be to look at the performance of ZDB vs. a broad market bond ETF (like ZAG) as we are essentially trying to deliver that performance and risk, but with more tax-efficient discount bonds.

Appreciate your prompt reply and follow-up clarification Justin!

What are your thoughts between ZDB and GIC laddering for the fixed income potion of a taxable corporation (small business) investment account portfolio? Current ZDB weighted average yield to maturity is 2.0 and 2yr to 5yr compound GIC rates between 2.25 to 2.7% paid at maturity.

Also, any advice on GIC laddering?

Thanks again,

Silva

@Silva: For my clients’ larger taxable accounts, I tend to use a combination of ZDB and 1-5 year laddered GICs (ensuring that there are adequate liquid bond ETFs available to rebalance the portfolio back to its target asset mix if we experience a market downturn of about 50%).

I unfortunately have no idea where interest rates are heading, so I just divide the GIC allocation evenly between 1-5 years (sometimes I’ll skip the first year if I can receive a higher interest rate on cash, investing the cash in a 5-year GIC after a year to complete the ladder).

Thanks Justin. I also noticed that ZDB has a high turnover (52.81%) compared to ZAG (10.33%). Isn’t that too high for an ETF and would result in higher short term capital gains that would be taxed as regular income?

@Silva: ZDB would be expected to have a higher turnover than plain-vanilla funds (as it has to sell bonds if they start to trade at too high of a premium). This is actually more tax-efficient, as only 50% of the gain will be taxed (Canada does not differentiate between short term and long term capital gains).

Hey Justin, What is the strategy to re-balance a portfolio containing a mix of both Canadian and US-listed ETFs, such as your example under RRSP/RRIF (VCN and ZAG are Canadian, and ITOT, IEFA and IEMG are US)? With a mix of Canadian and US assets, doesn’t this make re-balancing more difficult due to the currency exchange?

@Lester: Investing in US-listed ETFs definitely complicates the investment of new cash as well as rebalancing. For new cash contributions, you could consider adding them to the Canadian-listed ETF equivalents until the amounts are large enough in size to switch to a US-listed ETF (using Norbert’s gambit). For large rebalancing (when you are required to sell equities), you would need to implement a reverse gambit (sell US-listed ETFs, buy DLR.U, sell DLR).

Another reason most DIY investors may prefer to simply avoid US-listed ETFs.

Justin, thanks once again for a highly informative post, and thanks to everyone who comments with questions and suggestions that help to illuminate both possibilities and pitfalls. One common theme that pops up in this comment thread, and has before, relates to how to map (a model) over a set of RRSP, TFSA, and nonregistered accounts. Similar to others others in this thread, between my wife and I we have two TFSAs, two RRSPs, and a joint non-registered account. For ETF holdings that include Canadian equities, US equities, global equities, universal bond, and short-term bond, juggling the allocation of assets to account types, given the prospective yield on each class and the different tax treatment of each class, continues to be an interesting struggle. The blog posts that deal with the treatment of, for example, US equity ETF’s in each type of account are quite valuable. How about a blog post that, with suitable caveats, provides a simple guide indicating the preference order for allocating each type of asset? I suspect I might not be the only one who would find this both educational and useful. Thanks!

@Alan: This is definitely on my list of topics to write about (unfortunately, there is no shortage of ideas…just time). Once I’ve completed the corporate taxation series, I may move into the asset location discussion.

Hi Justin,

Great post – thanks. My question is concerning the fixed portion of my portfolio. I am lucky enough to have a Defined Benefit Pension plan, so I only hold about 10% fixed income (although now that I’m within 3 years of retirement, I may increase this). In your opinion, is it better to hold this as a GIC, or as a bond ETF? And if you recommend a bond ETF, would it be best held in my RRSP?

@Heather: I would say that a 1-5 year GIC ladder would be preferably to a short-term bond ETF, as the yields are generally higher with GICs. A broad-market bond ETF has a yield-to-maturity that is slightly higher than 1-5 year GIC ladder, but with more term risk. If you’re someone who doesn’t like fluctuations in their fixed income allocation (and doesn’t require liquidity), you could consider the GICs. If you likely do not require the funds for the mid to long term and are comfortable with the additional term risk, you could consider the bond ETF.

Hi Justin,

Great update – thank you. What would be a general recommendation as to when it makes sense to bite the bullet and switch to US-listed ETFs in RRSP or TFSA accounts? How large(ish) is large?

“… investors with larger accounts can save $100s to $1,000s annually in foreign withholding taxes and product fees by investing in US-listed foreign equity ETFs…”

@David: There’s not much benefit of holding US-listed ETFs in a TFSA account (it’s actually worse to hold a US-listed international equity ETF in a TFSA account, relative to a Canadian-listed international equity ETF that holds the underlying stocks directly).

Holding US-listed foreign equity ETFs in RRSP accounts does save on taxes and product fees relative to holding Canadian-listed foreign equity ETFs (if implemented properly using Norbert’s gambit). If you compare the total FWT and product fees on my TFSA/RESP model ETF balanced portfolio (0.23%) to the total FWT and product fees on my RRSP/RRIF model ETF balanced portfolio (0.13%), the difference is only 0.10% per year. On a $50K RRSP, that’s $50 per year. On a $100K RRSP, that’s $100 per year.

I likely wouldn’t bother for anything less than $100 per year.

Thanks Justin, model portfolios for the various account types is very useful. I understand that some people may only have one type of account (i.e. TFSA), and I figure that’s why each account type has both equities and bonds. But if a person has all three types of accounts, do you recommend treating them as a single portfolio and putting particular asset types in each account? If so, I’d be very interested in what ETF is best suited for each account.

BTW, love the new website!

@Brian: Every asset location strategy has its positives and negatives. For example, having a naïve approach of holding the same asset allocation in your TFSA, RRSP and taxable can help defer taxes when it’s time to rebalance (i.e. you could sell equities in the TFSA or RRSP accounts, and leave the equities in the taxable accounts alone).

As a general rule of thumb, I tend to hold all equities in TFSA accounts. I then max out the taxable accounts with the remaining equities (unless liquidity may be required) in the following order: Canadian equities, US equities, emerging markets equities and international equities. If equities must be held in the RRSP account, I hold equities in the reverse order as above (i.e. international equities first, emerging markets next, etc.).

Hi Justin, you did an amazing job. Thanks for sharing it.

As @Brian, I have tons of questions related to how invest in each account (TFSA/RRSP/Taxable) using your Rebalance spreadsheet as support. When you have time, can you do a post using some examples?

Here is some some context. My wife and I have 3 investment goals. Each goal uses a different allocation from your Model. Today we put each goal in one type of account (eg. Retirement inside RRSP) and buy equities and bonds in the same account. We tried once to divide ETFs per type of account (as you explained to @Brian). However, it became too complicated to manage using the spreadsheet.

Thanks again for all your support.

@Bruno: Would you be able to provide more detail regarding the account set-up (it’s still not clear to me)? Thanks!

@Justin

I will try to do my best. My questions are related to how correctly use the spreadsheets from your Toolkit.

My and I have 3 different goals: 1 short-term 5yrs, 1 medium-term 10yrs and retirement +30years. We use the same ETFs (VCN/XAW/ZAG/XSB) for all of them, but in different distribution because of the timeframe of each goal.

We have 8 accounts (2 TFSAs, 2 RRSPs, 1 SRRPs, 1 Pension RRSP, 2 Non-Reg).

Our first strategy as beginners defined that RRSPs will hold the Retirements, TFSAs will hold the medium-term goal and Non-Regs will hold the short-term goal. Reading your blog + CCP, we figured out this is not a tax efficient strategy. Also, the limits for RRSPs and TFSA will not allow us to keep this strategy forever, forcing us to invest part of the money using Non-Regs.

We have tried to use the rebalance spreadsheet to help us, however:

– Controlling the limits of TFSAs and RRSPs is hard. We are worried to cross them and pay penalties.

-We would like to keep more less the same distribution avoiding my wife or I holding all the stocks or bonds.

– One account (e.g. non-Reg) holds the same ETFs, but for different goals (e.g. 10 shares of VCN for goal 1 and 20 shares for goal 2). We start to lose control to calculate the rebalance every month we need to invest part of our salary.

I tried to build my own spreadsheet based on yours, but it still very complicated.

I loved the videos you did for Norbert’s Gambit. Now I hope we have series how to use the toolkit. Jokes a side, I can pay you a hourly rate to teach me, but sharing the knowledge as part of the blog content will also be great.

@Bruno: Why not set-up a separate non-registered account for your short-term and mid-term goals (holding mostly GICs, tax-efficient bond ETFs (BXF/ZDB), and investment savings accounts)? This would be your “safer” money, and not exposed to stock market fluctuations.

You could then have a single long-term (and likely riskier) asset allocation for the TFSAs, RRSPs and existing non-registered accounts (you may have to move cash from the existing non-registered account to the new non-registered account, based on the timeframe of your goals).

@Justin: Sounds a good advice. I will study it tonight, thanks.

Question: Should I not prioritize equities inside non-regs accounts and bonds inside reg. accounts because of tax efficiency? Thanks in advance.

@Bruno: The issue with traditional asset location advice is that it doesn’t account for lump-sum requirements. If you require a certain amount of cash from your non-registered account at a specific point in time, you likely don’t want to hold equities there, in case of a market downturn at the worst possibly time.

@Justin: Does your advice above still applicable if I have an emergency fund to cover short-term needs inside a non-reg account?

@Bruno: If you have short-term goals (i.e. 1-5 years), the investments for these goals should be relatively safe. If you have a separate account for very short-term expenses (i.e. within a year), they should just be in a savings/chequing account (or an investment savings account product).

If you have mid-term and long term goals in two non-registered accounts (where you intend to invest in equities), one account could hold all Vanguard ETFs (i.e. VCN, VUN, VIU, VEE) and the other account could hold all iShares ETFs (i.e. XIC, XUU, XEF, XEC). This would avoid the situation of having to track the consolidated ACBs of the holdings in both accounts.

@Justin: I think now I am close to solving my issues.I took your rebalance tool and converted it to work with shares (instead of working with values). Now does matter if I have 2 or more investing goals inside the same non-reg account because I know the number of shares each one has there. This way it seems easier to keep track of ACB.

I will use RRSPs to support my retirement (long term) and TFSA to support medium term goals. It seems logic for me based on the purpose of each account. I just need to decide now the strategy of keeping bonds or equities inside the registered accounts when my portfolio exceeds their limits. I took an article from you and Dan to study, but the topic still very complex for me. (http://canadiancouchpotato.com/2014/04/24/do-bonds-still-belong-in-an-rrsp/ ) .

The last thing I am trying to find is a list of GIC providers. I could not find any references inside CCP/PWL/Money Sense. I am using ZAG/VSB to invest my fixed income allocation, but I think I should diversify with some GICs. I use Questrade and TD today, but I would like to compare them with other providers. Do you have any tips here?

Thanks again for all support here.

@Bruno Alves: Glad to hear things are starting to come together :)

I’ll be posting a blog (or two) in the next couple of weeks regarding the asset location decision, which you may find useful.

In terms of GICs, most of the brokerages’ GIC lists have fairly competitive rates (these change daily though). RBC Direct Investing has a fairly long GIC list of issuers last time I checked.

@Justin: Thank you very much for constantly updating your site. Your support is amazing.

@Bruno: Happy to help :)

@Justin: Hi again :) I have researched GICs/HISA rates and the most attractive are from Oaken Financial. I know it is off-topic, but could you give us your opinion about Home Capital situation? Should I put money there to get some extra basis points even in their delicate situation? I know CIDC covers them, but I am not sure if I could have future headaches with it. My goal is to invest half of my 6 months emergency fund there to combat inflation, and also part of the fixed income portion from a 5 years goal. Thank you!

@Bruno: You could have future headaches with any GIC issuer if they run into financial difficulty. I don’t see an issue with this if you’re comfortable with the inconvenience risk (and possibly a loss of interest while things get sorted out). Just be certain to stick to the CDIC limits.

You may also want to consider worst case scenarios: What happens if you need the emergency fund but the company has just gone bankrupt (leaving you without access to the cash)? Do you have a line of credit that you could draw from in the meantime?

@Justin, thanks for sharing your knowledge. I’ve never used a line of credit. I will research about it.

You mentioned above:

“What happens if you need the emergency fund but the company has just gone bankrupt (leaving you without access to the cash)?”

I am assuming that CDIC would pay me in 3 business days. Wrong assumption?

@Bruno: I would assume that it could take a few months to receive payment, even though CDIC says that they will aim to have all savings accounts reimbursed within a few days:

http://www.cdic.ca/en/about-cdic/resolution/Pages/tools.aspx

@Bruno I’m just an amateur but for the sake of discussion, this is what I did with our six accounts. I treat my accounts (RRSP, TFSA and Non-reg) as a one portfolio, and my wife’s accounts as another portfolio. That means I have two portfolios to manage/rebalance. I’ve created a rebalancing spreadsheet for each portfolio.

Feel free to have a look at an example of my rebalancing spreadsheet: http://goo.gl/gvI2VD (Hovering over the headings hopefully explain how to use it.)

@Brian: Thank you very much for sharing your spreadsheet and knowledge. Apparently, your case is very similar where I started. Now my portfolio developed, and I am facing some challenges:

1) My wife and I have multiple goals with different time frames. I build one spreadsheet for each one as you mentioned.

2) Our registered accounts achieved their limits. We are immigrants, so our limits are meager right now. As a result, we need to invest both in registered and non-registered accounts.

3) Because I need to invest in non-regs, now I need to control average cost base (ACB). Dan Bortinolli (from CCP) recommended keeping one non-reg account only to facilitates ACB tracking. Makes a lot of sense from a tax perspective, but now I have money for 3 different goals in the same non-reg account. As a result, re balancing has become a little bit complicated to manage.

I rebuild Justin’s spreadsheet trying to solve the problem, but it still complicated. I am trying to find people facing same issues to gather some advice as you did :) I am also a complete amateur.

Thanks Justin, much appreciated! 🙂

Could I ask you why, when it comes to stocks, you invest in the order of TFSA then taxable then RRSP?

I agree with your order in taxable accounts. Canadian equities first in taxable, as they are the most tax efficient dividends. Then US stocks, because with their lower dividend yield, you lose less to tax on dividends. After that emerging markets, because lower divdends then EAFE, but higher than US stocks. Finally, EAFE stocks, as they tend to have the highest dividends of international stocks.

Similarly, your order when it comes to RRSP makes sense. You maximize the tax advantage with that order, which is the opposite of the taxable account order.

But I still don’t understand TFSA first then taxable then RRSP. For example, you can’t recover dividend withholding taxes on US listed ETFs in an RRSP, but you can in a TFSA.

My last sentence is wrong. You can recover such taxes in an RRSP, but not a TFSA.

@Park: With tax decisions, you usually can’t win all the time. I prefer equities in the TFSAs first (over RRSPs) as the income and growth is never taxed (even though there is a slight tax drag each year). The RRSPs will eventually be fully taxable, so you would likely not want to hold your highest growth asset classes in these accounts first.

I know there’s no perfection in all of this, but may I add another wrinkle to the discussion? Re: TFSA vs RRSP – what about foreign withholding taxes? For example, VTI in RRSPs does not have FWT due to the tax treaty with the US. TFSAs do not enjoy this exemption. So are US-listed equities still better in RRSPs, even in spite of higher eventual taxation?

@Chrissy: It’s impossible to know which decision will be the optimal one in advance. If you’d prefer to hold only Canadian-listed Canadian equity and international equity ETFs (that hold the underlying stocks directly) in your TFSA account, and US-listed US equity and emerging markets equity ETFs in your RRSP, I don’t see any issues with this.

Hi Justin. I was surprised to read that you now recommend holding all equities in TFSA accounts. A couple of years ago, you recommended holding all interest-bearing investments due to taxation issues. Can you explain why your thinking has changed and, what would you recommend for someone who now has 100% bond ETFs in a TFSA?

@Lynn: When TFSA accounts were released, they were a very small portion of an investor’s overall portfolio (so the decision of whether to hold bonds or equities in them wouldn’t make much of an impact from a dollar point of view (this is similar to RESP accounts at the onset). Now that the account thresholds are considerably larger (over $50,000), the expected tax benefit from holding equities in TFSAs over the long term is starting to become more noticeable.

When rebalancing a portfolio in the future, investors with fixed income in their TFSA accounts could consider selling it there and buying back equities.

Hello Justin,

If XUU, XEF, XEC is replaced with XAW do you think the overall return will be the same?

Thanks for the model portfolios. Much appreciated.

@Pete: The overall return should be similar (XAW has slightly different global equity weights than my model ETF portfolios, but the differences are relatively modest). Year-to-date, a 3-ETF balanced portfolio would have returned 4.16%, while the 5-ETF portfolio would have returned 4.29%.

@Justin: I noticed you replaced XUU/XEF/XEC inside RRSP. Do you have a replacement for XAW? (I would like to keep the basic 3 ETF portfolio).

@Bruno: XAW is perfectly fine if you’d like to stick to a 3-ETF portfolio. If you want to complicate things by using a US-listed ETF in order to mitigate some foreign withholding taxes and product fees (ensuring that you use Norbert’s gambit to convert your CAD to USD first), the closest single ETF would be the Vanguard Total World Stock ETF (VT), although it allocates a small portion to Canadian stocks (whereas XAW doesn’t).

Hey Justin, I just wanted to say many thanks! This is a tremendous amount of legwork saved for your average investor looking to be as efficient as possible across the board in Canada that’s provided for free! Thanks again for all the hard work and in-depth reviews, I look forward to future posts.

@Colby: You’re very welcome – glad I could help :)

Comparing the returns to the standard deviations, it seems like the higher percentage of stocks to bonds you go, the higher the risk, but the returns barely increase. Comparing the 50/50% mix to the 100% stock mix, the returns differ by 0.1% but the standard deviation doubles (across your TFSA/RSP/Taxable portfolios). With these portfolios, wouldn’t it make more sense to go with a 50/50% allocation regardless of your risk profile from the questionnaire?

@Sid: Bonds did very well over this period of decreasing interest rates, which is why the long term return figures look similar across different asset allocations. Going forward, it could be argued that bonds are expected to underperform equities (but there is no guarantee of this – which may nudge investors towards a more balanced portfolio).